-

Five things to know about Panama Canal, in Trump's sights

Five things to know about Panama Canal, in Trump's sights

-

NBA fines Minnesota guard Edwards $75,000 for outburst

-

Haitians massacred for practicing voodoo were abducted, hacked to death: UN

Haitians massacred for practicing voodoo were abducted, hacked to death: UN

-

Inter beat Como to keep in touch with leaders Atalanta

-

Man Utd boss Amorim questions 'choices' of Rashford's entourage

Man Utd boss Amorim questions 'choices' of Rashford's entourage

-

Trump's TikTok love raises stakes in battle over app's fate

-

Is he serious? Trump stirs unease with Panama, Greenland ploys

Is he serious? Trump stirs unease with Panama, Greenland ploys

-

England captain Stokes to miss three months with torn hamstring

-

Support grows for Blake Lively over smear campaign claim

Support grows for Blake Lively over smear campaign claim

-

Canada records 50,000 opioid overdose deaths since 2016

-

Jordanian, Qatari envoys hold talks with Syria's new leader

Jordanian, Qatari envoys hold talks with Syria's new leader

-

France's second woman premier makes surprise frontline return

-

France's Macron announces fourth government of the year

France's Macron announces fourth government of the year

-

Netanyahu tells Israel parliament 'some progress' on Gaza hostage deal

-

Guatemalan authorities recover minors taken by sect members

Guatemalan authorities recover minors taken by sect members

-

Germany's far-right AfD holds march after Christmas market attack

-

Serie A basement club Monza fire coach Nesta

Serie A basement club Monza fire coach Nesta

-

Mozambique top court confirms ruling party disputed win

-

Syrian medics say were coerced into false chemical attack testimony

Syrian medics say were coerced into false chemical attack testimony

-

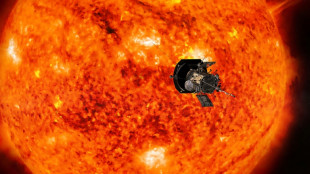

NASA solar probe to make its closest ever pass of Sun

-

London toy 'shop' window where nothing is for sale

London toy 'shop' window where nothing is for sale

-

Volkswagen boss hails cost-cutting deal but shares fall

-

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

-

Global stock markets mostly higher

-

Not for sale. Greenland shrugs off Trump's new push

Not for sale. Greenland shrugs off Trump's new push

-

Acid complicates search after deadly Brazil bridge collapse

-

Norwegian Haugan dazzles in men's World Cup slalom win

Norwegian Haugan dazzles in men's World Cup slalom win

-

Arsenal's Saka out for 'many weeks' with hamstring injury

-

Mali singer Traore child custody case postponed

Mali singer Traore child custody case postponed

-

France mourns Mayotte victims amid uncertainy over government

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

African players in Europe: Salah leads Golden Boot race after brace

-

German far-right AfD to march in city hit by Christmas market attack

German far-right AfD to march in city hit by Christmas market attack

-

Ireland centre Henshaw signs IRFU contract extension

-

Bangladesh launches $5bn graft probe into Hasina's family

Bangladesh launches $5bn graft probe into Hasina's family

-

US probes China chip industry on 'anticompetitive' concerns

-

Biden commutes sentences for 37 of 40 federal death row inmates

Biden commutes sentences for 37 of 40 federal death row inmates

-

Clock ticks down on France government nomination

-

Mozambique on edge as judges rule on disputed election

Mozambique on edge as judges rule on disputed election

-

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

Honda and Nissan to launch merger talks

-

Police arrest suspect who set woman on fire in New York subway

-

China vows 'cooperation' over ship linked to severed Baltic Sea cables

China vows 'cooperation' over ship linked to severed Baltic Sea cables

-

Australian tennis star Purcell provisionally suspended for doping

-

Luxury Western goods line Russian stores, three years into sanctions

Luxury Western goods line Russian stores, three years into sanctions

-

Wallace and Gromit return with comic warning about AI dystopia

-

Philippine military says will acquire US Typhon missile system

Philippine military says will acquire US Typhon missile system

-

Afghan bread, the humble centrepiece of every meal

-

Honda and Nissan expected to begin merger talks

Honda and Nissan expected to begin merger talks

-

'Draconian' Vietnam internet law heightens free speech fears

No evidence yet of credit crunch after banking turmoil: Yellen

US Treasury Secretary Janet Yellen said Tuesday that she has not seen evidence of a contraction in credit, despite fears that households and firms could have a tougher time borrowing after recent banking sector turmoil.

Her comments come as central bankers, finance ministers and other participants gather in Washington for the International Monetary Fund and World Bank's spring meetings this week, where global growth and debt restructuring feature among key topics on the agenda.

While the IMF warned in a report released Tuesday that chances of a "hard landing" for the world economy have risen on the back of financial sector stress, Yellen told reporters: "I've not really seen evidence at this stage suggesting a contraction in credit."

But she acknowledged that this is a possibility, while stressing that the US banking system remains resilient.

She said she is not anticipating a downturn in the economy even if that remains a risk.

Yellen added in a speech that there remains "considerable room for improvement" in the global debt restructuring process.

The World Bank has warned of an especially tough outlook for the poorest economies as global growth slows while countries grapple with heavy debt burdens and weak investment.

And this week, ministers from both creditor and debtor countries, as well as representatives of private creditors will convene for a global sovereign debt roundtable.

Yellen said she looks forward to "robust discussion on improvements to the Common Framework process for low-income countries and the debt treatment process more broadly."

Yellen noted China's willingness to provide specific assurances in Sri Lanka's case recently "as a positive sign," with Beijing's moves enabling the IMF to proceed with a financial support and economic reform program.

- China visit on the cards -

She still hopes to visit China at "the appropriate time" as well, given that President Joe Biden has emphasized the importance of opening up and maintaining communication channels.

Meanwhile, the United States remains "vigilant" in the face of risks to the economy, she said, as countries continue tackling fallout from Russia's invasion of Ukraine while recovering from the pandemic.

"In some countries, including the United States, there have been recent pressures on our banking systems," she added.

"I've been in close communication with my counterparts over the past few weeks on these developments and I look forward to continuing that dialogue this week," she said.

On Washington's pursuit of "friend-shoring," or deepening economic ties with trusted partners, Yellen pushing back on the idea that this process would cause fragmentation.

Saying such arguments are "not valid," she defended the process as an approach to dealing with supply chain threats.

L.Henrique--PC