-

'Taiwan also has baseball': jubilant fans celebrate historic win

'Taiwan also has baseball': jubilant fans celebrate historic win

-

Russia pummels Ukraine with 'record' drone barrage

-

Paul Pogba blackmail trial set to open in Paris

Paul Pogba blackmail trial set to open in Paris

-

Landmine victims gather to protest US decision to supply Ukraine

-

Indian rival royal factions clash outside palace

Indian rival royal factions clash outside palace

-

Manga adaptation 'Drops of God' nets International Emmy Award

-

Philippine VP denies assassination plot against Marcos

Philippine VP denies assassination plot against Marcos

-

Hong Kong's legal battles over LGBTQ rights: key dates

-

US lawmakers warn Hong Kong becoming financial crime hub

US lawmakers warn Hong Kong becoming financial crime hub

-

Compressed natural gas vehicles gain slow momentum in Nigeria

-

As Arctic climate warms, even Santa runs short of snow

As Arctic climate warms, even Santa runs short of snow

-

Plastic pollution talks: the key sticking points

-

Indonesia rejects Apple's $100 million investment offer

Indonesia rejects Apple's $100 million investment offer

-

Pakistan police fire tear gas, rubber bullets at pro-Khan supporters

-

Hong Kong same-sex couples win housing, inheritance rights

Hong Kong same-sex couples win housing, inheritance rights

-

Indonesia digs out as flooding, landslide death toll hits 20

-

Liverpool's old guard thriving despite uncertain futures

Liverpool's old guard thriving despite uncertain futures

-

Mbappe takes reins for Real Madrid in Liverpool clash

-

As AI gets real, slow and steady wins the race

As AI gets real, slow and steady wins the race

-

China's Huawei to launch 'milestone' smartphone with homegrown OS

-

Porzingis and Morant make triumphant NBA returns

Porzingis and Morant make triumphant NBA returns

-

Hong Kong top court affirms housing, inheritance rights for same-sex couples

-

Philippines, China clashes trigger money-making disinformation

Philippines, China clashes trigger money-making disinformation

-

Most Asian markets drop, dollar gains as Trump fires tariff warning

-

England 'not quivering' ahead of New Zealand Test challenge

England 'not quivering' ahead of New Zealand Test challenge

-

Bethell to bat at three on England Test debut against New Zealand

-

Trump vows big tariffs on Mexico, Canada and China

Trump vows big tariffs on Mexico, Canada and China

-

New Zealand and England to play for Crowe-Thorpe Trophy

-

Scheffler, Schauffele and McIlroy up for PGA Player of the Year

Scheffler, Schauffele and McIlroy up for PGA Player of the Year

-

Trump to face less internal pushback in new term: ex-commerce chief

-

Extreme weather threatens Canada's hydropower future

Extreme weather threatens Canada's hydropower future

-

More than 34,000 register as candidates for Mexico judges' election

-

Australia ban cycling's Richardson for life after UK defection

Australia ban cycling's Richardson for life after UK defection

-

Internal displacement in Africa triples in 15 years: monitor

-

'Remarkable global progress': HIV cases and deaths declining

'Remarkable global progress': HIV cases and deaths declining

-

Social media firms raise 'serious concerns' over Australian U-16 ban

-

Tiger to skip Hero World Challenge after back surgery

Tiger to skip Hero World Challenge after back surgery

-

MLB shifts six 2025 Rays games to avoid weather issues

-

US women's keeper Naeher retiring after Europe matches

US women's keeper Naeher retiring after Europe matches

-

West Ham stun Newcastle to ease pressure on Lopetegui

-

Arteta calls on Arsenal to show 'ruthless' streak on Champions League travels

Arteta calls on Arsenal to show 'ruthless' streak on Champions League travels

-

Israel bids emotional farewell to rabbi killed in UAE

-

Sonar image was rock formation, not Amelia Earhart plane: explorer

Sonar image was rock formation, not Amelia Earhart plane: explorer

-

Tottenham goalkeeper Vicario has ankle surgery

-

Green light for Cadillac to join Formula One grid in 2026

Green light for Cadillac to join Formula One grid in 2026

-

Israel to decide on ceasefire as US says deal 'close'

-

California vows to step in if Trump kills US EV tax credit

California vows to step in if Trump kills US EV tax credit

-

Special counsel asks judge to dismiss subversion case against Trump

-

Ronaldo double takes Al Nassr to brink of Asian Champions League quarters

Ronaldo double takes Al Nassr to brink of Asian Champions League quarters

-

Brazil minister says supports meat supplier 'boycott' of Carrefour

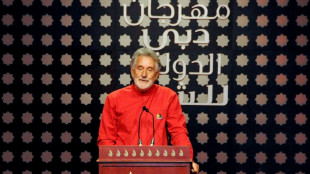

Sergio Ermotti: George Clooney of Swiss banking back as UBS boss

Sergio Ermotti, back as chief executive of UBS to oversee the mammoth takeover of Credit Suisse, has gone from local apprentice to the two-time boss of a top global bank.

Nicknamed the "George Clooney of Paradeplatz", after the Hollywood star and the Zurich square at the heart of Switzerland's banking industry, the silver-haired 62-year-old is known for always being immaculately turned out.

The Swiss banker, who returns to the UBS hot seat at its annual general meeting on Wednesday, has a reputation that lives up to such star billing, having turned around the fortunes of UBS after the 2008 global financial crisis.

As a child, he dreamed of a career in football but made his mark instead as one of the most talented bankers of his generation, the Neue Zurcher Zeitung newspaper said after his return to UBS was announced on Tuesday.

At 15, he quit school to become an apprentice at the Corner private bank in Lugano, his home town in the Italian-speaking south of Switzerland.

From there, he started out on a dazzling journey seen as a shining example of the Swiss apprenticeship system.

After a stint at the US bank Citigroup, he rose through the ranks of the US investment bank Merrill Lynch between 1987 and 2004, completing his training along the way via the advanced management programme at Britain's prestigious Oxford University.

In 2005, he joined the Italian bank UniCredit for five years, where he notably headed the markets and investment banking division.

He was then entrusted with the CEO role at UBS, running Switzerland's biggest bank from 2011 to 2020.

In 2021, he became the chairman of the reinsurance giant Swiss Re.

- Call of duty -

Ermotti is "made for the takeover of Credit Suisse" as he "used to playing the fireman role" and coming in to douse down trouble, said the Tribune de Geneve newspaper.

Back in 2020, Ermotti called the UBS chief executive role a dream job, but he will now find it "a much less comfortable chair", the daily said.

Amid fears of a growing banking crisis following the collapse of two banks in the United States, Credit Suisse's share price plummeted on March 15 as investor confidence evaporated.

On March 19, the Swiss government, the central bank and the financial regulators strongarmed UBS into buying Credit Suisse for $3.25 billion to prevent it from collapsing -- something which it was feared could have triggered a global banking meltdown.

The somewhat forced marriage needs stitching together carefully.

This prompted the UBS board to turn once more to Ermotti, thinking him the "better pilot" than current Dutch CEO Ralph Hamers to navigate the new flight path, said UBS chairman Colm Kelleher.

The quickfire merger of the two biggest banks in Switzerland triggered unease in the wealthy Alpine nation, with choice for customers and small businesses now seriously reduced.

While Kelleher admitted that Ermotti's Swiss nationality helped a little, he recalled that most of UBS's business is international, and said the decision to ask him back was dictated by the task ahead.

Ermotti will have to merge two institutions which were both among the 30 banks around the world deemed of global importance to the banking system -- in short, too big to fail.

Ermotti said he felt the "call of duty" to return and carry out the merger -- which Kelleher admitted comes with "huge" execution risks.

- Settling disputes -

UBS came in for fierce criticism after its bailout by the state during the 2008 financial crisis.

But the losses in 2011 of a rogue trader who blew $2.3 billion in shady transactions was the straw that broke the camel's back.

Heads rolled and UBS turned to Ermotti, who was little-known within Switzerland, having made his career mainly in London, New York and Milan.

But he returned home after being overlooked for the CEO role at UniCredit.

He made cuts in the investment bank, refocused UBS on wealth management and settled the disputes accumulated by the bank, including the Libor and exchange rate manipulation scandals.

A.Silveira--PC