-

Tennis power couple de Minaur and Boulter get engaged

Tennis power couple de Minaur and Boulter get engaged

-

Supermaxi yachts eye record in gruelling Sydney-Hobart race

-

Hawaii's Kilauea volcano erupts, spewing columns of lava

Hawaii's Kilauea volcano erupts, spewing columns of lava

-

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

Five things to know about Panama Canal, in Trump's sights

-

NBA fines Minnesota guard Edwards $75,000 for outburst

-

Haitians massacred for practicing voodoo were abducted, hacked to death: UN

Haitians massacred for practicing voodoo were abducted, hacked to death: UN

-

Inter beat Como to keep in touch with leaders Atalanta

-

Man Utd boss Amorim questions 'choices' of Rashford's entourage

Man Utd boss Amorim questions 'choices' of Rashford's entourage

-

Trump's TikTok love raises stakes in battle over app's fate

-

Is he serious? Trump stirs unease with Panama, Greenland ploys

Is he serious? Trump stirs unease with Panama, Greenland ploys

-

England captain Stokes to miss three months with torn hamstring

-

Support grows for Blake Lively over smear campaign claim

Support grows for Blake Lively over smear campaign claim

-

Canada records 50,000 opioid overdose deaths since 2016

-

Jordanian, Qatari envoys hold talks with Syria's new leader

Jordanian, Qatari envoys hold talks with Syria's new leader

-

France's second woman premier makes surprise frontline return

-

France's Macron announces fourth government of the year

France's Macron announces fourth government of the year

-

Netanyahu tells Israel parliament 'some progress' on Gaza hostage deal

-

Guatemalan authorities recover minors taken by sect members

Guatemalan authorities recover minors taken by sect members

-

Germany's far-right AfD holds march after Christmas market attack

-

Serie A basement club Monza fire coach Nesta

Serie A basement club Monza fire coach Nesta

-

Mozambique top court confirms ruling party disputed win

-

Syrian medics say were coerced into false chemical attack testimony

Syrian medics say were coerced into false chemical attack testimony

-

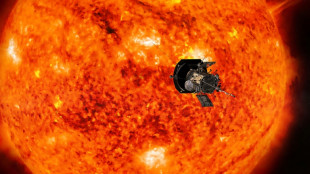

NASA solar probe to make its closest ever pass of Sun

-

London toy 'shop' window where nothing is for sale

London toy 'shop' window where nothing is for sale

-

Volkswagen boss hails cost-cutting deal but shares fall

-

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

-

Global stock markets mostly higher

-

Not for sale. Greenland shrugs off Trump's new push

Not for sale. Greenland shrugs off Trump's new push

-

Acid complicates search after deadly Brazil bridge collapse

-

Norwegian Haugan dazzles in men's World Cup slalom win

Norwegian Haugan dazzles in men's World Cup slalom win

-

Arsenal's Saka out for 'many weeks' with hamstring injury

-

Mali singer Traore child custody case postponed

Mali singer Traore child custody case postponed

-

France mourns Mayotte victims amid uncertainy over government

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

African players in Europe: Salah leads Golden Boot race after brace

-

German far-right AfD to march in city hit by Christmas market attack

German far-right AfD to march in city hit by Christmas market attack

-

Ireland centre Henshaw signs IRFU contract extension

-

Bangladesh launches $5bn graft probe into Hasina's family

Bangladesh launches $5bn graft probe into Hasina's family

-

US probes China chip industry on 'anticompetitive' concerns

-

Biden commutes sentences for 37 of 40 federal death row inmates

Biden commutes sentences for 37 of 40 federal death row inmates

-

Clock ticks down on France government nomination

-

Mozambique on edge as judges rule on disputed election

Mozambique on edge as judges rule on disputed election

-

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

Honda and Nissan to launch merger talks

-

Police arrest suspect who set woman on fire in New York subway

-

China vows 'cooperation' over ship linked to severed Baltic Sea cables

China vows 'cooperation' over ship linked to severed Baltic Sea cables

-

Australian tennis star Purcell provisionally suspended for doping

-

Luxury Western goods line Russian stores, three years into sanctions

Luxury Western goods line Russian stores, three years into sanctions

-

Wallace and Gromit return with comic warning about AI dystopia

Cash crops: Dutch use bitcoin mining to grow tulips

Tulips and bitcoin have both been associated with financial bubbles in their time, but in a giant greenhouse near Amsterdam the Dutch are trying to make them work together.

Engineer Bert de Groot inspects the six bitcoin miners as they perform complex sums to earn cryptocurrency, filling the air with a noisy whine along with a blast of warmth.

That warmth is now heating the hothouse where rows of tulips grow, cutting the farmers' reliance on gas whose price has soared since Russia's invasion of Ukraine.

The servers in turn are powered by solar energy from the roof, reducing the normally huge electricity costs for mining, and cutting the impact on the environment.

Meanwhile both the farmers and de Groot's company, Bitcoin Brabant, are earning crypto, which is still attracting investors despite a recent crash in the market.

"We think with this way of heating our greenhouse but also earning some bitcoin we have a win-win situation," flower farmer Danielle Koning, 37, told AFP.

The Netherlands' love of tulips caused the first stock market crash in the 17th century when speculation bulb prices caused prices to soar, only to later collapse.

Now the Netherlands is the world's biggest tulip producer and also the second biggest agricultural exporter overall after the United States, with much grown in greenhouses.

- 'Improving the environment' -

But the low-lying country is keenly aware of the effect of the agricultural industry on climate change, while farmers are struggling with high energy prices.

Mining for cryptocurrency meanwhile requires huge amounts of electricity to power computers, leading to an environmental impact amid global efforts to tackle climate change.

De Groot, 35, who only started his business earlier this year and now has 17 clients including restaurants and warehouses, says this makes bitcoin and tulips a perfect fit.

"This operation is actually carbon negative, as are all the operations I basically build," says the long-haired de Groot, sporting an orange polo shirt with his firm's logo.

"We're actually improving the environment."

He is also selling tulips online for bitcoin via a business called Bitcoinbloem.

The collaboration started when Koning saw a Twitter video de Groot had made about bitcoin mining, and called him up.

Now there are six servers at their hothouse, whose exact location Koning asked to keep secret to avoid thieves targeting the 15,000-euro machines.

Koning's company owns half of them and keeps the bitcoin they produce, while de Groot is allowed to keep his three servers there in exchange for monthly visits to clean dust and insects out of the servers' fans.

With a 20 degree Celsius difference between the air entering the machine and leaving them, this provides the heat needed to grow the tulips, and to dry the bulbs that produce them.

- 'No worries' -

"The most important thing we get out of it is, we save on natural gas," says Koning. "Secondly, well, we earn Bitcoin by running them in the greenhouse."

Huge energy costs have driven some Dutch agricultural firms that often rely on greenhouses to stop growing this year, while others have even gone bankrupt, says Koning.

Meanwhile, the philosopher Nassim Nicholas Taleb, who developed the idea of the unpredictable but historic "black swan" event, has compared Bitcoin to the "Tulipmania" that engulfed the Netherlands nearly 400 years ago.

This saw prices for a single bulb rise to more than 100 times the average annual income at the time before the bubble burst in 1637, causing banks to fail and people to lose their life savings.

The cryptocurrency sector is currently reeling from the collapse of a major exchange -- with Bitcoin currently worth around $16,300 per unit, down from a high of $68,000 in November 2021 -- but De Groot isn't worried.

"I have absolutely no worries about the long-term value proposition of an immutable monetary system," he says.

"Bitcoin will last for ever."

M.Carneiro--PC