-

South Korea grieves after deadliest plane crash kills 179

South Korea grieves after deadliest plane crash kills 179

-

Five-star Liverpool pull eight points clear with West Ham rout

-

Sudan government rejects UN-backed famine declaration

Sudan government rejects UN-backed famine declaration

-

Past champions USA and Germany win at United Cup

-

Both 'Mufasa' and 'Sonic' claim N.America box office supremacy

Both 'Mufasa' and 'Sonic' claim N.America box office supremacy

-

Juve game interrupted after fans abuse Vlahovic

-

No enjoyment, 'just relief' for Guardiola as Man City stop rot at Leicester

No enjoyment, 'just relief' for Guardiola as Man City stop rot at Leicester

-

Man City find winning formula as Forest go second in Premier League

-

Glitzy Calabar Carnival wraps up tough year in Nigeria

Glitzy Calabar Carnival wraps up tough year in Nigeria

-

Man City stop the rot with victory at Leicester

-

Suriname ex-dictator died of liver failure, autopsy shows

Suriname ex-dictator died of liver failure, autopsy shows

-

Shahidi 179 not out as draw looms for Afghanistan in Zimbabwe Test

-

Some Americans in Panama reject Trump's canal threat

Some Americans in Panama reject Trump's canal threat

-

Ljutic powers to Semmering slalom to end Croatian drought

-

Taliban leader bans windows overlooking women's areas

Taliban leader bans windows overlooking women's areas

-

Mikheil Kavelashvili, ex-Man City striker and Georgia's disputed far-right president

-

Azerbaijan says Russia shot at plane before crash, demands it admit

Azerbaijan says Russia shot at plane before crash, demands it admit

-

Salome Zurabishvili: outgoing Georgian leader defying the government

-

Moeller wins super-G to record maiden World Cup victory

Moeller wins super-G to record maiden World Cup victory

-

At least 177 dead in South Korea's worst plane crash

-

Rabada unlikely batting star as South Africa edge Pakistan in thriller

Rabada unlikely batting star as South Africa edge Pakistan in thriller

-

Chad votes in triple elections after three years of army rule

-

Jailed PKK leader says 'ready' to support Turkey peace drive

Jailed PKK leader says 'ready' to support Turkey peace drive

-

Three die in clandestine Channel crossing attempt

-

Georgia's new president sworn in amid political showdown

Georgia's new president sworn in amid political showdown

-

Celestial V70 wins overall honours in Sydney to Hobart yacht race

-

Zverev helps champions Germany knock Brazil out of United Cup

Zverev helps champions Germany knock Brazil out of United Cup

-

All but two feared dead after South Korea plane crashes with 181 aboard

-

Croatia elects president as incumbent looks favourite

Croatia elects president as incumbent looks favourite

-

Ruud wins but Norway crash to Czech Republic at United Cup

-

Olympic table tennis champ says never 'officially informed' about fines

Olympic table tennis champ says never 'officially informed' about fines

-

Djokovic plans to keep playing for 'years to come'

-

North Korea calls for 'toughest' US strategy at party meeting

North Korea calls for 'toughest' US strategy at party meeting

-

Djokovic calls for doping transparency after Sinner, Swiatek cases

-

Bumrah rips out Australia middle order as India fight back in 4th Test

Bumrah rips out Australia middle order as India fight back in 4th Test

-

Brunson's 55 points propel Knicks to overtime win over Wizards

-

Drama, dreams: Japan's wildly popular school football breeds future stars

Drama, dreams: Japan's wildly popular school football breeds future stars

-

Georgia set to inaugurate disputed president amid political crisis

-

Japan's Wajima craftmakers see hope in disaster-hit region

Japan's Wajima craftmakers see hope in disaster-hit region

-

Five events to look out for in 2025

-

Five sports stars to watch in 2025

Five sports stars to watch in 2025

-

Plane with 181 on board crashes in South Korea, killing 29

-

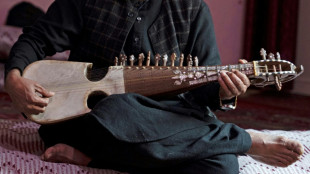

UNESCO-listed musical instrument stifled in Afghanistan

UNESCO-listed musical instrument stifled in Afghanistan

-

Excited Osaka says 'deep love' of tennis keeps her going

-

Baseball superstar Ohtani expecting first baby

Baseball superstar Ohtani expecting first baby

-

For German 'sick leave detective', business is booming

-

Konstas, Khawaja fall as Australia extend lead to 158 over India

Konstas, Khawaja fall as Australia extend lead to 158 over India

-

Impressive Herbert leads Chargers into playoffs, Broncos denied

-

One dead in Ecuador, Peru ports closed amid massive waves

One dead in Ecuador, Peru ports closed amid massive waves

-

NBA hand out suspensions after fracas in Phoenix

| NGG | 0.66% | 59.31 | $ | |

| CMSD | -0.67% | 23.32 | $ | |

| SCS | 0.58% | 11.97 | $ | |

| RIO | -0.41% | 59.01 | $ | |

| BTI | -0.33% | 36.31 | $ | |

| BCC | -1.91% | 120.63 | $ | |

| GSK | -0.12% | 34.08 | $ | |

| RBGPF | 100% | 59.84 | $ | |

| BCE | -0.93% | 22.66 | $ | |

| CMSC | -0.85% | 23.46 | $ | |

| RELX | -0.61% | 45.58 | $ | |

| AZN | -0.39% | 66.26 | $ | |

| RYCEF | 0.14% | 7.27 | $ | |

| JRI | -0.41% | 12.15 | $ | |

| VOD | 0.12% | 8.43 | $ | |

| BP | 0.38% | 28.96 | $ |

Eurozone stocks lift as French political stand-off eases

Eurozone stock markets rebounded Thursday as France's political stand-off showed signs of easing, while Chinese equities fell despite reports the United States may be less stringent than feared with its curb on tech equipment to China.

Wall Street ended lower Wednesday as traders booked profits ahead of the Thanksgiving holiday.

Official data Wednesday showed that US inflation edged up but remained in line with forecasts -- cementing expectations that the Federal Reserve will still cut interest rates in December but have fewer reductions than thought next year.

The dollar gained versus main rivals Thursday.

In Europe, the Paris stock market rose 0.6 percent in midday deals.

France's finance minister Antoine Armand said the country's government was ready to offer concessions to parliament to pass its budget amid a standoff that has caused market turbulence and risks bringing down the government of Prime Minister Michel Barnier.

Germany's stock market rebounded 0.7 percent. Outside the eurozone, London edged higher for a second session running.

European stock markets recovered from the previous day's losses caused also by concerns that Europe could be the next target for tariffs by US president-elect Donald Trump.

European Central Bank chief Christine Lagarde said Thursday that the European Union must cooperate with Trump to avoid a trade war.

"This is a better scenario than a pure retaliation strategy, which can lead to a tit-for-tat process where no one is really a winner," she said in an interview with The Financial Times.

Rising tariff fears have weighed on Asian markets after Trump flagged they would target China and appointed several hawks to his cabinet.

Hong Kong and Shanghai retreated as Bloomberg reported that Washington was considering escalating its crackdown on tech supplies to China by putting fresh sanctions on sales of semiconductor equipment and AI chips to the country.

But the reported measures would stop short of stricter action that had been expected.

Oil prices rose as the OPEC+ alliance postponed a weekend meeting to December 5 in what analysts said were signs of disagreement among the group over plans to increase output.

The 22-member OPEC+ group led by Saudi Arabia and Russia was due to decide on its 2025 output policy at a ministerial meeting originally scheduled for Sunday.

In the crypto sphere, bitcoin was hovering around $96,500, having bounced back from just below $90,300 earlier in the week following its worst run since Trump's electoral success.

Still, it is widely tipped to top $100,000 on expectations the new president will ease restrictions on the digital currency market.

- Key figures around 1130 GMT -

London - FTSE 100: UP 0.1 percent at 8,279.12

Paris - CAC 40: UP 0.6 percent at 7,182.15

Frankfurt - DAX: UP 0.7 percent at 19,391.69

Tokyo - Nikkei 225: UP 0.6 percent at 38,349.06 (close)

Hong Kong - Hang Seng Index: DOWN 1.2 percent at 19,366.96 (close)

Shanghai - Composite: DOWN 0.4 percent at 3,295.70 (close)

New York - Dow: DOWN 0.3 percent at 44,722.06 (close)

Euro/dollar: DOWN at $1.0554 from $1.0565 on Wednesday

Pound/dollar: DOWN at $1.2666 from $1.2678

Dollar/yen: UP at 151.78 yen from 151.17 yen

Euro/pound: FLAT at 83.33 pence

Brent North Sea Crude: UP 0.7 percent at $72.78 per barrel

West Texas Intermediate: UP 0.6 percent at $69.10 per barrel

M.Gameiro--PC