-

Seko Fofana joins Rennes after Saudi Arabia stint

Seko Fofana joins Rennes after Saudi Arabia stint

-

Brazil's Amazon saw highest number of fires in 17 years: agency

-

McGregor wants no let-up as Celtic aim to maintain Old Firm grip

McGregor wants no let-up as Celtic aim to maintain Old Firm grip

-

Truck ramming kills 10 New Year's revelers in New Orleans, injures dozens

-

Ten dead as man drives truck into New Year crowd in New Orleans

Ten dead as man drives truck into New Year crowd in New Orleans

-

Gaza rescuers say 15 killed in Israeli New Year strike

-

Rugby chief backs 'trailblazer' Maher to fuel Women's World Cup fever

Rugby chief backs 'trailblazer' Maher to fuel Women's World Cup fever

-

Right-wing YouTubers back South Korea president's last stand

-

Championship side Stoke appoint Robins as new manager

Championship side Stoke appoint Robins as new manager

-

Bangladesh saw surge of mob killings in 2024: rights groups

-

Moscow, Kyiv end Russian gas transit to Europe via Ukraine

Moscow, Kyiv end Russian gas transit to Europe via Ukraine

-

Carter's Middle East peace legacy survives, but mostly in name

-

South Korea investigators vow to execute Yoon arrest warrant

South Korea investigators vow to execute Yoon arrest warrant

-

South Korea says will send Jeju Air crash black box to US

-

Navarro stunned by wildcard as Dimitrov cruises in Brisbane

Navarro stunned by wildcard as Dimitrov cruises in Brisbane

-

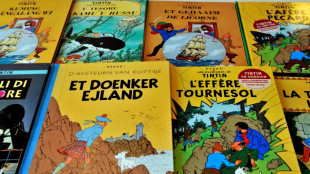

Tintin, Popeye, Hemingway among US copyrights expiring in 2025

-

Cavs top Lakers in LeBron's first game at 40, Celtics crush Raptors

Cavs top Lakers in LeBron's first game at 40, Celtics crush Raptors

-

Finnish police probing seven sailors over cut cables

-

Canada's Dabrowski reveals cancer treatment amid run to Olympic bronze

Canada's Dabrowski reveals cancer treatment amid run to Olympic bronze

-

Milan says no to all outdoor smoking in Italy's toughest ban

-

Zverev out of United Cup with injury as Australian Open looms

Zverev out of United Cup with injury as Australian Open looms

-

FBI makes its largest bomb bust on Virginia farm

-

Rain break helps Osaka overcome nerves to reach Auckland quarters

Rain break helps Osaka overcome nerves to reach Auckland quarters

-

Ex-India coach Shastri wants two-tier Test system after MCG blockbuster

-

New year hope and joy reign in a Damascus freed from Assad

New year hope and joy reign in a Damascus freed from Assad

-

End of Russian gas via Ukraine sparks unease in eastern Europe

-

Zelensky vows Ukraine will do everything in 2025 to stop Russia

Zelensky vows Ukraine will do everything in 2025 to stop Russia

-

Island-wide blackout hits Puerto Rico on New Year's Eve

-

Serbia enters New Year with student protests over train station tragedy

Serbia enters New Year with student protests over train station tragedy

-

Romania, Bulgaria join borderless Schengen zone

-

US Capitol riot fugitive seeks asylum in Canada

US Capitol riot fugitive seeks asylum in Canada

-

Musk flummoxes internet with 'Kekius Maximus' persona

-

Venezuela opposition urges protests against Maduro's inauguration

Venezuela opposition urges protests against Maduro's inauguration

-

Syria's de facto leader meets minority Christians

-

Suriname ex-dictator Bouterse to be cremated on Saturday

Suriname ex-dictator Bouterse to be cremated on Saturday

-

£1.5 mn reward offered after 'brazen' London gem raid

-

Zimbabwe abolishes the death penalty

Zimbabwe abolishes the death penalty

-

Barcelona race against clock to register Olmo

-

Arteta wants Arsenal to hammer away in title race

Arteta wants Arsenal to hammer away in title race

-

Panama marks canal handover anniversary in shadow of Trump threat

-

Gaza hospital chief held by Israel becomes face of crumbling healthcare

Gaza hospital chief held by Israel becomes face of crumbling healthcare

-

Russian advances in Ukraine grew seven-fold in 2024, data shows

-

US farmers fret over Trump's deportation plans

US farmers fret over Trump's deportation plans

-

BBC celebrates 100 years of 'poetic' shipping forecast

-

West Ham's Bowen sidelined with foot fracture

West Ham's Bowen sidelined with foot fracture

-

Global markets rode AI, interest rate roller coaster in 2024

-

Ocalan: PKK chief held in solitary on Turkish prison island

Ocalan: PKK chief held in solitary on Turkish prison island

-

Yemen's Huthis a 'menace' for Israel despite weakened Iran: analysts

-

Rooney exit extends managerial struggles for England's 'golden generation'

Rooney exit extends managerial struggles for England's 'golden generation'

-

Gaza healthcare nearing 'total collapse' due to Israeli strikes: UN

European stocks drop on Trump trade war worries

European stock markets mostly retreated Wednesday on concerns Europe could be the next tariffs target for US president-elect Donald Trump, who has announced a tough-negotiating hawk as his trade envoy.

Trump plans to hit China, Canada and Mexico with hefty tariffs from January.

"Investors are growing increasingly concerned that Donald Trump's next tariff target is continental Europe," said Dan Coatsworth, investment analyst at AJ Bell.

For Europe, this would create "another potential headwind on top of the existing one in the form of lacklustre economic activity", he added.

While there were losses for Paris and Frankfurt stock markets approaching the half-way stage Wednesday, London managed to nudge higher.

After another record-breaking lead from Wall Street on Tuesday, Chinese markets rallied as data showed that China's industrial sector narrowed losses in October.

Trump has announced Jamieson Greer as his trade envoy, saying he played a "key role" in imposing tariffs on China during his previous term in office.

The dollar dropped against main rivals awaiting the release Wednesday of the Federal Reserve's preferred gauge of inflation, as well as figures on jobless claims and economic growth.

The Fed has indicated support for a gradual approach to future interest-rate cuts as the jobs market remains solid, according to minutes from their November policy meeting.

Elsewhere, oil prices edged up having slid on news that Israel and Hezbollah in Lebanon had agreed a ceasefire.

Crude won support from the prospect that key OPEC+ nations will delay a pick-up in production, which was due to begin in January, when they meet Sunday.

Bitcoin sat around $93,500, having hit a record Friday and come within a whisker of the $100,000 mark on hopes that Trump will move to ease restrictions on the crypto market.

London stocks bucked the downward trend across most European stock markets, rising 0.1 percent.

Shares in EasyJet rose one percent in late morning deals after the UK airline posted a 40-percent rise in annual profits on strong demand for its package holidays.

The Paris stock market slid more than one percent as a French political standoff over a belt-tightening draft budget for 2025 threatens to topple the government.

Tokyo fell with Hello Kitty owner Sanrio tumbling more than 14 percent after major shareholders said they would reduce their stake in the firm.

- Key figures around 1100 GMT -

London - FTSE 100: UP 0.1 percent at 8,267.52

Paris - CAC 40: DOWN 1.2 percent at 7,106.02

Frankfurt - DAX: DOWN 0.6 percent at 19,186.60

Tokyo - Nikkei 225: DOWN 0.8 percent at 38,134.97 (close)

Hong Kong - Hang Seng Index: UP 2.3 percent at 19,603.13 (close)

Shanghai - Composite: UP 1.5 percent at 3,309.78 (close)

New York - Dow: UP 0.3 percent at 44,860.31 (close)

Euro/dollar: UP at $1.0529 from $1.0482 on Tuesday

Pound/dollar: UP at $1.2615 from $1.2567

Dollar/yen: DOWN at 151.39 yen from 153.06 yen

Euro/pound: UP at 83.47 pence from 83.41 pence

Brent North Sea Crude: UP 0.2 percent at $72.52 per barrel

West Texas Intermediate: UP 0.3 percent at $68.96 per barrel

O.Salvador--PC