-

Egyptian clubs go on scoring sprees in CAF Champions League

Egyptian clubs go on scoring sprees in CAF Champions League

-

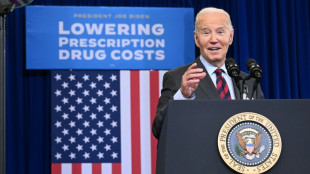

Biden hails Lebanon ceasefire deal as 'good news'

-

Brazil's Bolsonaro 'participated' in 2022 coup plot against Lula: police

Brazil's Bolsonaro 'participated' in 2022 coup plot against Lula: police

-

Barcelona striker Lewandowski scores 100th Champions League goal

-

Autos, food: What are the risks from Trump's tariff threat?

Autos, food: What are the risks from Trump's tariff threat?

-

Alvarez, Correa net braces as Atletico thrash Sparta Prague

-

Trump brings back government by social media

Trump brings back government by social media

-

Animal rights activist on FBI 'most wanted terrorist' list arrested

-

Netanyahu seeks ceasefire after two months of war in Lebanon

Netanyahu seeks ceasefire after two months of war in Lebanon

-

Trump tariffs threat casts chill over Canada

-

Hong Kong tycoon Jimmy Lai's court case a 'show trial': son

Hong Kong tycoon Jimmy Lai's court case a 'show trial': son

-

Blinken says Lebanon ceasefire talks 'in final stages'

-

Mascherano re-unites with Messi as new coach of Inter Miami

Mascherano re-unites with Messi as new coach of Inter Miami

-

Real Madrid's Bellingham gone from 'scapegoat' to smiling

-

Bangladeshi Hindus protest over leader's arrest, one dead

Bangladeshi Hindus protest over leader's arrest, one dead

-

Celtic fuelled by Dortmund embarrassment: Rodgers

-

Salah driven not distracted by contract deadlock, says Slot

Salah driven not distracted by contract deadlock, says Slot

-

Algeria holds writer Boualem Sansal on national security charges: lawyer

-

Biden proposes huge expansion of weight loss drug access

Biden proposes huge expansion of weight loss drug access

-

Saudi 2025 budget sees lower deficit on spending trims

-

Pogba's brother, five others, on trial for blackmailing him

Pogba's brother, five others, on trial for blackmailing him

-

Prosecutors seek up to 15-year terms for French rape trial defendants

-

Emery bids to reverse Villa slump against Juventus

Emery bids to reverse Villa slump against Juventus

-

Carrefour attempts damage control against Brazil 'boycott'

-

Namibians heads to the polls wanting change

Namibians heads to the polls wanting change

-

Sales of new US homes lowest in around two years: govt

-

Paris mayor Hidalgo says to bow out in 2026

Paris mayor Hidalgo says to bow out in 2026

-

Stocks, dollar mixed on Trump tariff warning

-

ICC to decide fate of Pakistan's Champions Trophy on Friday

ICC to decide fate of Pakistan's Champions Trophy on Friday

-

Man Utd revenue falls as Champions League absence bites

-

Russia vows reply after Ukraine strikes again with US missiles

Russia vows reply after Ukraine strikes again with US missiles

-

Trump threatens trade war on Mexico, Canada, China

-

Motta's injury-hit Juve struggling to fire ahead of Villa trip

Motta's injury-hit Juve struggling to fire ahead of Villa trip

-

Cycling chiefs seek WADA ruling on carbon monoxide use

-

Israel pounds Beirut as security cabinet to discuss ceasefire

Israel pounds Beirut as security cabinet to discuss ceasefire

-

Fewest new HIV cases since late 1980s: UNAIDS report

-

4 security forces killed as ex-PM Khan supporters flood Pakistan capital

4 security forces killed as ex-PM Khan supporters flood Pakistan capital

-

Four bodies, four survivors recovered from Egypt Red Sea sinking: governor

-

Ayub century helps Pakistan crush Zimbabwe, level series

Ayub century helps Pakistan crush Zimbabwe, level series

-

French court cracks down on Corsican language use in local assembly

-

Russia expels UK diplomat accused of espionage

Russia expels UK diplomat accused of espionage

-

Israeli security cabinet to discuss ceasefire as US says deal 'close'

-

COP29 president blames rich countries for 'imperfect' deal

COP29 president blames rich countries for 'imperfect' deal

-

No regrets: Merkel looks back at refugee crisis, Russia ties

-

IPL history-maker, 13, who 'came on Earth to play cricket'

IPL history-maker, 13, who 'came on Earth to play cricket'

-

Prosecutors seek up to 12-year terms for French rape trial defendants

-

Laos hostel staff detained after backpackers' deaths

Laos hostel staff detained after backpackers' deaths

-

Hong Kong LGBTQ advocate wins posthumous legal victory

-

Rod Stewart to play Glastonbury legends slot

Rod Stewart to play Glastonbury legends slot

-

Winter rains pile misery on war-torn Gaza's displaced

| SCS | -1.33% | 13.54 | $ | |

| CMSC | -0.65% | 24.57 | $ | |

| RIO | -1.53% | 62.03 | $ | |

| RBGPF | 1.33% | 61 | $ | |

| NGG | -0.68% | 62.83 | $ | |

| BCE | -1.46% | 26.63 | $ | |

| RELX | 0.51% | 46.81 | $ | |

| JRI | -0.98% | 13.24 | $ | |

| RYCEF | 0.44% | 6.8 | $ | |

| BTI | 1.01% | 37.71 | $ | |

| BCC | -2.76% | 148.41 | $ | |

| CMSD | -0.61% | 24.43 | $ | |

| BP | -1.24% | 28.96 | $ | |

| VOD | -0.56% | 8.86 | $ | |

| GSK | -0.38% | 34.02 | $ | |

| AZN | -0.06% | 66.36 | $ |

Global stocks slip as markets take post-US election breather

A stocks rally following Donald Trump's US election win lost steam Tuesday as traders looked to consolidate recent gains, sending major indices lower on both sides of the Atlantic.

The euro hit a one-year low and the pound fell against the dollar, which has been invigorated by expectations that Trump's trade policies could keep interest rates higher.

Wall Street's main indices all closed lower after having racked up huge gains in the days following Trump's victory and Republican gains in Congress.

"We got a significant run," Art Hogan from B. Riley Wealth Management told AFP. "After a run like that in such a short period of time, it's not surprising for markets to take a breather."

- Hefty losses -

Leading European and Asian markets closed the day with hefty losses, with both Frankfurt and Paris falling more than two percent and Hong Kong finishing nearly three percent lower.

Chinese stocks were already under pressure after disappointment about Beijing's lack of extra measures to boost China's stuttering economy.

Trump's support for cryptocurrency pushed bitcoin to a record high of almost $90,000 at one point on Tuesday.

Trump's decision to pick China hawks for key positions in his cabinet has added to fears that the next few years could be bumpy for global markets.

"The latest moves from Trump's camp... are sending chills through the markets and casting a decidedly icy glow on US-China relations," noted independent analyst Stephen Innes.

Analysts are also expecting tariffs on European imports, hurting the region's top stock markets.

The dollar extended gains against its peers that started after news of Trump's election, which has sparked bets on a pick-up in inflation that could complicate the Federal Reserve's plans to lower US interest rates.

The latest reading of the US consumer price index due Wednesday will be closely watched as investors try to ascertain the central bank's plans for next month's monetary policy meeting.

"We assume the Trump administration will deliver on their key policy proposals with the degree and timing of these policies the bigger uncertainty," said National Australia Bank's Rodrigo Catril.

"Most of these policies (lower taxes, tariffs, immigration, deregulation, unfunded expansionary fiscal policy) can be regarded as pro-growth and or inflationary," he continued.

"This means, all else equal, a shallower Fed easing cycle and a stronger dollar," he added.

- Key figures around 2115 GMT -

New York - Dow: DOWN 0.9 percent at 43,910.98 points (close)

New York - S&P 500: DOWN 0.3 percent at 5,983.99 (close)

New York - Nasdaq Composite: DOWN 0.1 percent at 19,281.40 (close)

London - FTSE 100: DOWN 1.2 percent at 8,025.77 (close)

Paris - CAC 40: DOWN 2.7 percent at 7,226.98 (close)

Frankfurt - DAX: DOWN 2.1 percent at 19,033.64 (close)

Tokyo - Nikkei 225: DOWN 0.4 percent at 39,376.09 (close)

Hong Kong - Hang Seng Index: DOWN 2.8 percent at 19,846.88 (close)

Shanghai - Composite: DOWN 1.4 percent at 3,421.97 (close)

Dollar/yen: UP at 154.59 yen from 153.81 yen on Monday

Euro/dollar: DOWN at $1.0625 from $1.0648

Pound/dollar: DOWN at $1.2748 from $1.2872

Euro/pound: UP at 83.34 pence from 82.73 pence

Brent North Sea Crude: UP 0.1 percent at $71.89 per barrel

West Texas Intermediate: UP 0.1 percent at $68.12 per barrel

burs-rl/ach/da-tu/aha

J.Pereira--PC