-

Manchester United fans in favour of leaving Old Trafford

Manchester United fans in favour of leaving Old Trafford

-

Saudi Aramco's quarterly profit drops 15% on low oil prices

-

Kenya court jails Olympian Kiplagat's killers for 35 years

Kenya court jails Olympian Kiplagat's killers for 35 years

-

Dutch, French authorities raid Netflix offices in tax probe

-

Barcelona to replace flood-hit Valencia for MotoGP finale

Barcelona to replace flood-hit Valencia for MotoGP finale

-

Spain unveils aid plan a week after catastrophic floods

-

Neymar to miss two weeks' training in fresh setback: coach

Neymar to miss two weeks' training in fresh setback: coach

-

Indonesia volcano erupts again after killing nine day earlier

-

Injured Djokovic to miss ATP Finals

Injured Djokovic to miss ATP Finals

-

South Korea fines Meta for illegal collection of user data

-

UK parliament to debate world's first 'smoke-free generation' bill

UK parliament to debate world's first 'smoke-free generation' bill

-

'Incalculable' bill awaits Spain after historic floods

-

Europe auto struggles lead to cuts at Michelin, Germany's Schaeffler

Europe auto struggles lead to cuts at Michelin, Germany's Schaeffler

-

Award-winning Cambodian reporter quits journalism after arrest

-

Kenyan athletes' deaths expose mental health struggles

Kenyan athletes' deaths expose mental health struggles

-

Start without a shot: PTSD sufferers welcome marathon effort

-

Norway speeds ahead of EU in race for fossil-free roads

Norway speeds ahead of EU in race for fossil-free roads

-

Harris or Trump: America decides in knife-edge election

-

Smog sickness: India's capital struggles as pollution surges

Smog sickness: India's capital struggles as pollution surges

-

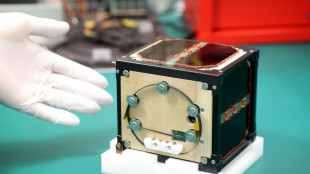

World's first wooden satellite launched into space

-

Myanmar junta chief visits key ally China

Myanmar junta chief visits key ally China

-

Nintendo lowers sales forecast as first-half profits plunge

-

Greenland seeks to capitalise on 'last-chance tourism'

Greenland seeks to capitalise on 'last-chance tourism'

-

Saudi Aramco says quarterly profit drops 15% on low oil prices

-

Greenland eyes tourism takeoff with new airport runway

Greenland eyes tourism takeoff with new airport runway

-

Boeing union says approves contract, ending over 7-week strike

-

Harris, Trump end historic campaigns with final pitch to voters

Harris, Trump end historic campaigns with final pitch to voters

-

Cavs down Bucks to improve to 8-0, Thunder unbeaten in West

-

New Hampshire hamlet tied in first US Election day votes

New Hampshire hamlet tied in first US Election day votes

-

Outsider Knight's Choice wins Melbourne Cup photo-finish thriller

-

Chiefs stay perfect with overtime win over Bucs

Chiefs stay perfect with overtime win over Bucs

-

Uncertain Inter with questions to answer before Arsenal clash

-

With Mbappe gone, misfiring PSG are under pressure in Champions League

With Mbappe gone, misfiring PSG are under pressure in Champions League

-

China's premier 'fully confident' of hitting growth targets

-

North Korea fires short-range ballistic missile salvo ahead of US election

North Korea fires short-range ballistic missile salvo ahead of US election

-

Taiwan couple charged with trying to influence elections for China

-

Indonesian President Prabowo to visit China this week

Indonesian President Prabowo to visit China this week

-

Critically endangered Sumatran elephant calf born in Indonesia

-

The marble 'living Buddhas' trapped by Myanmar's civil war

The marble 'living Buddhas' trapped by Myanmar's civil war

-

How East Germany's 'traffic light man' became a beloved icon

-

Japan expresses concern to China over Russia-North Korea ties

Japan expresses concern to China over Russia-North Korea ties

-

Asian markets swing ahead of toss-up US election

-

Palau polls open as pro-US president faces election test

Palau polls open as pro-US president faces election test

-

'Panic buttons,' SWAT teams: US braces for election unrest

-

Hundreds of UK police sacked for misconduct

Hundreds of UK police sacked for misconduct

-

Harris, Trump fight through final campaign hours

-

Top-ranked Nelly Korda wins LPGA Player of Year award

Top-ranked Nelly Korda wins LPGA Player of Year award

-

Israel accuses Turkey of 'malice' over UN arms embargo call

-

Man City will 'struggle' to overcome injury crisis, says Guardiola

Man City will 'struggle' to overcome injury crisis, says Guardiola

-

First candidates grilled in parliament test for EU top team

Stock markets rise, dollar pressured as US votes

Major stock markets rose and the dollar remained under pressure Tuesday as the United States votes in a knife-edge presidential election.

Equities in Shanghai and Hong Kong won strong support from hopes over China's economy, while European indices grew slightly as investors await interest-rate decisions from the US Federal Reserve and Bank of England on Thursday.

"A contested election result could cause volatility on the markets," noted Russ Mould, investment director at AJ Bell.

"Equally, a clear winner quickly after voting ends could provide some relief to investors."

A win for Republican Donald Trump is expected to boost the dollar, restoke inflation, and send Treasury yields higher owing to his pledges to slash taxes and impose tariffs on imports.

Analysts see less upheaval from a win by Democratic Vice President Kamala Harris.

"A pro-tariff Trump presidency could see the dollar strengthen amid concerns higher inflation will prompt the Fed to keep interest rates higher," predicted Matt Britzman, senior equity analyst at Hargreaves Lansdown.

"There is likely to a period of volatility particularly if the result is contested, but investors should keep their eyes on long-term horizons as historically financial markets have risen over the course of both Democratic and Republican presidencies."

Wall Street's three main indices ended in the red Monday.

Hong Kong and Shanghai each closed up by more than two percent Tuesday after data showed China's services sector expanded last month at its fastest pace since July.

The news came as traders await the end of a Chinese government meeting this week to hammer out an economic stimulus.

Officials are expected to give the go-ahead to about $140 billion in extra budget spending, mostly for indebted local governments, and a similar one-off payment for banks.

Adding to the risk-on mood were comments by Chinese Premier Li Qiang, who said he was "fully confident" that China's economy would hit its growth targets this year and indicated that there was room to do more.

Oil prices gained less sharply having surged almost three percent Monday after top producers agreed to extend output cuts through to the end of December and on worries about the Middle East crisis.

On the corporate front, striking workers at Boeing approved a contract proposal late Monday, ending more than seven weeks of stoppages that underscored discontent within the workforce of the beleaguered US aviation giant.

Shares in Vodafone gained 1.5 percent in London after UK regulators moved closer to approving the mobile phone group's multi-billion-pound proposed merger of its British operations with those of Hong Kong-based CK Hutchison.

The Competition and Markets Authority indicated that it could seal the deal between Vodafone and Three should the pair commit to investing in the UK's mobile phone infrastructure and take steps to protect consumers over pricing.

- Key figures around 1030 GMT -

London - FTSE 100: UP 0.3 percent at 8,204.82 points

Paris - CAC 40: UP 0.1 percent at 7,377.88

Frankfurt - DAX: UP 0.1 percent at 19,170.66

Tokyo - Nikkei 225: UP 1.1 percent at 38,474.90 (close)

Hong Kong - Hang Seng Index: UP 2.1 percent at 21,006.97 (close)

Shanghai - Composite: UP 2.3 percent at 3,386.99 (close)

New York - Dow: DOWN 0.6 percent at 41,794.60 (close)

Euro/dollar: UP at $1.0894 from $1.0878 on Monday

Pound/dollar: UP at $1.2985 from $1.2954

Dollar/yen: UP at 152.20 yen from 152.17 yen

Euro/pound: DOWN at 83.89 from 83.94 pence

Brent North Sea Crude: UP 0.5 percent at $75.48 per barrel

West Texas Intermediate: UP 0.6 percent at $71.86 per barrel

H.Portela--PC