-

Jurgen Klopp to target player welfare in Red Bull role

Jurgen Klopp to target player welfare in Red Bull role

-

Volkswagen sees 'painful' cost cuts ahead as profit plunges

-

Spain races to save victims as floods kill 62

Spain races to save victims as floods kill 62

-

Tuberculosis cases hit record high: WHO

-

Volcanoes 'hidden source' of CO2 in past climate change: study

Volcanoes 'hidden source' of CO2 in past climate change: study

-

Eurozone economy grows faster than expected

-

Mediators to propose Gaza truce amid deadly Israeli strikes

Mediators to propose Gaza truce amid deadly Israeli strikes

-

China's Hisense first sponsor of new Club World Cup

-

Georgia prosecutors probe alleged election 'falsification'

Georgia prosecutors probe alleged election 'falsification'

-

New Zealand's Ajaz 'emotional' on Mumbai return after perfect 10

-

Trump, Harris in frantic campaign push as US election nears

Trump, Harris in frantic campaign push as US election nears

-

Worries for Japan economy after election shock

-

Israel short on soldiers after year of war

Israel short on soldiers after year of war

-

Volkswagen profit plunges on high costs, Chinese slump

-

De Zorzi out for 177 as S.Africa power to 413-5 against Bangladesh

De Zorzi out for 177 as S.Africa power to 413-5 against Bangladesh

-

'CEO of supercute': Hello Kitty turns 50

-

Australia head coach McDonald handed new deal until 2027

Australia head coach McDonald handed new deal until 2027

-

Visual artist grabs 'decisive moment' to nurture Chad art scene

-

Industrial slump leaves Germany on brink of recession

Industrial slump leaves Germany on brink of recession

-

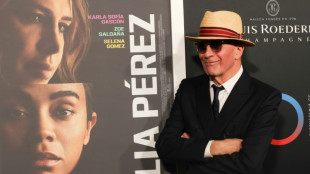

'I'm terrified': French auteur Audiard hits Oscars trail for 'Emilia Perez'

-

New Indonesia defence chief harks back to dictator's rule

New Indonesia defence chief harks back to dictator's rule

-

In Tennessee, the despair of gun control advocates

-

US economy's solid growth unlikely to register at ballot box

US economy's solid growth unlikely to register at ballot box

-

'A treasure': Japan's Ohtani a hometown hero win or lose in World Series

-

Botswana votes with ruling party seeking to extend six decades of power

Botswana votes with ruling party seeking to extend six decades of power

-

Bitcoin close to record as cautious markets eye US election

-

Hometown hero Volpe lives dream with grand slam for Yankees

Hometown hero Volpe lives dream with grand slam for Yankees

-

Rested relief pitchers please Roberts even after Dodgers defeat

-

UK's Labour govt prepares to deliver decisive first budget

UK's Labour govt prepares to deliver decisive first budget

-

Volpe's grand slam helps Yankees avoid World Series sweep

-

Taiwan battens down for Super Typhoon Kong-rey

Taiwan battens down for Super Typhoon Kong-rey

-

MotoGP world title in sight as Martin, Bagnaia set for Sepang duel

-

'New wave' as start-up sweeps up Thai ocean plastic

'New wave' as start-up sweeps up Thai ocean plastic

-

Botswana votes with ruling party aiming to extend six decades of power

-

How harmful are microplastics to human health?

How harmful are microplastics to human health?

-

Are bioplastics really the wonder alternative to petro plastics?

-

Rumble in the Jungle remembered after 50 years

Rumble in the Jungle remembered after 50 years

-

Trump risks backlash with anti-trans ads targeting Harris

-

Alzheimer's patient 'relieved' at Quebec's assisted suicide policy shift

Alzheimer's patient 'relieved' at Quebec's assisted suicide policy shift

-

Who should get paid for nature's sequenced genes?

-

Bodies found as torrential rains slam Spain

Bodies found as torrential rains slam Spain

-

Climate change driving 'record threats to health': report

-

Harris warns of 'obsessed' Trump power grab at mass Washington rally

Harris warns of 'obsessed' Trump power grab at mass Washington rally

-

Southampton, Brentford scrape into League Cup quarter-finals

-

PGA players council seeks smaller fields, fewer full tour spots

PGA players council seeks smaller fields, fewer full tour spots

-

Napoli extend lead at top of Serie A with win at AC Milan

-

Jennifer Lopez to boost Harris at glitzy Las Vegas event

Jennifer Lopez to boost Harris at glitzy Las Vegas event

-

Global stocks mixed as markets await Big Tech results

-

Three-person crew blasts off for China's Tiangong space station

Three-person crew blasts off for China's Tiangong space station

-

Google reports strong growth driven by AI, Cloud

| RBGPF | 100% | 62.35 | $ | |

| CMSC | -0.65% | 24.57 | $ | |

| SCS | -3.11% | 12.21 | $ | |

| NGG | -1.35% | 65.12 | $ | |

| BCC | -5.3% | 131.64 | $ | |

| GSK | 0.76% | 38.17 | $ | |

| AZN | -1.05% | 75.22 | $ | |

| BTI | -1.31% | 34.46 | $ | |

| RELX | -0.52% | 47.91 | $ | |

| RIO | 0.6% | 66.58 | $ | |

| RYCEF | 0.55% | 7.25 | $ | |

| BCE | -0.71% | 32.46 | $ | |

| JRI | -0.69% | 12.98 | $ | |

| CMSD | -0.16% | 24.84 | $ | |

| VOD | -2.8% | 9.28 | $ | |

| BP | -5.76% | 29.36 | $ |

Oil prices jump, Europe stocks sink on Ukraine invasion

World oil prices rallied and European equities sank Tuesday with investors unnerved by key crude producer Russia's attack on Ukraine.

Brent oil surged more than five percent to top $103 per barrel and approach recent 2014 peaks, on the eve of a key output meeting of OPEC and non-member producers including Russia.

Frankfurt and Paris stock markets meanwhile accelerated losses to shed around three percent in early afternoon deals.

London slid 1.4 percent, as investors shrugged off Asian gains.

"European stocks are once again heading lower with Russia/Ukraine headlines continuing to hurt sentiment," City Index analyst Fiona Cincotta told AFP.

"Losses on the FTSE are modest, thanks to a strong performance from resource stocks, as commodity prices rise."

Frankfurt's steeper losses were "unsurprising given Germany's reliance on Russian energy", she added.

Bitcoin gained five percent to $43,603 with strong support for the world's most popular cryptocurrency in Russia, where many investors are seeking shelter from the nation's sanctions-ravaged economy.

Key European stocks indices had also fallen Monday after world powers imposed new sanctions on Russia.

With no let-up in the assault on its neighbour, Russia has been pummelled by a series of widespread and debilitating sanctions.

The measures have sent the ruble crashing to a record low, hammered Russia's stock market and forced the central bank to more than double interest rates to 20 percent.

The Moscow Stock Exchange remained shut on Tuesday in an attempt by authorities to stave off another widely expected dramatic sell-off.

The crisis has also ramped up fears about supplies of crucial commodities from the region including wheat and nickel but particularly crude, just as demand surges owing to economic reopenings.

The conflict provides an extra headache for global central banks, who will likely have to recalibrate their plans to tighten monetary policy as they try to support their economies.

Back in London, Shell's share price dipped 0.7 percent after the energy major announced it would sell its stake in all joint ventures with Gazprom, following Russia's invasion of Ukraine.

The news came after rival energy titan BP also signalled its exit from Russia.

TotalEnergies on Tuesday said while it would stop providing capital for new projects in Russia, the French giant was not withdrawing from current projects in the country.

Nevertheless, "there has been a mass exodus by Western companies from Russia in recent days as the Kremlin looks increasingly isolated and fragile", said Hargreaves Lansdown analyst Sophie Lund-Yates.

"It is clear that while most pain will be felt by Moscow, these decisions will weigh on European businesses too, which will come through in their next quarterly results," she noted.

- Key figures around 1145 GMT -

Brent North Sea crude: UP 5.3 percent at $103.22 per barrel

West Texas Intermediate: UP 3.4 percent at $98.96 per barrel

London - FTSE 100: DOWN 1.3 percent at 7,365.10 points

Frankfurt - DAX: DOWN 2.7 percent at 14,072.50

Paris - CAC 40: DOWN 3.0 percent at 6,456.29

EURO STOXX 50: DOWN 3.0 percent at 3,807.39

Tokyo - Nikkei 225: UP 1.2 percent at 26,844.72 (close)

Hong Kong - Hang Seng Index: UP 0.2 percent at 22,761.71 (close)

Shanghai - Composite: UP 0.8 percent at 3,488.83 (close)

New York - Dow: DOWN 0.5 percent at 33,892.60 (close)

Euro/dollar: DOWN at $1.1189 from $1.1219 late Monday

Pound/dollar: DOWN at $1.3413 from $1.3420

Euro/pound: DOWN at 83.31 pence from 83.60 pence

Dollar/yen: DOWN at 114.78 yen from 115.00 yen

M.Gameiro--PC