-

Syrian medics say were coerced into false chemical attack testimony

Syrian medics say were coerced into false chemical attack testimony

-

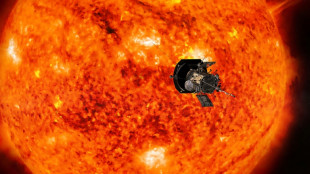

NASA solar probe to make its closest ever pass of Sun

-

London toy 'shop' window where nothing is for sale

London toy 'shop' window where nothing is for sale

-

Volkswagen boss hails cost-cutting deal but shares fall

-

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

-

Global stock markets mostly higher

-

Not for sale. Greenland shrugs off Trump's new push

Not for sale. Greenland shrugs off Trump's new push

-

Acid complicates search after deadly Brazil bridge collapse

-

Norwegian Haugan dazzles in men's World Cup slalom win

Norwegian Haugan dazzles in men's World Cup slalom win

-

Arsenal's Saka out for 'many weeks' with hamstring injury

-

Mali singer Traore child custody case postponed

Mali singer Traore child custody case postponed

-

France mourns Mayotte victims amid uncertainy over government

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

African players in Europe: Salah leads Golden Boot race after brace

-

German far-right AfD to march in city hit by Christmas market attack

German far-right AfD to march in city hit by Christmas market attack

-

Ireland centre Henshaw signs IRFU contract extension

-

Bangladesh launches $5bn graft probe into Hasina's family

Bangladesh launches $5bn graft probe into Hasina's family

-

US probes China chip industry on 'anticompetitive' concerns

-

Biden commutes sentences for 37 of 40 federal death row inmates

Biden commutes sentences for 37 of 40 federal death row inmates

-

Clock ticks down on France government nomination

-

Mozambique on edge as judges rule on disputed election

Mozambique on edge as judges rule on disputed election

-

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

Honda and Nissan to launch merger talks

-

Police arrest suspect who set woman on fire in New York subway

-

China vows 'cooperation' over ship linked to severed Baltic Sea cables

China vows 'cooperation' over ship linked to severed Baltic Sea cables

-

Australian tennis star Purcell provisionally suspended for doping

-

Luxury Western goods line Russian stores, three years into sanctions

Luxury Western goods line Russian stores, three years into sanctions

-

Wallace and Gromit return with comic warning about AI dystopia

-

Philippine military says will acquire US Typhon missile system

Philippine military says will acquire US Typhon missile system

-

Afghan bread, the humble centrepiece of every meal

-

Honda and Nissan expected to begin merger talks

Honda and Nissan expected to begin merger talks

-

'Draconian' Vietnam internet law heightens free speech fears

-

Israeli women mobilise against ultra-Orthodox military exemptions

Israeli women mobilise against ultra-Orthodox military exemptions

-

Asian markets track Wall St rally as US inflation eases rate worries

-

Tens of thousands protest in Serbian capital over fatal train station accident

Tens of thousands protest in Serbian capital over fatal train station accident

-

Trump vows to 'stop transgender lunacy' as a top priority

-

'Who's next?': Misinformation and online threats after US CEO slaying

'Who's next?': Misinformation and online threats after US CEO slaying

-

Only 12 trucks delivered food, water in North Gaza Governorate since October: Oxfam

-

Beyond Work Unveils Next-Generation Memory-Augmented AI Agent (MATRIX) for Enterprise Document Intelligence

Beyond Work Unveils Next-Generation Memory-Augmented AI Agent (MATRIX) for Enterprise Document Intelligence

-

Langers edge Tiger and son Charlie in PNC Championship playoff

-

Explosive batsman Jacobs gets New Zealand call-up for Sri Lanka series

Explosive batsman Jacobs gets New Zealand call-up for Sri Lanka series

-

Holders PSG edge through on penalties in French Cup

-

Daniels throw five TDs as Commanders down Eagles

Daniels throw five TDs as Commanders down Eagles

-

Atalanta fight back to take top spot in Serie A, Roma hit five

-

Mancini admits regrets over leaving Italy for Saudi Arabia

Mancini admits regrets over leaving Italy for Saudi Arabia

-

Run machine Ayub shines as Pakistan sweep South Africa

-

Slovak PM Fico on surprise visit to Kremlin

Slovak PM Fico on surprise visit to Kremlin

-

'Incredible' Liverpool must stay focused: Slot

-

Maresca 'absolutely happy' as title-chasing Chelsea drop points in Everton draw

Maresca 'absolutely happy' as title-chasing Chelsea drop points in Everton draw

-

Salah happy wherever career ends after inspiring Liverpool rout

Carbon credits 'ineffective', says corporate climate watchdog

The world's top judge of corporate climate action on Tuesday described carbon credits as "ineffective" at addressing global warming and a risk for companies trying to reach net zero targets.

The use of credits by companies to make claims of carbon neutrality has long been challenged and the findings by the influential Science Based Targets Initiative (SBTi) were much anticipated.

SBTi is the gold standard for assessing the net zero plans of big businesses and the tick of approval allows companies to say their climate pledges align with science.

But the nonprofit, which is backed by the UN and WWF, sparked a staff revolt in April when it proposed allowing companies to use more carbon credits to meet their climate goals.

In response to demands that the CEO and board resign, SBTi promised to review third-party literature on carbon credits and present its expert findings in July.

On Tuesday, it said the evidence "suggests that various types of carbon credits are ineffective" and that using such offsets poses "clear risks" for companies.

"This includes potential unintended effects of hindering the net-zero transformation," stated one of the reports published on the SBTi website on Tuesday.

There was no evidence submitted to the review "that identified characteristics or operating conditions associated with effective carbon credits and projects", it added.

"The evaluation of evidence of carbon credit effectiveness reinforces what many academics have been saying for decades: carbon credits of any sort should not be used to compensate for fossil emissions," said Doreen Stabinsky, who sits on SBTI's technical council, an independent advisory body.

Carbon credits are supposed to help tackle global warming by funding activities that reduce or avoid the release of planet-heating emissions, such as protecting tropical forests or peatlands.

Critics say they allow companies that buy them to keep polluting without taking the necessary steps to clean up their act.

SBTi had taken a narrow view on carbon credits, requiring companies take action first to reduce their greenhouse gas output, and only turn to offsets for the remaining, hardest-to-cut emissions.

Then in April, its board flagged relaxing these rules in regards to offsetting Scope 3 emissions, which occur in the value chain, and represent the lion's share of the carbon footprints of most companies.

The proposal was seen as a major shift for a widely respected organisation that has verified the climate pledges of nearly 5,800 companies and financial institutions.

Gilles Dufrasne from Carbon Market Watch, a think tank, said SBTi's reviewed position was a "clear rebuttal" of its earlier move.

"This paper sets the record straight for SBTi, and is proof that SBTi staff are performing high-quality, unbiased work," he said in a statement.

SBTI's chief executive stepped down in July citing personal reasons.

The initiative plans to publish a draft update to its overall net zero corporate standards in late 2024, and said its guidance remained unchanged until then.

P.Cavaco--PC