-

Netflix with Beyonce make splash despite NFL ratings fall

Netflix with Beyonce make splash despite NFL ratings fall

-

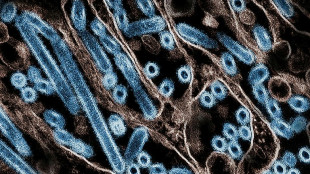

Bird flu mutated inside US patient, raising concern

-

Slovakia says ready to host Russia-Ukraine peace talks

Slovakia says ready to host Russia-Ukraine peace talks

-

Maresca challenges Chelsea to react to Fulham blow

-

Tech slump slays Santa rally, weak yen lifts Japan stocks higher

Tech slump slays Santa rally, weak yen lifts Japan stocks higher

-

Test records for Zimbabwe and Williams as Afghanistan toil

-

LawConnect wins punishing Sydney-Hobart yacht race

LawConnect wins punishing Sydney-Hobart yacht race

-

Barca's Yamal vows to 'come back better' after ankle injury

-

Olmo closer to Barcelona exit after registration request rejected

Olmo closer to Barcelona exit after registration request rejected

-

Watching the sun rise over a new Damascus

-

Malaysia man flogged in mosque for crime of gender mixing

Malaysia man flogged in mosque for crime of gender mixing

-

Montenegro to extradite crypto entrepreneur Do Kwon to US

-

Brazil views labor violations at BYD site as human 'trafficking'

Brazil views labor violations at BYD site as human 'trafficking'

-

No extra pressure for Slot as Premier League leaders Liverpool pull clear

-

Tourists return to post-Olympic Paris for holiday magic

Tourists return to post-Olympic Paris for holiday magic

-

'Football harder than Prime Minister' comment was joke, says Postecoglou

-

Driver who killed 35 in China car ramming sentenced to death

Driver who killed 35 in China car ramming sentenced to death

-

Bosch gives South Africa 90-run lead against Pakistan

-

French skier Sarrazin 'conscious' after training crash

French skier Sarrazin 'conscious' after training crash

-

NATO to boost military presence in Baltic after cables 'sabotage'

-

Howe hopes Newcastle have 'moved on' in last two seasons

Howe hopes Newcastle have 'moved on' in last two seasons

-

German president dissolves parliament, sets Feb 23 election date

-

Slot says 'too early' for Liverpool title talk

Slot says 'too early' for Liverpool title talk

-

Mayotte faces environment, biodiversity crisis after cyclone

-

Amorm says 'survival' aim for Man Utd after Wolves loss

Amorm says 'survival' aim for Man Utd after Wolves loss

-

Desertions spark panic, and pardons, in Ukraine's army

-

China sanctions US firms over Taiwan military support

China sanctions US firms over Taiwan military support

-

World number six Rybakina makes winning start at United Cup

-

Israeli strikes hit Yemen airport as WHO chief prepares to leave

Israeli strikes hit Yemen airport as WHO chief prepares to leave

-

Swiatek not expecting WADA appeal over doping scandal

-

'Dangerous new era': climate change spurs disaster in 2024

'Dangerous new era': climate change spurs disaster in 2024

-

Fritz motivated for Slam success after low-key off-season

-

Move over Mercedes: Chinese cars grab Mexican market share

Move over Mercedes: Chinese cars grab Mexican market share

-

Zverev aiming to challenge Sinner for top ranking

-

N. Korean soldier captured in Russia-Ukraine war: Seoul

N. Korean soldier captured in Russia-Ukraine war: Seoul

-

Inspired Tsitsipas looking to 'refresh, regroup' in Australia

-

Seahawks edge Bears to boost NFL playoff hopes

Seahawks edge Bears to boost NFL playoff hopes

-

Thunder NBA win streak at nine as Shai ties career high with 45

-

India announces state funeral for ex-PM Manmohan Singh

India announces state funeral for ex-PM Manmohan Singh

-

Japan govt approves record budget for ageing population, defence

-

Japanese shares gain on weaker yen after Christmas break

Japanese shares gain on weaker yen after Christmas break

-

South Korea's acting president faces impeachment vote

-

Fleeing Myanmar, Rohingya refugees recall horror of war

Fleeing Myanmar, Rohingya refugees recall horror of war

-

Smith century puts Australia in control of 4th Test against India

-

Israeli strikes hit Yemen as Netanyahu fires warning

Israeli strikes hit Yemen as Netanyahu fires warning

-

Peru ex-official denies running Congress prostitution ring

-

Australia's Smith reaches 34th Test century

Australia's Smith reaches 34th Test century

-

NHL Red Wings fire Lalonde and name McLellan as head coach

-

The Bilingual Book Company Launches New, Innovative Bilingual Audiobook App

The Bilingual Book Company Launches New, Innovative Bilingual Audiobook App

-

Injured Halep withdraws from Australian Open

| CMSC | -0.55% | 23.53 | $ | |

| RIO | -0.62% | 58.885 | $ | |

| JRI | -0.91% | 12.09 | $ | |

| BCC | -1.92% | 120.61 | $ | |

| SCS | 0.63% | 11.975 | $ | |

| RBGPF | -1.17% | 59.8 | $ | |

| NGG | 0.56% | 59.25 | $ | |

| RYCEF | -0.69% | 7.2 | $ | |

| BCE | -1.01% | 22.642 | $ | |

| GSK | -0.27% | 34.029 | $ | |

| BTI | -0.4% | 36.285 | $ | |

| VOD | 0.12% | 8.43 | $ | |

| CMSD | -0.46% | 23.3691 | $ | |

| RELX | -0.64% | 45.57 | $ | |

| AZN | -0.51% | 66.18 | $ | |

| BP | 0.33% | 28.945 | $ |

Japanese shares gain on weaker yen after Christmas break

Japanese stocks rose Friday on a weaker yen after a muted day on Wall Street following the Christmas holiday.

Japan's key Nikkei index was up more than 1 percent in morning trade, after the yen hit 158.08 per US dollar on Thursday evening -- its lowest level in almost six months.

The Nikkei had closed up 1.1. percent on Thursday, boosted by comments from the Bank of Japan chief and share price gains for top-selling automaker Toyota.

"Today's Japanese market is expected to start with an upswing, continuing the upward momentum of the previous day's Japanese market, driven by the weak yen, while the US market was slightly mixed," said Kosuke Oka, an analyst at Monex Securities.

The yen was "marginally stronger" on Friday, Bloomberg reported, after data showed inflation in Tokyo rose for a second month in December.

Other positive figures from Japan showed industrial production declined less than expected in November while retail sales came in higher than estimated last month.

With the country's unemployment rate holding at 2.5 percent in November -- low by international standards but slightly above Japan's pre-pandemic average -- Moody's Analytics said Friday that the data confirmed their view that "employment conditions are wobbly".

Investor attention is now focused "on whether the Nikkei average will expand its rise to recover to the 40,000 points range by the end of the year", added Oka from Monex.

Bank of Japan (BoJ) Governor Kazuo Ueda had bewildered observers last week by suggesting a prolonged pause in the institution's monetary policy tightening, in the face of domestic and international economic uncertainties, which had sent the Japanese currency tumbling.

On Wednesday, Ueda said rates would be "adjusted" if the situation continued to improve on the economic and price fronts, leaving investors without a clear signal on a possible interest rate hike and contributing to the yen's slide.

"With the calendar year winding down and little in the way of tier-one economic data, the market is content mainly to drift until something shakes it from its slumber -- likely a late-year squeeze or perhaps a Trump-driven shift in global economic sentiment," said Stephen Innes from SPI Asset Management, ahead of US President-elect Donald Trump retaking the White House in January.

In New York on Thursday, major indices veered in and out of positive territory in a sleepy post-Christmas session. The broad-based S&P 500 finished down less than 0.1 percent.

Large tech companies that have led the market in much of 2024 mostly took a breather, including Netflix, Tesla and Amazon, which all declined.

In Asia, Hong Kong and Shanghai were down Friday morning.

Seoul dropped about 1.5 percent as South Korea struggles to shake off political turmoil sparked by suspended President Yoon Suk Yeol's martial law declaration that shocked the world early this month.

Sydney, Wellington and Taipei rose.

Key figures around 0230 GMT -

Tokyo - Nikkei 225: UP 1.3 percent at 40,065.55 points

Hang Seng: DOWN 0.2 percent at 20,051.15

Shanghai - Composite: DOWN 0.1 percent at 3,394.87

Euro/dollar: DOWN at $1.0409 from $1.0424 on Thursday

Pound/dollar: DOWN at $1.2521 from $1.2526

Dollar/yen: DOWN at 157.59 yen from 158.00 yen

Euro/pound: DOWN at 83.14 pence from 83.19 pence

West Texas Intermediate: FLAT at $69.62 per barrel

Brent North Sea Crude: FLAT at $73.25 per barrel

New York - Dow: UP 0.1 percent at 43,325.80 (close)

P.Queiroz--PC