-

Mexico says Trump tariffs would cost 400,000 US jobs

Mexico says Trump tariffs would cost 400,000 US jobs

-

Car-centric Saudi to open first part of Riyadh Metro

-

Brussels, not Paris, will decide EU-Mercosur trade deal: Lula

Brussels, not Paris, will decide EU-Mercosur trade deal: Lula

-

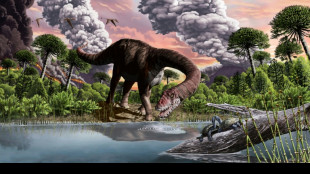

Faeces, vomit offer clues to how dinosaurs rose to rule Earth

-

Ruby slippers from 'The Wizard of Oz' up for auction

Ruby slippers from 'The Wizard of Oz' up for auction

-

Spain factory explosion kills three, injures seven

-

US Fed's favored inflation gauge ticks up in October

US Fed's favored inflation gauge ticks up in October

-

Defence lawyers plead to judges in French mass rape trial

-

US says China releases three 'wrongfully detained' Americans

US says China releases three 'wrongfully detained' Americans

-

Romania officials to meet over 'cyber risks' to elections

-

Chelsea visit next stop in Heidenheim's 'unthinkable' rise

Chelsea visit next stop in Heidenheim's 'unthinkable' rise

-

Former England prop Marler announces retirement from rugby

-

Kumara gives Sri Lanka edge on rain-hit day against South Africa

Kumara gives Sri Lanka edge on rain-hit day against South Africa

-

Namibia votes with ruling party facing toughest race yet

-

Spurs goalkeeper Vicario out for 'months' with broken ankle

Spurs goalkeeper Vicario out for 'months' with broken ankle

-

Moscow expels German journalists, Berlin denies closing Russia TV bureau

-

Spain govt defends flood response and offers new aid

Spain govt defends flood response and offers new aid

-

France says Netanyahu has 'immunity' from ICC warrants

-

Nigerian state visit signals shift in France's Africa strategy

Nigerian state visit signals shift in France's Africa strategy

-

Tens of thousands in Lebanon head home as Israel-Hezbollah truce takes hold

-

Opposition candidates killed in Tanzania local election

Opposition candidates killed in Tanzania local election

-

Amorim eyes victory in first Man Utd home game to kickstart new era

-

Fresh fury as Mozambique police mow down protester

Fresh fury as Mozambique police mow down protester

-

Defeat at Liverpool could end Man City title hopes, says Gundogan

-

Indonesians vote in regional election seen as test for Prabowo

Indonesians vote in regional election seen as test for Prabowo

-

Guardiola says no intent to 'make light' of self harm in post-match comments

-

Opposition figures killed as Tanzania holds local election

Opposition figures killed as Tanzania holds local election

-

Taiwan Olympic boxing champion quits event after gender questions

-

European stocks drop on Trump trade war worries

European stocks drop on Trump trade war worries

-

Volkswagen to sell operations in China's Xinjiang

-

FA probes referee David Coote over betting claim

FA probes referee David Coote over betting claim

-

Serbia gripped by TV series about murder of prime minister

-

Putin seeks to shore up ties on visit to 'friendly' Kazakhstan

Putin seeks to shore up ties on visit to 'friendly' Kazakhstan

-

Plastic pollution talks must speed up, chair warns

-

Pakistan web controls quash dissent and potential

Pakistan web controls quash dissent and potential

-

1,000 Pakistan protesters arrested in pro-Khan capital march

-

ICC prosecutor seeks arrest warrant for Myanmar junta chief

ICC prosecutor seeks arrest warrant for Myanmar junta chief

-

Philippine VP's bodyguards swapped out amid investigation

-

EasyJet annual profit rises 40% on package holidays

EasyJet annual profit rises 40% on package holidays

-

Ukraine sees influx of Western war tourists

-

Greeks finally get Thessaloniki metro after two-decade wait

Greeks finally get Thessaloniki metro after two-decade wait

-

New EU commission to get all clear with big push on defence and economy

-

Australia takes step to ban under 16s from social media

Australia takes step to ban under 16s from social media

-

Volkswagen says to sell operations in China's Xinjiang

-

Japan prosecutor bows in apology to former death row inmate

Japan prosecutor bows in apology to former death row inmate

-

Thailand to return nearly 1,000 trafficked lemurs, tortoises to Madagascar

-

Namibia votes with ruling party facing its toughest race yet

Namibia votes with ruling party facing its toughest race yet

-

Indian protest wrestler given four-year ban for avoiding dope test

-

UK parliament to debate assisted dying law

UK parliament to debate assisted dying law

-

Ireland has a cultural moment, from rock and books to cinema

US Fed's favored inflation gauge ticks up in October

US inflation -- set to be a key issue for incoming president Donald Trump -- accelerated slightly last month, according to data published Wednesday, underscoring price pressures in the world's largest economy.

The personal consumption expenditures (PCE) price index rose 2.3 percent in the 12 months to October, up from 2.1 percent in September, the Commerce Department announced in a statement.

This was in line with the median forecast from economists surveyed by Dow Jones Newswires and The Wall Street Journal.

Despite the small uptick last month, headline PCE inflation remains close to the Fed's long-term target of two percent, keeping the bank's inflation fight largely on track.

The Fed -- the independent US central bank -- is responsible for tackling inflation and unemployment, largely by hiking or lowering interest rates to affect demand.

This indirectly impacts the cost of borrowing for consumers and businesses, affecting everything from mortgages to car loans.

"What I think, particularly from a market perspective, catches your eye is that the inflation readings came in right as expected," Nationwide chief economist Kathy Bostjancic told AFP.

"Those readings are encouraging enough, in our opinion, for the Federal Reserve to go ahead and cut rates 25 basis points next month," she added. "But you know, it's still a close call."

- Rise in healthcare costs -

The increase in inflation was driven by the services sector, where prices increased by 3.9 percent from a year earlier. Goods prices decreased 1.0 percent over the same period.

The largest contributor to the increase was healthcare, a category that includes both hospitals and outpatient services, the Commerce Department said.

On a monthly basis, the PCE price index rose 0.2 percent between September and October, the same as the month prior, the Commerce Department said. This was also in line with expectations.

Excluding the volatile food and energy segments, the core PCE price index was up 2.8 percent from a year earlier, and by 0.3 percent from a month earlier.

Personal income rose 0.6 percent month-on-month, an acceleration from September, when it rose by 0.3 percent.

The rate of personal saving as a percentage of disposable income rose to 4.4 percent, up slightly from a revised figure of 4.1 percent a month earlier.

This indicates that consumers saved more of their money last month than they did in September.

- Trump and the Fed -

Trump's victory in the presidential election on November 5 has been broadly welcomed in the financial markets, but there have also been some concerns that his widely-pledged rise in tariffs could prove to be inflationary.

In a worst-case scenario, this could force the Fed to keep interest rates higher than they otherwise would be, which could hit consumers in the pocket.

Futures traders currently see a roughly 70 percent chance that the Fed will cut rates by a quarter of a percentage point next month, up slightly from last week, according to data from CME Group.

But next year, some analysts think the Fed could move more cautiously as it awaits the outcome of Trump's economic policies.

"We now think that there's likely to be three 25 basis point rate cuts" in 2025, said Bostjancic from Nationwide.

"Previously, we were actually looking for 125 basis points," she added. "So, you know, we did pair that back."

"We think the FOMC can pause in December on data like this, urging a wait-and-see approach to cutting rates gradually," economists at high Frequency Economics wrote in a note to clients, referring to the rate-setting Federal Open Market Committee.

A.Motta--PC