-

Special counsel asks judge to dismiss subversion case against Trump

Special counsel asks judge to dismiss subversion case against Trump

-

Ronaldo double takes Al Nassr to brink of Asian Champions League quarters

-

Brazil minister says supports meat supplier 'boycott' of Carrefour

Brazil minister says supports meat supplier 'boycott' of Carrefour

-

Steelmaker ArcelorMittal to close two plants in France: unions

-

Macy's says employee hid up to $154 mn in costs over 3 years

Macy's says employee hid up to $154 mn in costs over 3 years

-

EU grocery shoppers 'fooled' by 'maze' of food labels: audit

-

Awaiting Commerzbank, Italy's UniCredit bids for Italian rival

Awaiting Commerzbank, Italy's UniCredit bids for Italian rival

-

Alonso jokes about playing return amid Leverkusen injury woes

-

G7 ministers discuss ceasefire efforts in Mideast

G7 ministers discuss ceasefire efforts in Mideast

-

Bayern need to win all remaining Champions League games, says Kane

-

Indian cricketer, 13, youngest to be sold in IPL history

Indian cricketer, 13, youngest to be sold in IPL history

-

Beating Man City eases pressure for Arsenal game: new Sporting coach

-

Argentine court hears bid to end rape case against French rugby players

Argentine court hears bid to end rape case against French rugby players

-

Egypt says 17 missing after Red Sea tourist boat capsizes

-

Dortmund boss calls for member vote on club's arms sponsorship deal

Dortmund boss calls for member vote on club's arms sponsorship deal

-

Chanel family matriarch dies aged 99: company

-

US boss Hayes says Chelsea stress made her 'unwell'

US boss Hayes says Chelsea stress made her 'unwell'

-

China's Ding beats 'nervous' Gukesh in world chess opener

-

Man City can still do 'very good things' despite slump, says Guardiola

Man City can still do 'very good things' despite slump, says Guardiola

-

'After Mazan': France unveils new measures to combat violence against women

-

Scholz named party's top candidate for German elections

Scholz named party's top candidate for German elections

-

Flick says Barca must eliminate mistakes after stumble

-

British business group hits out at Labour's tax hikes

British business group hits out at Labour's tax hikes

-

German Social Democrats name Scholz as top candidate for snap polls

-

Fresh strikes, clashes in Lebanon after ceasefire calls

Fresh strikes, clashes in Lebanon after ceasefire calls

-

Russia and Ukraine trade aerial attacks amid escalation fears

-

Georgia parliament convenes amid legitimacy crisis

Georgia parliament convenes amid legitimacy crisis

-

Plastic pollution talks must not fail: UN environment chief

-

Beeches thrive in France's Verdun in flight from climate change

Beeches thrive in France's Verdun in flight from climate change

-

UAE names Uzbek suspects in Israeli rabbi's murder

-

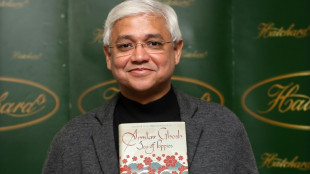

Indian author Ghosh wins top Dutch prize

Indian author Ghosh wins top Dutch prize

-

Real Madrid star Vinicius out of Liverpool clash with hamstring injury

-

For Ceyda: A Turkish mum's fight for justice for murdered daughter

For Ceyda: A Turkish mum's fight for justice for murdered daughter

-

Bestselling 'Woman of Substance' author Barbara Taylor Bradford dies aged 91

-

Ukraine drones hit Russian oil energy facility: Kyiv source

Ukraine drones hit Russian oil energy facility: Kyiv source

-

Maximum term demanded in French rape trial for husband who drugged wife

-

Salah feels 'more out than in' with no new Liverpool deal on table

Salah feels 'more out than in' with no new Liverpool deal on table

-

Pro-Russia candidate leads Romanian polls, PM out of the race

-

Taiwan fighter jets to escort winning baseball team home

Taiwan fighter jets to escort winning baseball team home

-

DHL cargo plane crashes in Lithuania, killing one

-

Le Pen meets PM as French government wobbles

Le Pen meets PM as French government wobbles

-

From serious car crash to IPL record for 'remarkable' Pant

-

Philippine VP Duterte 'mastermind' of assassination plot: justice department

Philippine VP Duterte 'mastermind' of assassination plot: justice department

-

India two wickets away from winning first Australia Test

-

39 foreigners flee Myanmar scam centre: Thai police

39 foreigners flee Myanmar scam centre: Thai police

-

As baboons become bolder, Cape Town battles for solutions

-

Uruguay's Orsi: from the classroom to the presidency

Uruguay's Orsi: from the classroom to the presidency

-

UN chief slams landmine threat days after US decision to supply Ukraine

-

Sporting hope for life after Amorim in Arsenal Champions League clash

Sporting hope for life after Amorim in Arsenal Champions League clash

-

Head defiant as India sense victory in first Australia Test

Awaiting Commerzbank, Italy's UniCredit bids for Italian rival

With its plans for Germany's Commerzbank seemingly stalled, UniCredit, Italy's second-largest lender, launched Monday a bid to buy its rival BPM for 10.1 billion euros ($10.6 billion).

But Prime Minister Giorgia Meloni's government was quick to pour cold water on the deal, saying it had not agreed and raising the possibility of using the government's so-called "golden power", which allows it to block takeovers in strategic sectors of the economy.

Before Monday's bid, speculation had been rife about a tie-up between Banco BPM and Monte dei Paschi di Siena (MPS), which could challenge UniCredit and Italy's number one bank, Intesa Sanpaolo.

UniCredit Chief Executive Andrea Orcel said Monday that after his bank's aborted attempts to buy MPS came to an end three years ago, it had "no ambitions" for it now.

By contrast, UniCredit's bid for Banco BPM -- Italy's third-biggest bank -- would create "an even stronger number 2 bank in an attractive market generating significant long-term value for all stakeholders and for Italy", the lender said in a statement.

If it secures regulatory approval, UniCredit hopes to be able to complete the deal by June 2025.

Yet Italian Economy Minister Giancarlo Giorgetti said the bid had been "communicated but not agreed with the government".

The government would make an assessment, he said, noting that "the golden power exists".

- Bigger banks -

UniCredit valued BPM shares at around 6.657 euros each, about 0.5 percent above Friday's closing price -- not enough, according to Equita analysts.

BPM shares rose more than five percent on the Milan Stock Exchange on Monday, to 6.988 euros at around 1600 GMT -- a sign that investors expect UniCredit will have to increase its bid to secure a deal.

Conversely, UniCredit stock fell more than five percent to 36.14 euros.

"Europe needs stronger, bigger banks to help it develop its economy and help it compete against the other major economic blocs," Orcel said in a statement.

UniCredit surprised markets and Berlin in September when it announced it had built a significant stake in Commerzbank, Germany's second-largest lender, fuelling speculation of a takeover bid.

Germany's new finance minister, Joerg Kukies, scolded UniCredit last week for acting "aggressively" and using "unfriendly methods".

He said that "hostile takeovers are not what we need for stable banks in Europe and in Germany".

Kukies was appointed after Chancellor Olaf Scholz fired his predecessor, an act that brought Germany's government coalition crashing down, precipitating general elections set for February 23.

Orcel said earlier this month that UniCredit would need a year to decide on the Commerzbank deal, and on Monday insisted: "We need to be patient and give everyone the time to deliberate."

"We would only proceed if certain conditions are achieved, which requires a change of position of certain counterparts," he said in a call with analysts.

O.Gaspar--PC