-

The real-life violence that inspired South Korea's 'Squid Game'

The real-life violence that inspired South Korea's 'Squid Game'

-

Blogs to Bluesky: social media shifts responses after 2004 tsunami

-

Tennis power couple de Minaur and Boulter get engaged

Tennis power couple de Minaur and Boulter get engaged

-

Supermaxi yachts eye record in gruelling Sydney-Hobart race

-

Hawaii's Kilauea volcano erupts, spewing columns of lava

Hawaii's Kilauea volcano erupts, spewing columns of lava

-

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

Five things to know about Panama Canal, in Trump's sights

-

NBA fines Minnesota guard Edwards $75,000 for outburst

-

Haitians massacred for practicing voodoo were abducted, hacked to death: UN

Haitians massacred for practicing voodoo were abducted, hacked to death: UN

-

Inter beat Como to keep in touch with leaders Atalanta

-

Man Utd boss Amorim questions 'choices' of Rashford's entourage

Man Utd boss Amorim questions 'choices' of Rashford's entourage

-

Trump's TikTok love raises stakes in battle over app's fate

-

Is he serious? Trump stirs unease with Panama, Greenland ploys

Is he serious? Trump stirs unease with Panama, Greenland ploys

-

England captain Stokes to miss three months with torn hamstring

-

Support grows for Blake Lively over smear campaign claim

Support grows for Blake Lively over smear campaign claim

-

Canada records 50,000 opioid overdose deaths since 2016

-

Jordanian, Qatari envoys hold talks with Syria's new leader

Jordanian, Qatari envoys hold talks with Syria's new leader

-

France's second woman premier makes surprise frontline return

-

France's Macron announces fourth government of the year

France's Macron announces fourth government of the year

-

Netanyahu tells Israel parliament 'some progress' on Gaza hostage deal

-

Guatemalan authorities recover minors taken by sect members

Guatemalan authorities recover minors taken by sect members

-

Germany's far-right AfD holds march after Christmas market attack

-

Serie A basement club Monza fire coach Nesta

Serie A basement club Monza fire coach Nesta

-

Mozambique top court confirms ruling party disputed win

-

Syrian medics say were coerced into false chemical attack testimony

Syrian medics say were coerced into false chemical attack testimony

-

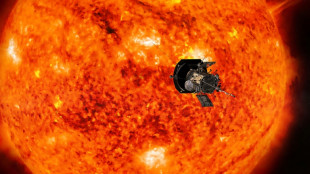

NASA solar probe to make its closest ever pass of Sun

-

London toy 'shop' window where nothing is for sale

London toy 'shop' window where nothing is for sale

-

Volkswagen boss hails cost-cutting deal but shares fall

-

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

-

Global stock markets mostly higher

-

Not for sale. Greenland shrugs off Trump's new push

Not for sale. Greenland shrugs off Trump's new push

-

Acid complicates search after deadly Brazil bridge collapse

-

Norwegian Haugan dazzles in men's World Cup slalom win

Norwegian Haugan dazzles in men's World Cup slalom win

-

Arsenal's Saka out for 'many weeks' with hamstring injury

-

Mali singer Traore child custody case postponed

Mali singer Traore child custody case postponed

-

France mourns Mayotte victims amid uncertainy over government

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

African players in Europe: Salah leads Golden Boot race after brace

-

German far-right AfD to march in city hit by Christmas market attack

German far-right AfD to march in city hit by Christmas market attack

-

Ireland centre Henshaw signs IRFU contract extension

-

Bangladesh launches $5bn graft probe into Hasina's family

Bangladesh launches $5bn graft probe into Hasina's family

-

US probes China chip industry on 'anticompetitive' concerns

-

Biden commutes sentences for 37 of 40 federal death row inmates

Biden commutes sentences for 37 of 40 federal death row inmates

-

Clock ticks down on France government nomination

-

Mozambique on edge as judges rule on disputed election

Mozambique on edge as judges rule on disputed election

-

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

Honda and Nissan to launch merger talks

-

Police arrest suspect who set woman on fire in New York subway

-

China vows 'cooperation' over ship linked to severed Baltic Sea cables

China vows 'cooperation' over ship linked to severed Baltic Sea cables

-

Australian tennis star Purcell provisionally suspended for doping

Linacre Investments Temporarily Caps the Digital Asset Innovation Fund

Linacre Investments Limited, a leading institutional fund manager headquartered in the Isle of Man, has announced a $1 billion cap on its Digital Asset Innovation Fund. The decision comes in response to exceptional demand during the second half of 2024 and aims to ensure effective liquidity management.

Linacre Investments Limited, a leading institutional fund manager headquartered in the Isle of Man, has announced a $1 billion cap on its Digital Asset Innovation Fund. The decision comes in response to exceptional demand during the second half of 2024 and aims to ensure effective liquidity management.

The fund was designed to seize emerging opportunities within the rapidly growing digital asset sector by focusing on digital assets and blockchain-based companies driving innovation. It offers institutional and accredited high-net-worth investors a unique chance to leverage the transformative potential of these technologies. Over the past six months, the fund has experienced extraordinary demand, fueled by the increasing mainstream adoption of digital assets, recent regulatory advancements such as ETF approvals, and the momentum generated by the recent U.S. elections.

Over the past twelve months, the Digital Asset Innovation Fund has delivered record-breaking performance, cementing its reputation as a premier investment vehicle for those seeking exposure to this transformative sector. The fund's success reflects Linacre Investments' strategic expertise and the growing confidence among investors in digital asset opportunities.

In response to this strong demand and to maintain the fund's high performance standards, Linacre Investments has decided to cap the Digital Asset Innovation Fund at $1 billion. This measure will ensure effective management of the fund's portfolio and address liquidity considerations inherent in the digital asset market.

"The Digital Asset Innovation Fund is exclusively designed for institutional investors and accredited high-net-worth individuals, targeting blockchain-based companies and digital assets that are pioneering industry innovation," said Alexander Reeve, Chief Investment Officer at Linacre Investments Limited. "By capping the fund at $1 billion, we can maintain a disciplined approach to portfolio management while continuing to deliver exceptional value for our clients."

While the fund is currently open only to institutional investors and accredited high-net-worth individuals, Linacre Investments is preparing to expand its offerings to retail investors in 2025. This move reflects the company's commitment to broadening access to high-potential investment opportunities and bringing innovative solutions to a wider audience.

Linacre Investments will periodically review the fund's cap in line with market conditions, and liquidity improvements. Future opportunities to reopen the fund to new investors will be evaluated as conditions evolve.

As a leader in private wealth management, Linacre Investments remains dedicated to providing cutting-edge investment solutions tailored to the needs of its global clientele. The company looks forward to updating its investors on the fund's progress and exploring additional opportunities within the digital asset market.

About Linacre Investments Limited

Linacre Investments Limited is a leading institutional fund manager based in the Isle of Man, specializing in private wealth management for institutional investors, multinational corporations, and accredited high-net-worth individuals. With a focus on innovative investment strategies, Linacre Investments leverages its expertise to identify opportunities in disruptive sectors such as private equity, digital assets and blockchain technology.

For media enquiries, please contact:

Mrs. Sarah Bramston (Public Relations Officer)

Linacre Investments Ltd

Email: [email protected]

Web: www.linacreinvestments.com

Tel: +44(0)845 004 7888

Address: Victory House, Prospect Hill, Douglas, IM1 1EQ

SOURCE: Linacre Investments Limited

O.Gaspar--PC