-

Is he serious? Trump stirs unease with Panama, Greenland ploys

Is he serious? Trump stirs unease with Panama, Greenland ploys

-

England captain Stokes to miss three months with torn hamstring

-

Support grows for Blake Lively over smear campaign claim

Support grows for Blake Lively over smear campaign claim

-

Canada records 50,000 opioid overdose deaths since 2016

-

Jordanian, Qatari envoys hold talks with Syria's new leader

Jordanian, Qatari envoys hold talks with Syria's new leader

-

France's second woman premier makes surprise frontline return

-

France's Macron announces fourth government of the year

France's Macron announces fourth government of the year

-

Netanyahu tells Israel parliament 'some progress' on Gaza hostage deal

-

Guatemalan authorities recover minors taken by sect members

Guatemalan authorities recover minors taken by sect members

-

Germany's far-right AfD holds march after Christmas market attack

-

Serie A basement club Monza fire coach Nesta

Serie A basement club Monza fire coach Nesta

-

Mozambique top court confirms ruling party disputed win

-

Syrian medics say were coerced into false chemical attack testimony

Syrian medics say were coerced into false chemical attack testimony

-

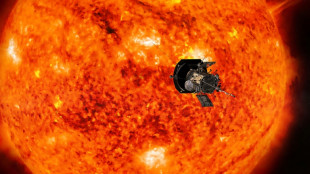

NASA solar probe to make its closest ever pass of Sun

-

London toy 'shop' window where nothing is for sale

London toy 'shop' window where nothing is for sale

-

Volkswagen boss hails cost-cutting deal but shares fall

-

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

-

Global stock markets mostly higher

-

Not for sale. Greenland shrugs off Trump's new push

Not for sale. Greenland shrugs off Trump's new push

-

Acid complicates search after deadly Brazil bridge collapse

-

Norwegian Haugan dazzles in men's World Cup slalom win

Norwegian Haugan dazzles in men's World Cup slalom win

-

Arsenal's Saka out for 'many weeks' with hamstring injury

-

Mali singer Traore child custody case postponed

Mali singer Traore child custody case postponed

-

France mourns Mayotte victims amid uncertainy over government

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

African players in Europe: Salah leads Golden Boot race after brace

-

German far-right AfD to march in city hit by Christmas market attack

German far-right AfD to march in city hit by Christmas market attack

-

Ireland centre Henshaw signs IRFU contract extension

-

Bangladesh launches $5bn graft probe into Hasina's family

Bangladesh launches $5bn graft probe into Hasina's family

-

US probes China chip industry on 'anticompetitive' concerns

-

Biden commutes sentences for 37 of 40 federal death row inmates

Biden commutes sentences for 37 of 40 federal death row inmates

-

Clock ticks down on France government nomination

-

Mozambique on edge as judges rule on disputed election

Mozambique on edge as judges rule on disputed election

-

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

Honda and Nissan to launch merger talks

-

Police arrest suspect who set woman on fire in New York subway

-

China vows 'cooperation' over ship linked to severed Baltic Sea cables

China vows 'cooperation' over ship linked to severed Baltic Sea cables

-

Australian tennis star Purcell provisionally suspended for doping

-

Luxury Western goods line Russian stores, three years into sanctions

Luxury Western goods line Russian stores, three years into sanctions

-

Wallace and Gromit return with comic warning about AI dystopia

-

Philippine military says will acquire US Typhon missile system

Philippine military says will acquire US Typhon missile system

-

Afghan bread, the humble centrepiece of every meal

-

Honda and Nissan expected to begin merger talks

Honda and Nissan expected to begin merger talks

-

'Draconian' Vietnam internet law heightens free speech fears

-

Israeli women mobilise against ultra-Orthodox military exemptions

Israeli women mobilise against ultra-Orthodox military exemptions

-

Asian markets track Wall St rally as US inflation eases rate worries

-

Tens of thousands protest in Serbian capital over fatal train station accident

Tens of thousands protest in Serbian capital over fatal train station accident

-

Trump vows to 'stop transgender lunacy' as a top priority

-

'Who's next?': Misinformation and online threats after US CEO slaying

'Who's next?': Misinformation and online threats after US CEO slaying

-

Only 12 trucks delivered food, water in North Gaza Governorate since October: Oxfam

| CMSC | 0.24% | 23.917 | $ | |

| CMSD | 0% | 23.561 | $ | |

| NGG | 0.76% | 58.95 | $ | |

| BCE | -1.74% | 22.765 | $ | |

| BCC | -0.39% | 122.27 | $ | |

| SCS | -0.64% | 11.665 | $ | |

| RIO | 0.76% | 59.09 | $ | |

| AZN | 1.46% | 66.315 | $ | |

| JRI | -0.08% | 12.05 | $ | |

| GSK | 0.93% | 33.915 | $ | |

| RBGPF | 0% | 60.5 | $ | |

| RYCEF | -0.69% | 7.22 | $ | |

| BP | 0.17% | 28.65 | $ | |

| RELX | 0.13% | 45.53 | $ | |

| BTI | -0.37% | 36.105 | $ | |

| VOD | -0.66% | 8.335 | $ |

Top US securities regulator to exit, clearing way for Trump pick

The top US securities regulator, a skeptic towards cryptocurrency who was appointed by President Joe Biden, announced Thursday he will step down in January when Donald Trump takes office.

Gary Gensler, chair of the Securities and Exchange Commission (SEC), said he will resign on January 20, the same day Trump assumes the presidency. The move clears the way for the president-elect to pick Gensler's successor.

The news comes as bitcoin hit a fresh record, trading above $99,000 and nearing the symbolic $100,000 level.

Gensler's five-year term does not end until 2026, but agency chairs customarily step down when the party of presidential administration turns over. During the election campaign, Trump promised to fire him.

Gensler took office in April 2021 shortly after the so-called "meme stock" frenzy in January 2021 prompted massive volatility in GameStop and a handful of other stocks.

A former mergers and acquisitions partner at Goldman Sachs, Gensler led rulemaking proposals intended to improve efficiency in capital markets.

But his future in Washington looked precarious in light of the SEC's confrontational approach to cryptocurrency throughout the Biden years. Gensler referred to crypto as "the Wild West."

During the campaign, Trump drew heavy financial support from cryptocurrency backers, some of whom are also close to the Republican's close ally, Tesla and SpaceX CEO Elon Musk.

In the absence of clear regulations, Gensler took an aggressive stance toward digital currencies, treating them like traditional financial securities such as stocks and bonds.

The approach has prompted SEC lawsuits against major trading platforms including Binance, Coinbase, and Kraken, along with various smaller startups.

Legislation currently in Congress would shift oversight of cryptocurrency supervision to the Commodity Futures Trading Commission, known for its lighter-touch approach to regulation.

Gensler thanked Biden and fellow commissioners, saying in a statement, "The SEC has met our mission and enforced the law without fear or favor."

But the SEC's announcement drew cheers from the crypto industry.

The Blockchain Association posted a waving hand emoji on X in response to Gensler's impending exit, while its CEO, Kristin Smith, noted the announcement came the same day as a favorable US court ruling in Texas for cryptocurrency.

The Texas ruling constitutes "a fitting turning point of the SEC's harassment campaign of the crypto industry, and the beginning of a new era," Smith said on X.

Smith warned Gensler against "sneak" last-minute enforcement and called for a "better-functioning" SEC that avoids overreach and is willing to work "with industry to find fit-for-purpose solutions."

Hailey Lennon, a partner at law firm Brown Rudnick who was formerly general counsel at Coinbase, said the SEC under Gensler "played gatekeeper and stalled innovation."

Citing Gensler's departing comments, she wrote on X that "saying the SEC has regulated without fear or favor is insane gaslighting."

N.Esteves--PC