-

Atletico make comeback to beat Alaves as Simeone hits milestone

Atletico make comeback to beat Alaves as Simeone hits milestone

-

Aid only 'delaying deaths' as Sudan counts down to famine: agency chief

-

Leipzig lose more ground on Bayern with Hoffenheim loss

Leipzig lose more ground on Bayern with Hoffenheim loss

-

Arsenal back to winning ways, Chelsea up to third in Premier League

-

Sinner powers Davis Cup holders Italy past Australia to final

Sinner powers Davis Cup holders Italy past Australia to final

-

Andy Murray to coach Novak Djokovic

-

Leipzig lose ground on Bayern, Dortmund and Leverkusen win

Leipzig lose ground on Bayern, Dortmund and Leverkusen win

-

Fear in central Beirut district hit by Israeli strikes

-

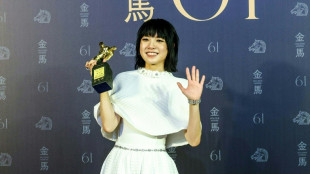

Chinese film about Covid-19 wins Taiwan's top Golden Horse prizes

Chinese film about Covid-19 wins Taiwan's top Golden Horse prizes

-

Tuipulotu puts anger behind him as he captains Scotland against native Australia

-

Inter smash Verona to take Serie A lead

Inter smash Verona to take Serie A lead

-

Mass rape trial sparks demonstrations across France

-

Eddie Jones will revel in winding up England - Genge

Eddie Jones will revel in winding up England - Genge

-

Storms bring chaos to Ireland, France, UK

-

Berrettini gives Italy edge on Australia in Davis Cup semis

Berrettini gives Italy edge on Australia in Davis Cup semis

-

Amber Glenn storms to gold in Cup of China

-

High-flying Chelsea see off Leicester

High-flying Chelsea see off Leicester

-

Climate-threatened nations stage protest at COP29 over contentious deal

-

Families fleeing after 32 killed in new sectarian violence in Pakistan

Families fleeing after 32 killed in new sectarian violence in Pakistan

-

Ancelotti says 'ugly' to speculate about Mbappe mental health

-

Failure haunts UN environment conferences

Failure haunts UN environment conferences

-

Colapinto in doubt for Las Vegas GP after crashing

-

Lebanon says 11 killed in Israeli strike on central Beirut

Lebanon says 11 killed in Israeli strike on central Beirut

-

Three arrested in Spain for racist abuse at Liga Clasico

-

Pope to skip Notre Dame opening for Corsica visit

Pope to skip Notre Dame opening for Corsica visit

-

Tokyo police care for lost umbrellas, keys, flying squirrels

-

Neuville closes in on world title after Rally Japan recovery

Neuville closes in on world title after Rally Japan recovery

-

Jaiswal slams unbeaten 90 as India seize control against Australia

-

'Nice surprise' for Verstappen to edge Norris in Las Vegas GP qualifying

'Nice surprise' for Verstappen to edge Norris in Las Vegas GP qualifying

-

Indian teen admits to 'some nerves' in bid for world chess crown

-

Patrick Reed shoots rare 59 to make Hong Kong Open history

Patrick Reed shoots rare 59 to make Hong Kong Open history

-

Record-breaker Kane hits back after England criticism

-

Cameron Smith jumps into lead at Australian PGA Championship

Cameron Smith jumps into lead at Australian PGA Championship

-

Russell on pole position at Las Vegas GP, Verstappen ahead of Norris

-

Philippine VP made 'active threat' on Marcos' life: palace

Philippine VP made 'active threat' on Marcos' life: palace

-

Celtics labor to win over Wizards, Warriors into Cup quarters

-

Balkans women stage ancient Greek play to condemn women's suffering in war

Balkans women stage ancient Greek play to condemn women's suffering in war

-

Nvidia CEO says will balance compliance and tech advances under Trump

-

Grand Slam ambition dawning for Australia against Scotland

Grand Slam ambition dawning for Australia against Scotland

-

Japan game set to leave England with more questions than answers

-

Amorim's to-do list to make Man Utd great again

Amorim's to-do list to make Man Utd great again

-

What forcing Google to sell Chrome could mean

-

Fears for Gaza hospitals as fuel and aid run low

Fears for Gaza hospitals as fuel and aid run low

-

Anderson to Starc: Five up for grabs in IPL player auction

-

Big money as Saudi makes foray into cricket with IPL auction

Big money as Saudi makes foray into cricket with IPL auction

-

Budget, debt: Trump's Treasury chief faces urgent challenges

-

Trump names hedge fund manager Scott Bessent as Treasury chief

Trump names hedge fund manager Scott Bessent as Treasury chief

-

Putin vows more tests of nuke-capable missile fired at Ukraine

-

Yin avoids penalty to keep lead as Korda charges at LPGA Tour Championship

Yin avoids penalty to keep lead as Korda charges at LPGA Tour Championship

-

With favourites out MLS playoffs promise more upsets

Russian ruble hits lowest level against dollar since March 2022

The Russian ruble slumped on Friday to its lowest level against the US dollar since March 2022, a day after Moscow fired a hypersonic missile on Ukraine and Washington sanctioned a key Russian bank.

The Russian currency has been highly volatile throughout Moscow's near three-year military offensive on Ukraine, reacting dramatically to developments on the battlefield and Western sanctions.

The central bank set its official exchange rate for the ruble at 102.58 against the US dollar, data published on its website showed, the lowest level since 24 March 2022, a month after the start of the conflict.

The latest lurch lower came hours after Russian President Vladimir Putin said Moscow had fired a new generation hypersonic missile at Ukraine.

The Kremlin leader implied the new missile was nuclear-capable and said Moscow saw the United States and its European allies as legitimate targets.

Threatening "decisive" retaliation to any further escalation, Putin said the Ukraine conflict had taken on "elements of a global character."

Analysts said the currency had been hit hard by the United States on Thursday announcing sanctions on Russian lender Gazprombank, widely used to handle Moscow's international energy payments.

"There is a significant risk that the weakening of the ruble will continue," said Yevgeny Kogan, a professor at Moscow's Higher School of Economics.

Sanctioned Russian banks cannot conduct any transactions that touch the US financial system in any way.

Such is the importance of access to the US that even non-Western banks and companies typically automatically halt deals with sanctioned entities.

"Eventually new international payment chains will be built, but until that process is completed, export revenues may temporarily decline. So the ruble is likely to depreciate in the coming months," Kogan added in a post on Telegram.

Before launching its full-scale offensive on Ukraine, the Russian currency traded at around 75-80 against the US dollar.

The official rate, set by the central bank and based on trading data, fell to a record low of 120 in March 2022, before starting to recover.

Russia's ability to redirect its crucial oil and gas exports away from Europe has provided support to the ruble throughout the conflict.

R.Veloso--PC