-

Jordanian, Qatari envoys hold talks with Syria's new leader

Jordanian, Qatari envoys hold talks with Syria's new leader

-

France's second woman premier makes surprise frontline return

-

France's Macron announces fourth government of the year

France's Macron announces fourth government of the year

-

Netanyahu tells Israel parliament 'some progress' on Gaza hostage deal

-

Guatemalan authorities recover minors taken by sect members

Guatemalan authorities recover minors taken by sect members

-

Germany's far-right AfD holds march after Christmas market attack

-

Serie A basement club Monza fire coach Nesta

Serie A basement club Monza fire coach Nesta

-

Mozambique top court confirms ruling party disputed win

-

Syrian medics say were coerced into false chemical attack testimony

Syrian medics say were coerced into false chemical attack testimony

-

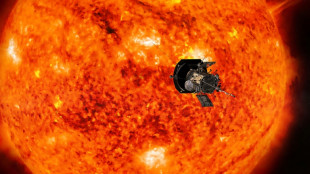

NASA solar probe to make its closest ever pass of Sun

-

London toy 'shop' window where nothing is for sale

London toy 'shop' window where nothing is for sale

-

Volkswagen boss hails cost-cutting deal but shares fall

-

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

-

Global stock markets mostly higher

-

Not for sale. Greenland shrugs off Trump's new push

Not for sale. Greenland shrugs off Trump's new push

-

Acid complicates search after deadly Brazil bridge collapse

-

Norwegian Haugan dazzles in men's World Cup slalom win

Norwegian Haugan dazzles in men's World Cup slalom win

-

Arsenal's Saka out for 'many weeks' with hamstring injury

-

Mali singer Traore child custody case postponed

Mali singer Traore child custody case postponed

-

France mourns Mayotte victims amid uncertainy over government

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

African players in Europe: Salah leads Golden Boot race after brace

-

German far-right AfD to march in city hit by Christmas market attack

German far-right AfD to march in city hit by Christmas market attack

-

Ireland centre Henshaw signs IRFU contract extension

-

Bangladesh launches $5bn graft probe into Hasina's family

Bangladesh launches $5bn graft probe into Hasina's family

-

US probes China chip industry on 'anticompetitive' concerns

-

Biden commutes sentences for 37 of 40 federal death row inmates

Biden commutes sentences for 37 of 40 federal death row inmates

-

Clock ticks down on France government nomination

-

Mozambique on edge as judges rule on disputed election

Mozambique on edge as judges rule on disputed election

-

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

Honda and Nissan to launch merger talks

-

Police arrest suspect who set woman on fire in New York subway

-

China vows 'cooperation' over ship linked to severed Baltic Sea cables

China vows 'cooperation' over ship linked to severed Baltic Sea cables

-

Australian tennis star Purcell provisionally suspended for doping

-

Luxury Western goods line Russian stores, three years into sanctions

Luxury Western goods line Russian stores, three years into sanctions

-

Wallace and Gromit return with comic warning about AI dystopia

-

Philippine military says will acquire US Typhon missile system

Philippine military says will acquire US Typhon missile system

-

Afghan bread, the humble centrepiece of every meal

-

Honda and Nissan expected to begin merger talks

Honda and Nissan expected to begin merger talks

-

'Draconian' Vietnam internet law heightens free speech fears

-

Israeli women mobilise against ultra-Orthodox military exemptions

Israeli women mobilise against ultra-Orthodox military exemptions

-

Asian markets track Wall St rally as US inflation eases rate worries

-

Tens of thousands protest in Serbian capital over fatal train station accident

Tens of thousands protest in Serbian capital over fatal train station accident

-

Trump vows to 'stop transgender lunacy' as a top priority

-

'Who's next?': Misinformation and online threats after US CEO slaying

'Who's next?': Misinformation and online threats after US CEO slaying

-

Only 12 trucks delivered food, water in North Gaza Governorate since October: Oxfam

-

Beyond Work Unveils Next-Generation Memory-Augmented AI Agent (MATRIX) for Enterprise Document Intelligence

Beyond Work Unveils Next-Generation Memory-Augmented AI Agent (MATRIX) for Enterprise Document Intelligence

-

Langers edge Tiger and son Charlie in PNC Championship playoff

-

Explosive batsman Jacobs gets New Zealand call-up for Sri Lanka series

Explosive batsman Jacobs gets New Zealand call-up for Sri Lanka series

-

Holders PSG edge through on penalties in French Cup

| CMSC | 0.33% | 23.939 | $ | |

| BCC | -0.39% | 122.275 | $ | |

| JRI | -0.08% | 12.05 | $ | |

| SCS | -1.03% | 11.62 | $ | |

| RIO | 0.66% | 59.03 | $ | |

| CMSD | -0.04% | 23.551 | $ | |

| RBGPF | 0% | 60.5 | $ | |

| RYCEF | -0.69% | 7.22 | $ | |

| NGG | 0.7% | 58.91 | $ | |

| AZN | 1.59% | 66.405 | $ | |

| GSK | 1.11% | 33.976 | $ | |

| VOD | -0.6% | 8.34 | $ | |

| RELX | 0.15% | 45.54 | $ | |

| BTI | -0.32% | 36.125 | $ | |

| BCE | -1.76% | 22.76 | $ | |

| BP | 0.33% | 28.695 | $ |

Stock markets diverge, as bitcoin closes in on $100,000

Major stock markets diverged and the dollar was mixed Thursday as traders weighed escalating tensions in the Russia-Ukraine war.

Bitcoin extended its surge, as the world's biggest cryptocurrency struck a record high of over $98,000.

Oil prices rallied "as geopolitical tensions outweighed concerns over rising US crude supplies", noted Matt Britzman, senior equity analyst, Hargreaves Lansdown.

"Geopolitical fears have also sent gold higher in recent sessions... as investors look for some safety as Russia-Ukraine tensions escalate," he added.

Kyiv accused Russia of launching an intercontinental ballistic missile attack at Ukraine for the first time on Thursday but without a nuclear warhead in a new escalation of the conflict.

Awaiting Wall Street's reopening, Asian and European stock markets travelled in different directions as blockbuster earnings late Wednesday from US chip titan Nvidia smashed forecasts but fell short of investor hopes.

A driver of artificial-intelligence transitioning by companies, Nvidia's market value has rocketed 200 percent over the last year to become the world's-richest company.

But its stock fell in after-hours trading.

"The negative market reaction to Nvidia's results suggests investors are now focusing on the minutiae rather than the big picture," noted Dan Coatsworth, investment analyst at AJ Bell.

"That's a natural evolution as the more people zoom in on a company, the more they learn about it, and the more granular detail they want."

Elsewhere on the corporate front, shares in Indian conglomerate Adani Group tanked after US prosecutors charged its industrialist owner Gautam Adani with handing out more than $250 million in bribes for key contracts.

Flagship operation Adani Enterprises dived almost 20 percent, while several of its subsidiaries -- from coal to media businesses -- lost between 10 and 20 percent.

On the upside, bitcoin closed in on $100,000 having soared since Donald Trump was elected US president in early November.

"The bitcoin boom shows no signs of slowing, with the crypto king... edging closer to the coveted six-figure milestone," added analyst Britzman.

Trump's "return to the White House is fuelling hopes of a more crypto-friendly federal stance", he said.

- Key figures around 1100 GMT -

London - FTSE 100: UP 0.2 percent at 8,101.90 points

Paris - CAC 40: DOWN 0.4 percent at 7,170.84

Frankfurt - DAX: FLAT at 18,998.49

Tokyo - Nikkei 225: DOWN 0.9 percent at 38,026.17 (close)

Hong Kong - Hang Seng Index: DOWN 0.5 percent at 19,601.11 (close)

Shanghai - Composite: UP 0.1 percent at 3,370.40 (close)

New York - Dow: DOWN 0.3 percent at 43,408.47 (close)

Euro/dollar: DOWN at $1.0521 from $1.0545 on Wednesday

Pound/dollar: DOWN at $1.2632 from $1.2652

Dollar/yen: DOWN at 154.39 yen from 155.45 yen

Euro/pound: DOWN at 83.28 pence from 83.33 pence

Brent North Sea Crude: UP 1.7 percent at $74.06 per barrel

West Texas Intermediate: UP 1.9 percent at $70.02 per barrel

F.Carias--PC