-

US panel could not reach consensus on US-Japan steel deal: Nippon

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

-

Blogs to Bluesky: social media shifts responses after 2004 tsunami

Blogs to Bluesky: social media shifts responses after 2004 tsunami

-

Tennis power couple de Minaur and Boulter get engaged

-

Supermaxi yachts eye record in gruelling Sydney-Hobart race

Supermaxi yachts eye record in gruelling Sydney-Hobart race

-

Hawaii's Kilauea volcano erupts, spewing columns of lava

-

El Salvador Congress votes to end ban on metal mining

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

-

NBA fines Minnesota guard Edwards $75,000 for outburst

NBA fines Minnesota guard Edwards $75,000 for outburst

-

Haitians massacred for practicing voodoo were abducted, hacked to death: UN

-

Inter beat Como to keep in touch with leaders Atalanta

Inter beat Como to keep in touch with leaders Atalanta

-

Man Utd boss Amorim questions 'choices' of Rashford's entourage

-

Trump's TikTok love raises stakes in battle over app's fate

Trump's TikTok love raises stakes in battle over app's fate

-

Is he serious? Trump stirs unease with Panama, Greenland ploys

-

England captain Stokes to miss three months with torn hamstring

England captain Stokes to miss three months with torn hamstring

-

Support grows for Blake Lively over smear campaign claim

-

Canada records 50,000 opioid overdose deaths since 2016

Canada records 50,000 opioid overdose deaths since 2016

-

Jordanian, Qatari envoys hold talks with Syria's new leader

-

France's second woman premier makes surprise frontline return

France's second woman premier makes surprise frontline return

-

France's Macron announces fourth government of the year

-

Netanyahu tells Israel parliament 'some progress' on Gaza hostage deal

Netanyahu tells Israel parliament 'some progress' on Gaza hostage deal

-

Guatemalan authorities recover minors taken by sect members

-

Germany's far-right AfD holds march after Christmas market attack

Germany's far-right AfD holds march after Christmas market attack

-

Serie A basement club Monza fire coach Nesta

-

Mozambique top court confirms ruling party disputed win

Mozambique top court confirms ruling party disputed win

-

Syrian medics say were coerced into false chemical attack testimony

-

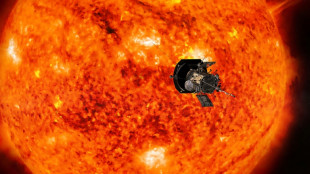

NASA solar probe to make its closest ever pass of Sun

NASA solar probe to make its closest ever pass of Sun

-

London toy 'shop' window where nothing is for sale

-

Volkswagen boss hails cost-cutting deal but shares fall

Volkswagen boss hails cost-cutting deal but shares fall

-

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

-

Global stock markets mostly higher

Global stock markets mostly higher

-

Not for sale. Greenland shrugs off Trump's new push

-

Acid complicates search after deadly Brazil bridge collapse

Acid complicates search after deadly Brazil bridge collapse

-

Norwegian Haugan dazzles in men's World Cup slalom win

-

Arsenal's Saka out for 'many weeks' with hamstring injury

Arsenal's Saka out for 'many weeks' with hamstring injury

-

Mali singer Traore child custody case postponed

-

France mourns Mayotte victims amid uncertainy over government

France mourns Mayotte victims amid uncertainy over government

-

UK economy stagnant in third quarter in fresh setback

-

African players in Europe: Salah leads Golden Boot race after brace

African players in Europe: Salah leads Golden Boot race after brace

-

German far-right AfD to march in city hit by Christmas market attack

-

Ireland centre Henshaw signs IRFU contract extension

Ireland centre Henshaw signs IRFU contract extension

-

Bangladesh launches $5bn graft probe into Hasina's family

-

US probes China chip industry on 'anticompetitive' concerns

US probes China chip industry on 'anticompetitive' concerns

-

Biden commutes sentences for 37 of 40 federal death row inmates

-

Clock ticks down on France government nomination

Clock ticks down on France government nomination

-

Mozambique on edge as judges rule on disputed election

-

Mobile cinema brings Tunisians big screen experience

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

-

Police arrest suspect who set woman on fire in New York subway

Police arrest suspect who set woman on fire in New York subway

-

China vows 'cooperation' over ship linked to severed Baltic Sea cables

Archegos founder jailed for 18 years for massive fraud: US media

The founder of US investment firm Archegos, Bill Hwang, was jailed for 18 years on Wednesday for a multibillion-dollar fraud that contributed to the fund's 2021 implosion, US media reported.

In July, a jury in New York convicted South Korean-born Hwang on 10 of the 11 charges he faced and for which he could have been sentenced to spend the rest of his life in prison.

"The sentence has to reflect the seriousness of the event," said judge Alvin Hellerstein according to The New York Times, which also reported the 18-year prison sentence.

Hwang's family-owned hedge fund had taken huge bets on a few stocks with money borrowed from banks, and when one of those bets soured, the fund was unable to meet "margin calls" to cover the losses.

The subsequent collapse of the fund sent shockwaves through the markets and caused $10 billion in losses for Credit Suisse, Nomura, Morgan Stanley and other large financial institutions.

Credit Suisse was the hardest hit, losing some $5.5 billion, which further weakened the bank and pushed it close to bankruptcy in 2023 before it was taken over by its Swiss rival UBS.

During the case, the prosecution relied on two former Archegos executives, with one testifying that Hwang had instructed him to misrepresent the fund's finances.

The case came about after Archegos took stakes in several companies with the goal of driving up share prices, including in ViacomCBS, which is now Paramount Global.

At its peak in March 2021, Archegos was exposed to $160 billion through derivatives.

The plan worked initially -- almost quadrupling the value of ViacomCBS -- but quickly unraveled when that company announced a capital increase in 2021, triggering a sudden sell-off on Wall Street.

This started a domino effect that plunged the value of shares held by Archegos and in turn hit the banks that had provided funds to Hwang's firm.

F.Cardoso--PC