-

The real-life violence that inspired South Korea's 'Squid Game'

The real-life violence that inspired South Korea's 'Squid Game'

-

Blogs to Bluesky: social media shifts responses after 2004 tsunami

-

Tennis power couple de Minaur and Boulter get engaged

Tennis power couple de Minaur and Boulter get engaged

-

Supermaxi yachts eye record in gruelling Sydney-Hobart race

-

Hawaii's Kilauea volcano erupts, spewing columns of lava

Hawaii's Kilauea volcano erupts, spewing columns of lava

-

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

Five things to know about Panama Canal, in Trump's sights

-

NBA fines Minnesota guard Edwards $75,000 for outburst

-

Haitians massacred for practicing voodoo were abducted, hacked to death: UN

Haitians massacred for practicing voodoo were abducted, hacked to death: UN

-

Inter beat Como to keep in touch with leaders Atalanta

-

Man Utd boss Amorim questions 'choices' of Rashford's entourage

Man Utd boss Amorim questions 'choices' of Rashford's entourage

-

Trump's TikTok love raises stakes in battle over app's fate

-

Is he serious? Trump stirs unease with Panama, Greenland ploys

Is he serious? Trump stirs unease with Panama, Greenland ploys

-

England captain Stokes to miss three months with torn hamstring

-

Support grows for Blake Lively over smear campaign claim

Support grows for Blake Lively over smear campaign claim

-

Canada records 50,000 opioid overdose deaths since 2016

-

Jordanian, Qatari envoys hold talks with Syria's new leader

Jordanian, Qatari envoys hold talks with Syria's new leader

-

France's second woman premier makes surprise frontline return

-

France's Macron announces fourth government of the year

France's Macron announces fourth government of the year

-

Netanyahu tells Israel parliament 'some progress' on Gaza hostage deal

-

Guatemalan authorities recover minors taken by sect members

Guatemalan authorities recover minors taken by sect members

-

Germany's far-right AfD holds march after Christmas market attack

-

Serie A basement club Monza fire coach Nesta

Serie A basement club Monza fire coach Nesta

-

Mozambique top court confirms ruling party disputed win

-

Syrian medics say were coerced into false chemical attack testimony

Syrian medics say were coerced into false chemical attack testimony

-

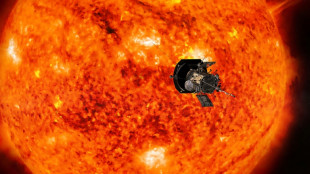

NASA solar probe to make its closest ever pass of Sun

-

London toy 'shop' window where nothing is for sale

London toy 'shop' window where nothing is for sale

-

Volkswagen boss hails cost-cutting deal but shares fall

-

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

-

Global stock markets mostly higher

-

Not for sale. Greenland shrugs off Trump's new push

Not for sale. Greenland shrugs off Trump's new push

-

Acid complicates search after deadly Brazil bridge collapse

-

Norwegian Haugan dazzles in men's World Cup slalom win

Norwegian Haugan dazzles in men's World Cup slalom win

-

Arsenal's Saka out for 'many weeks' with hamstring injury

-

Mali singer Traore child custody case postponed

Mali singer Traore child custody case postponed

-

France mourns Mayotte victims amid uncertainy over government

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

African players in Europe: Salah leads Golden Boot race after brace

-

German far-right AfD to march in city hit by Christmas market attack

German far-right AfD to march in city hit by Christmas market attack

-

Ireland centre Henshaw signs IRFU contract extension

-

Bangladesh launches $5bn graft probe into Hasina's family

Bangladesh launches $5bn graft probe into Hasina's family

-

US probes China chip industry on 'anticompetitive' concerns

-

Biden commutes sentences for 37 of 40 federal death row inmates

Biden commutes sentences for 37 of 40 federal death row inmates

-

Clock ticks down on France government nomination

-

Mozambique on edge as judges rule on disputed election

Mozambique on edge as judges rule on disputed election

-

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

Honda and Nissan to launch merger talks

-

Police arrest suspect who set woman on fire in New York subway

-

China vows 'cooperation' over ship linked to severed Baltic Sea cables

China vows 'cooperation' over ship linked to severed Baltic Sea cables

-

Australian tennis star Purcell provisionally suspended for doping

Asian markets struggle as traders weigh geopolitical tensions

Asian investors struggled Wednesday to track a positive lead from Wall Street as they assess the prospect of an escalation in the Russia-Ukraine war, Donald Trump's second presidency and the outlook for US interest rates.

They were also keenly awaiting the release of earnings from chip behemoth Nvidia later in the day, which many see as a bellwether of the tech sector and AI demand that have helped power markets to multiple record highs this year.

Traders were treading carefully this week amid uncertainty after Trump's re-election and as he picks his cabinet, with several China hawks up for key positions fanning worries of another trade war between the economic superpowers.

The tycoon has pledged to ramp up tariffs on imports, with China particularly in his sights, but observers warn that such a move -- along with planned tax cuts -- could relight still stubborn inflation.

That has dampened hopes for several Federal Reserve interest rate cuts next year.

Meanwhile, the war in Ukraine has burst back into the thoughts of traders as Moscow vowed to react "accordingly" after saying Kyiv had fired its first US-made long-range missile into Russian territory.

Washington this week said it had cleared Kyiv to use the US-supplied Army Tactical Missile System against military targets inside Russia -- a long-standing Ukrainian request.

Russian Foreign Minister Sergei Lavrov said the attack showed Western countries wanted to "escalate" the conflict, adding that "we will be taking this as a qualitatively new phase of the Western war against Russia".

President Vladimir Putin signed a decree Tuesday lowering the threshold for using nuclear weapons, which the White House, Britain and the European Union called "irresponsible".

Growing worries that the war will ramp up to another, more dangerous level weighed on sentiment in Europe but the S&P 500 and Nasdaq rose for a second straight day in New York.

Asia, however, was mostly in the red, with Tokyo, Hong Kong, Shanghai, Sydney, Singapore, Wellington and Taipei in retreat. Seoul, Manila and Jakarta bucked the trend.

The main focus of attention Wednesday is the upcoming earnings from Nvidia, the world's most expensive listed company and market darling.

The company has rocketed 200 percent this year -- and an eye-watering 2,670 in the past five years -- on the back of an unprecedented surge in demand for all things linked to artificial intelligence.

There are hopes it will live up to expectations and provide some insight into its new chips. The firm's shares rose nearly five percent on Tuesday.

"Nvidia's earnings will serve as a major test, given its status as the largest company by market cap and a cornerstone of the AI revolution," said Charu Chanana, chief investment strategist at Saxo Markets.

"The central question: Is the AI theme robust enough to sustain investor enthusiasm, or is it on shaky ground."

Finalto.com's Neil Wilson said investors will be "hungry for guidance on the new chips".

"Nvidia's Blackwell chip should become available in the first quarter of next year and could bring in between $5 billion and $8 billion, according to (investment bank) Piper Sandler," he said.

Bitcoin was sitting around the $92,000 mark after hitting a new all-time peak above 94,031 on Tuesday.

- Key figures around 0230 GMT -

Tokyo - Nikkei 225: DOWN 0.5 percent at 38,242.35 (break)

Hong Kong - Hang Seng Index: DOWN 0.1 percent at 19,640.50

Shanghai - Composite: DOWN 0.1 percent at 3,344.39

Euro/dollar: UP at $1.0601 from $1.0599 on Tuesday

Pound/dollar: UP at $1.2690 from $1.2682

Dollar/yen: UP at 154.85 yen from 154.67 yen

Euro/pound: DOWN at 83.52 pence from 83.54 pence

West Texas Intermediate: UP 0.2 percent at $69.53 per barrel

Brent North Sea Crude: DOWN 0.2 percent at $73.20 per barrel

New York - Dow: DOWN 0.3 percent at 43,268.94 (close)

London - FTSE 100: DOWN 0.1 percent at 8,099.02 (close)

T.Vitorino--PC