-

South Africa opt for all-pace attack against Pakistan

South Africa opt for all-pace attack against Pakistan

-

Guardiola adamant Man City slump not all about Haaland

-

Global stocks mostly higher in thin pre-Christmas trade

Global stocks mostly higher in thin pre-Christmas trade

-

Bethlehem marks sombre Christmas under shadow of war

-

11 killed in blast at Turkey explosives plant

11 killed in blast at Turkey explosives plant

-

Indonesia considers parole for ex-terror chiefs: official

-

Postecoglou says Spurs 'need to reinforce' in transfer window

Postecoglou says Spurs 'need to reinforce' in transfer window

-

Le Pen says days of new French govt numbered

-

Villa boss Emery set for 'very difficult' clash with Newcastle

Villa boss Emery set for 'very difficult' clash with Newcastle

-

Investors swoop in to save German flying taxi startup

-

How Finnish youth learn to spot disinformation

How Finnish youth learn to spot disinformation

-

12 killed in blast at Turkey explosives plant

-

Panama leaders past and present reject Trump's threat of Canal takeover

Panama leaders past and present reject Trump's threat of Canal takeover

-

Hong Kong police issue fresh bounties for activists overseas

-

Saving the mysterious African manatee at Cameroon hotspot

Saving the mysterious African manatee at Cameroon hotspot

-

India consider second spinner for Boxing Day Test

-

London wall illuminates Covid's enduring pain at Christmas

London wall illuminates Covid's enduring pain at Christmas

-

Poyet appointed manager at South Korea's Jeonbuk

-

South Korea's opposition vows to impeach acting president

South Korea's opposition vows to impeach acting president

-

The tsunami detection buoys safeguarding lives in Thailand

-

Teen Konstas to open for Australia in Boxing Day India Test

Teen Konstas to open for Australia in Boxing Day India Test

-

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

-

Blogs to Bluesky: social media shifts responses after 2004 tsunami

Blogs to Bluesky: social media shifts responses after 2004 tsunami

-

Tennis power couple de Minaur and Boulter get engaged

-

Supermaxi yachts eye record in gruelling Sydney-Hobart race

Supermaxi yachts eye record in gruelling Sydney-Hobart race

-

Hawaii's Kilauea volcano erupts, spewing columns of lava

-

El Salvador Congress votes to end ban on metal mining

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

-

NBA fines Minnesota guard Edwards $75,000 for outburst

NBA fines Minnesota guard Edwards $75,000 for outburst

-

Haitians massacred for practicing voodoo were abducted, hacked to death: UN

-

Inter beat Como to keep in touch with leaders Atalanta

Inter beat Como to keep in touch with leaders Atalanta

-

Man Utd boss Amorim questions 'choices' of Rashford's entourage

-

Trump's TikTok love raises stakes in battle over app's fate

Trump's TikTok love raises stakes in battle over app's fate

-

Is he serious? Trump stirs unease with Panama, Greenland ploys

-

England captain Stokes to miss three months with torn hamstring

England captain Stokes to miss three months with torn hamstring

-

Support grows for Blake Lively over smear campaign claim

-

Canada records 50,000 opioid overdose deaths since 2016

Canada records 50,000 opioid overdose deaths since 2016

-

Jordanian, Qatari envoys hold talks with Syria's new leader

-

France's second woman premier makes surprise frontline return

France's second woman premier makes surprise frontline return

-

France's Macron announces fourth government of the year

-

Netanyahu tells Israel parliament 'some progress' on Gaza hostage deal

Netanyahu tells Israel parliament 'some progress' on Gaza hostage deal

-

Guatemalan authorities recover minors taken by sect members

-

Germany's far-right AfD holds march after Christmas market attack

Germany's far-right AfD holds march after Christmas market attack

-

Serie A basement club Monza fire coach Nesta

-

Mozambique top court confirms ruling party disputed win

Mozambique top court confirms ruling party disputed win

-

Syrian medics say were coerced into false chemical attack testimony

-

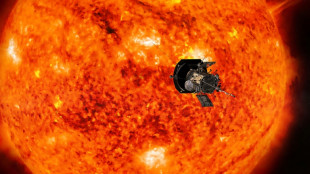

NASA solar probe to make its closest ever pass of Sun

NASA solar probe to make its closest ever pass of Sun

-

London toy 'shop' window where nothing is for sale

| RIO | -0.14% | 59.15 | $ | |

| BTI | -0.04% | 36.206 | $ | |

| BCE | 0.46% | 22.945 | $ | |

| SCS | -0.22% | 11.625 | $ | |

| CMSC | -0.64% | 23.7499 | $ | |

| NGG | -0.46% | 58.747 | $ | |

| AZN | -0.54% | 66.27 | $ | |

| GSK | -0.04% | 34.045 | $ | |

| JRI | 0.26% | 12.131 | $ | |

| BCC | 0.17% | 122.45 | $ | |

| RBGPF | -1.17% | 59.8 | $ | |

| RYCEF | -0.28% | 7.25 | $ | |

| BP | 0.4% | 28.865 | $ | |

| VOD | 1.09% | 8.462 | $ | |

| CMSD | -1.16% | 23.28 | $ | |

| RELX | 0.36% | 45.755 | $ |

Stocks, dollar hesitant as traders eye US rate outlook, Nvidia

Stock markets were mixed from Asia to the United States on Monday as cautious traders reassessed the outlook for interest rates ahead of Donald Trump's return to the White House, with policies that could reignite inflation after months of cooling prices.

Focus also turned to chip behemoth Nvidia ahead of its quarterly earnings on Wednesday, which could indicate prospects for the entire tech sector.

Global equity markets have cooled since Trump's US election win this month, while investors waiting in particular for his coming pick for Treasury secretary.

All three main indices on Wall Street ended deep in the red on Friday, with the Nasdaq down more than two percent, after Federal Reserve boss Jerome Powell signalled a slower pace of interest rate cuts.

"There is concern that a reckless spending policy could fuel inflation again, forcing the Fed to raise interest rates again at some point," said Konstantin Oldenburger, an analyst at CMC Markets.

European markets tracked those losses Monday and US stocks opened mixed before recovering some ground, with few investors willing to take new positions ahead of Nvidia's results.

"The generative AI chip giant... has the potential to influence markets substantially" given its outsize weight in all US indices, said David Morrison, senior analyst at Trade Nation.

He added that data showing US inflation is proving sticky even before any potential uplift to prices if Trump follows through on tariff threats and other policies once he re-enters the White House in January.

The Fed's next policy decision in December will be closely followed for an idea about officials' plans.

Expectations that a second Trump administration will impose painful fresh tariffs on Chinese goods have added to the unease and ramped up fears of another trade war between the economic powerhouses.

"It is likely that if Trump does proceed with tariffs on Chinese goods, they will respond aggressively," said Kathleen Brooks, research director at traders XTB.

In Europe, the vice president of the European Central Bank said Monday that Trump's spending plans risked inflating the US government's budgetary deficit and spreading worries on markets.

"Trade tensions could rise further," with resulting risks for economic activity, Luis de Guindos noted.

Investor focus this week will be on also the release of purchasing managers' index data for signals about the health of business activity in the eurozone, Britain and the United States.

Friday's PMI data "may capture some of the initial sentiment impact from around the world regarding Trump's victory," said Jim Reid, economist at Deutsche Bank.

"Europe will be especially interesting on this front as the continent awaits their trade fate," he added.

In Asia on Monday, Tokyo and Shanghai stock markets closed lower while Hong Kong rose, helped by hopes of more Chinese stimulus after a recent raft of measures.

Bitcoin sat at around $90,000, having hit another record high of $93,462 last week on hopes Trump will push for more deregulation of the crypto market.

Crude oil prices jumped after production stopped at a key Norwegian field in the North Sea, Sverdrup, due to an electrical supply disruption.

- Key figures around 1650 GMT -

New York - Dow: UP 0.1 percent at 43,501.07

New York - S&P 500: UP 0.6 percent at 5,907.77

New York - Nasdaq: UP 1.0 percent at 18,863.89

London - FTSE 100: UP 0.6 percent at 8,109.32 (close)

Paris - CAC 40: UP 0.1 percent at 7,278.23 (close)

Frankfurt - DAX: DOWN 0.1 percent at 19,189.19 (close)

Tokyo - Nikkei 225: DOWN 1.1 percent at 38,220.85 (close)

Hong Kong - Hang Seng Index: UP 0.8 percent at 19,576.61 (close)

Shanghai - Composite: DOWN 0.2 percent at 3,323.85 (close)

Euro/dollar: UP at $1.0574 from $1.0536 on Friday

Pound/dollar: UP at $1.2649 from $1.2611

Dollar/yen: UP at 155.04 yen from 154.32 yen

Euro/pound: UP at 83.59 pence from 83.52 pence

Brent North Sea Crude: UP 2.9 percent at $73.09 per barrel

West Texas Intermediate: UP 3.0 percent at $68.92 per barrel

N.Esteves--PC