-

UK's biggest dinosaur footprint site uncovered

UK's biggest dinosaur footprint site uncovered

-

Former Australia coach Langer to take charge of London Spirit

-

Most UK doctors suffer from 'compassion fatigue': poll

Most UK doctors suffer from 'compassion fatigue': poll

-

Everton boss Dyche unconcerned by Maupay jibe

-

FBI probes potential accomplices in New Orleans truck ramming

FBI probes potential accomplices in New Orleans truck ramming

-

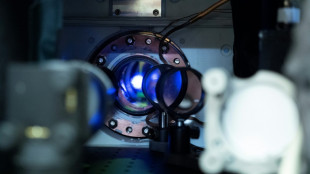

Secret lab developing UK's first quantum clock: defence ministry

-

Premier League chief fears Club World Cup's impact on Man City and Chelsea

Premier League chief fears Club World Cup's impact on Man City and Chelsea

-

US mulls new restrictions on Chinese drones

-

Rosita Missoni of Italy's eponymous fashion house dies age 93

Rosita Missoni of Italy's eponymous fashion house dies age 93

-

27 sub-Saharan African migrants die off Tunisia in shipwrecks

-

UK grime star Stormzy banned from driving for nine months

UK grime star Stormzy banned from driving for nine months

-

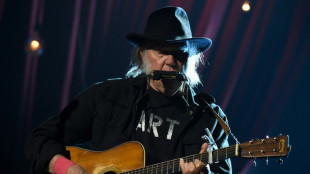

Neil Young dumps Glastonbury alleging 'BBC control'

-

Swiatek battles back to take Poland into United Cup semis

Swiatek battles back to take Poland into United Cup semis

-

Electric cars took 89% of Norway market in 2024

-

Rival South Korea camps face off as president holds out

Rival South Korea camps face off as president holds out

-

French downhill ace Sarrazin out of intensive care

-

Djokovic cruises past Monfils as rising stars impress in Brisbane

Djokovic cruises past Monfils as rising stars impress in Brisbane

-

Montenegro mourns after gunman kills 12

-

Sales surge in 2024 for Chinese EV giant BYD

Sales surge in 2024 for Chinese EV giant BYD

-

Agnes Keleti, world's oldest Olympic champion, dies at 103

-

Andreeva, Mpetshi Perricard showcase Australian Open potential

Andreeva, Mpetshi Perricard showcase Australian Open potential

-

Afghan refugees suffer 'like prisoners' in Pakistan crackdown

-

Coach tight-lipped on whether Rohit will play in final Australia Test

Coach tight-lipped on whether Rohit will play in final Australia Test

-

Blooming hard: Taiwan's persimmon growers struggle

-

South Korea's impeached president resists arrest over martial law bid

South Korea's impeached president resists arrest over martial law bid

-

Knicks roll to ninth straight NBA win, Ivey hurt in Pistons victory

-

'Numb' New Orleans grapples with horror of deadly truck attack

'Numb' New Orleans grapples with horror of deadly truck attack

-

Asia stocks begin year on cautious note

-

FBI probes 'terrorist' links in New Orleans truck-ramming that killed 15

FBI probes 'terrorist' links in New Orleans truck-ramming that killed 15

-

2024 was China's hottest year on record: weather agency

-

Perera smashes 46-ball ton as Sri Lanka pile up 218-5 in 3rd NZ T20

Perera smashes 46-ball ton as Sri Lanka pile up 218-5 in 3rd NZ T20

-

South Korea police raid Muan airport over Jeju Air crash that killed 179

-

South Korea's Yoon resists arrest over martial law bid

South Korea's Yoon resists arrest over martial law bid

-

Sainz set to step out of comfort zone to defend Dakar Rally title

-

New Year's fireworks accidents kill five in Germany

New Year's fireworks accidents kill five in Germany

-

'I'm Still Here': an ode to Brazil resistance

-

New Orleans attack suspect was US-born army veteran

New Orleans attack suspect was US-born army veteran

-

Australia axe Marsh, call-up Webster for fifth India Test

-

Jets quarterback Rodgers ponders NFL future ahead of season finale

Jets quarterback Rodgers ponders NFL future ahead of season finale

-

Eagles' Barkley likely to sit out season finale, ending rushing record bid

-

Syria FM hopes first foreign visit to Saudi opens 'new, bright page'

Syria FM hopes first foreign visit to Saudi opens 'new, bright page'

-

At least 10 dead in Montenegro restaurant shooting: minister

-

Arteta reveals Arsenal hit by virus before vital win at Brentford

Arteta reveals Arsenal hit by virus before vital win at Brentford

-

Palestinian Authority suspends Al Jazeera broadcasts

-

Arsenal close gap on Liverpool as Jesus stars again

Arsenal close gap on Liverpool as Jesus stars again

-

Witnesses describe 'war zone' left in wake of New Orleans attack

-

Cosmetic surgery aficionado Jocelyne Wildenstein dies aged 79: partner

Cosmetic surgery aficionado Jocelyne Wildenstein dies aged 79: partner

-

Tschofenig takes overall Four Hills lead after second leg win

-

10 killed in New Year's truck ramming in New Orleans, dozens hurt

10 killed in New Year's truck ramming in New Orleans, dozens hurt

-

Leeds and Burnley held to draws as Windass hits Wednesday wonder strike

Markets stall, inflation and bitcoin rise amid Trump fears

Global equities stalled Wednesday as traders fret over the impact of Donald Trump's presidency on the Chinese and global economies amid fears his policies could also reignite US inflation, which rose on latest data.

The prospect of higher prices on the back of Trump's planned tax cuts, import tariffs and an easing of regulations gave fresh impetus to the dollar, which has rallied since the Republican's election win last week.

Adding to concerns on the impending transfer of White House power, key US October consumer price data saw a 2.6-percent rise, up from 2.4 percent in September, the Labor Department said.

Although the figure was in line with the median forecast of economists surveyed by Dow Jones Newswires and The Wall Street Journal, the data complicates the US Federal Reserve's plans to cut interest rates, even if it remains broadly on track to slow the rate of price increases, EY chief economist Gregory Daco told AFP.

"It’s particularly pertinent given concerns that Trump’s tariff policies will be inflationary," said Susannah Streeter, head of money and markets at Hargreaves Lansdown.

"If prices are already looking unruly, expectations will rise for Trump's threats to be watered down."

For Srijan Katyal, global head of strategy and trading services at ADSS brokerage, "this (inflation data) reading has slightly disrupted the disinflationary pattern we have seen in the last few months but continues to remain stable around the targeted level".

Yet, given Trump's election victory, "inflation worries could return to markets," Katyal said.

As inflation edged up, bitcoin, the world's premier cryptocurrency, soared to fresh heights in topping $90,000, hitting an all-time peak above $91,000 before easing to $90,670.

Trump has notably pledged to ease regulation around digital tokens.

Wall Street lacked direction in early trading as traders digested the inflation data.

Its three main indices had finished in the red Tuesday as investors took a breather from a week-long rally to more record highs, with the Dow barely in the green and the tech heavy Nasdaq off 0.2 percent.

Major European indices all were trading down some two hours out from the close, although Siemens Energy shares surged more than 15 percent after the German company posted positive annual results and upgraded its outlook.

Asian markets mostly ended lower as Trump named known China hawks to key cabinet positions, fuelling concerns about another debilitating trade war between the economic superpowers.

"We expect the effective tariff rate on US imports from China to rise to around 40 percent," said Harry Murphy Cruise at Moody's Analytics.

"That would effectively double the rate today," he told AFP.

Cruise said, "China would almost certainly follow suit."

The threat of another standoff comes as Beijing struggles to kickstart growth at home, unveiling a raft of measures at the end of September but leaving traders disappointed.

China's state media on Wednesday reported that Beijing had announced a raft of tax policies aimed at boosting the country's ailing property market.

- Key figures around 1445 GMT -

New York - Dow: UP 0.1 percent at 43,948.32 points

New York - S&P 500: FLAT 0.2 percent at 5,982.53

New York - Nasdaq Composite: DOWN 0.2 percent at 19,243.48

London - FTSE 100: DOWN 0.2 percent at 8,008.47

Paris - CAC 40: DOWN 0.7 percent at 7,179.08

Frankfurt - DAX: DOWN 0.8 percent at 18,890.76

Tokyo - Nikkei 225: DOWN 1.7 percent at 38,721.66 (close)

Hong Kong - Hang Seng Index: DOWN 0.1 percent at 19,823.45 (close)

Shanghai - Composite: UP 0.5 percent at 3,439.28 (close)

Dollar/yen: UP at 154.98 yen from 154.59 yen on Tuesday

Euro/dollar: DOWN at $1.0617 from $1.0625

Pound/dollar: DOWN at $1.2741 from $1.2748

Euro/pound: DOWN at 83.31 pence from 83.34 pence

Brent North Sea Crude: UP 1.0 percent at $71.21 per barrel

West Texas Intermediate: DOWN 1.0 percent at $67.45 per barrel

A.Magalhes--PC