-

Bangladeshi Hindus protest over leader's arrest, one dead

Bangladeshi Hindus protest over leader's arrest, one dead

-

Celtic fuelled by Dortmund embarrassment: Rodgers

-

Salah driven not distracted by contract deadlock, says Slot

Salah driven not distracted by contract deadlock, says Slot

-

Algeria holds writer Boualem Sansal on national security charges: lawyer

-

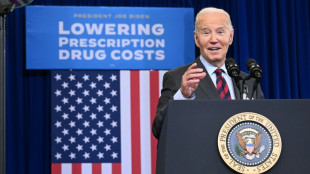

Biden proposes huge expansion of weight loss drug access

Biden proposes huge expansion of weight loss drug access

-

Saudi 2025 budget sees lower deficit on spending trims

-

Pogba's brother, five others, on trial for blackmailing him

Pogba's brother, five others, on trial for blackmailing him

-

Prosecutors seek up to 15-year terms for French rape trial defendants

-

Emery bids to reverse Villa slump against Juventus

Emery bids to reverse Villa slump against Juventus

-

Carrefour attempts damage control against Brazil 'boycott'

-

Namibians heads to the polls wanting change

Namibians heads to the polls wanting change

-

Sales of new US homes lowest in around two years: govt

-

Paris mayor Hidalgo says to bow out in 2026

Paris mayor Hidalgo says to bow out in 2026

-

Stocks, dollar mixed on Trump tariff warning

-

ICC to decide fate of Pakistan's Champions Trophy on Friday

ICC to decide fate of Pakistan's Champions Trophy on Friday

-

Man Utd revenue falls as Champions League absence bites

-

Russia vows reply after Ukraine strikes again with US missiles

Russia vows reply after Ukraine strikes again with US missiles

-

Trump threatens trade war on Mexico, Canada, China

-

Motta's injury-hit Juve struggling to fire ahead of Villa trip

Motta's injury-hit Juve struggling to fire ahead of Villa trip

-

Cycling chiefs seek WADA ruling on carbon monoxide use

-

Israel pounds Beirut as security cabinet to discuss ceasefire

Israel pounds Beirut as security cabinet to discuss ceasefire

-

Fewest new HIV cases since late 1980s: UNAIDS report

-

4 security forces killed as ex-PM Khan supporters flood Pakistan capital

4 security forces killed as ex-PM Khan supporters flood Pakistan capital

-

Four bodies, four survivors recovered from Egypt Red Sea sinking: governor

-

Ayub century helps Pakistan crush Zimbabwe, level series

Ayub century helps Pakistan crush Zimbabwe, level series

-

French court cracks down on Corsican language use in local assembly

-

Russia expels UK diplomat accused of espionage

Russia expels UK diplomat accused of espionage

-

Israeli security cabinet to discuss ceasefire as US says deal 'close'

-

COP29 president blames rich countries for 'imperfect' deal

COP29 president blames rich countries for 'imperfect' deal

-

No regrets: Merkel looks back at refugee crisis, Russia ties

-

IPL history-maker, 13, who 'came on Earth to play cricket'

IPL history-maker, 13, who 'came on Earth to play cricket'

-

Prosecutors seek up to 12-year terms for French rape trial defendants

-

Laos hostel staff detained after backpackers' deaths

Laos hostel staff detained after backpackers' deaths

-

Hong Kong LGBTQ advocate wins posthumous legal victory

-

Rod Stewart to play Glastonbury legends slot

Rod Stewart to play Glastonbury legends slot

-

Winter rains pile misery on war-torn Gaza's displaced

-

'Taiwan also has baseball': jubilant fans celebrate historic win

'Taiwan also has baseball': jubilant fans celebrate historic win

-

Russia pummels Ukraine with 'record' drone barrage

-

Paul Pogba blackmail trial set to open in Paris

Paul Pogba blackmail trial set to open in Paris

-

Landmine victims gather to protest US decision to supply Ukraine

-

Indian rival royal factions clash outside palace

Indian rival royal factions clash outside palace

-

Manga adaptation 'Drops of God' nets International Emmy Award

-

Philippine VP denies assassination plot against Marcos

Philippine VP denies assassination plot against Marcos

-

Hong Kong's legal battles over LGBTQ rights: key dates

-

US lawmakers warn Hong Kong becoming financial crime hub

US lawmakers warn Hong Kong becoming financial crime hub

-

Compressed natural gas vehicles gain slow momentum in Nigeria

-

As Arctic climate warms, even Santa runs short of snow

As Arctic climate warms, even Santa runs short of snow

-

Plastic pollution talks: the key sticking points

-

Indonesia rejects Apple's $100 million investment offer

Indonesia rejects Apple's $100 million investment offer

-

Pakistan police fire tear gas, rubber bullets at pro-Khan supporters

| RBGPF | 1.33% | 61 | $ | |

| RYCEF | 0.44% | 6.8 | $ | |

| RELX | 0.22% | 46.675 | $ | |

| BTI | 0.61% | 37.56 | $ | |

| NGG | -0.88% | 62.71 | $ | |

| GSK | -0.71% | 33.91 | $ | |

| CMSC | -0.65% | 24.57 | $ | |

| BCE | -1.83% | 26.535 | $ | |

| AZN | -0.17% | 66.285 | $ | |

| BP | -1.66% | 28.84 | $ | |

| RIO | -1.81% | 61.86 | $ | |

| VOD | -0.62% | 8.855 | $ | |

| SCS | -1.14% | 13.565 | $ | |

| BCC | -3.06% | 147.965 | $ | |

| JRI | -0.49% | 13.305 | $ | |

| CMSD | -0.71% | 24.407 | $ |

Most Asian markets extend losses as Trump fears build

Asian markets fell again Wednesday as traders fret over the impact of Donald Trump's presidency on the Chinese and global economies, with fears that his policies could also reignite US inflation.

The prospect of prices spiking again on the back of tax cuts, import tariffs, and an easing of regulations gave fresh impetus to the dollar, which has rallied since the Republican's election win last week.

Traders are also keeping tabs on bitcoin after it came within a whisker of breaking $90,000 for the first time, though observers are betting on it hitting $100,000 owing to Trump's pro-crypto campaign pledges.

After an initial rally in the wake of the tycoon regaining the White House, Asian markets have pulled back this week as his cabinet begins to emerge.

The naming of known China hawks to key positions has fuelled concerns about another debilitating trade war between the economic superpowers.

"We expect the effective tariff rate on US imports from China to rise to around 40 percent," said Harry Murphy Cruise at Moody's Analytics.

"That would effectively double the rate today and be a similar increase to that seen during the first trade war. It's likely the threat of further tariffs up to the touted 60 percent would be used as a negotiating tool," he told AFP.

"China would almost certainly follow suit, imposing tariffs of its own of equal magnitude."

The threat of another standoff comes as Beijing struggles to kickstart growth at home, unveiling a raft of measures at the end of September but leaving traders disappointed with anything new at a much-anticipated announcement Friday.

Uncertainty about the outlook heading into 2025 was weighing on Asian equities, with Hong Kong, Tokyo, Sydney, Seoul, Taipei, Wellington and Mumbai all in the red.

Still, Shanghai, Singapore, Manila and Bangkok rose, while London opened higher. Paris and Frankfurt dipped at the open.

The selling came after a negative lead from Wall Street, where all three main indexes finished in the red as investors took a breather from a week-long rally to more record highs.

Bitcoin was sitting at 87,654.

The dollar extended gains against its peers, having tapped a one-year high versus the euro, while it pushed back above 155 yen.

The greenback has risen as dealers pare bets on Federal Reserve interest rate cuts after Trump's win, with two seen through to June, compared with four forecast before the election, according to Bloomberg.

Focus is now on the release of key US October consumer price data due later in the day, with expectations for a slight uptick from the previous month.

The reading will be pored over for an idea about the central bank's plans for borrowing costs when it meets again in December.

It cut rates 25 basis points last week, having slashed them by 50 points in September, the first since the start of the pandemic.

- Key figures around 0810 GMT -

Tokyo - Nikkei 225: DOWN 1.7 percent at 38,721.66 (close)

Hong Kong - Hang Seng Index: DOWN 0.1 percent at 19,823.45 (close)

Shanghai - Composite: UP 0.5 percent at 3,439.28 (close)

London - FTSE 100: UP 0.1 percent at 8,034.76

Dollar/yen: UP at 155.07 yen from 154.59 yen on Tuesday

Euro/dollar: DOWN at $1.0606 from $1.0625

Pound/dollar: DOWN at $1.2737 from $1.2748

Euro/pound: DOWN at 83.27 pence from 83.34 pence

West Texas Intermediate: UP 0.1 percent at $68.18 per barrel

Brent North Sea Crude: UP 0.1 percent at $71.96 per barrel

New York - Dow: DOWN 0.9 percent at 43,910.98 (close)

J.Oliveira--PC