-

Teen Konstas to open for Australia in Boxing Day India Test

Teen Konstas to open for Australia in Boxing Day India Test

-

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

-

Blogs to Bluesky: social media shifts responses after 2004 tsunami

Blogs to Bluesky: social media shifts responses after 2004 tsunami

-

Tennis power couple de Minaur and Boulter get engaged

-

Supermaxi yachts eye record in gruelling Sydney-Hobart race

Supermaxi yachts eye record in gruelling Sydney-Hobart race

-

Hawaii's Kilauea volcano erupts, spewing columns of lava

-

El Salvador Congress votes to end ban on metal mining

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

-

NBA fines Minnesota guard Edwards $75,000 for outburst

NBA fines Minnesota guard Edwards $75,000 for outburst

-

Haitians massacred for practicing voodoo were abducted, hacked to death: UN

-

Inter beat Como to keep in touch with leaders Atalanta

Inter beat Como to keep in touch with leaders Atalanta

-

Man Utd boss Amorim questions 'choices' of Rashford's entourage

-

Trump's TikTok love raises stakes in battle over app's fate

Trump's TikTok love raises stakes in battle over app's fate

-

Is he serious? Trump stirs unease with Panama, Greenland ploys

-

England captain Stokes to miss three months with torn hamstring

England captain Stokes to miss three months with torn hamstring

-

Support grows for Blake Lively over smear campaign claim

-

Canada records 50,000 opioid overdose deaths since 2016

Canada records 50,000 opioid overdose deaths since 2016

-

Jordanian, Qatari envoys hold talks with Syria's new leader

-

France's second woman premier makes surprise frontline return

France's second woman premier makes surprise frontline return

-

France's Macron announces fourth government of the year

-

Netanyahu tells Israel parliament 'some progress' on Gaza hostage deal

Netanyahu tells Israel parliament 'some progress' on Gaza hostage deal

-

Guatemalan authorities recover minors taken by sect members

-

Germany's far-right AfD holds march after Christmas market attack

Germany's far-right AfD holds march after Christmas market attack

-

Serie A basement club Monza fire coach Nesta

-

Mozambique top court confirms ruling party disputed win

Mozambique top court confirms ruling party disputed win

-

Syrian medics say were coerced into false chemical attack testimony

-

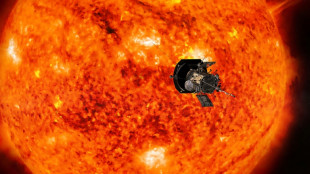

NASA solar probe to make its closest ever pass of Sun

NASA solar probe to make its closest ever pass of Sun

-

London toy 'shop' window where nothing is for sale

-

Volkswagen boss hails cost-cutting deal but shares fall

Volkswagen boss hails cost-cutting deal but shares fall

-

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

-

Global stock markets mostly higher

Global stock markets mostly higher

-

Not for sale. Greenland shrugs off Trump's new push

-

Acid complicates search after deadly Brazil bridge collapse

Acid complicates search after deadly Brazil bridge collapse

-

Norwegian Haugan dazzles in men's World Cup slalom win

-

Arsenal's Saka out for 'many weeks' with hamstring injury

Arsenal's Saka out for 'many weeks' with hamstring injury

-

Mali singer Traore child custody case postponed

-

France mourns Mayotte victims amid uncertainy over government

France mourns Mayotte victims amid uncertainy over government

-

UK economy stagnant in third quarter in fresh setback

-

African players in Europe: Salah leads Golden Boot race after brace

African players in Europe: Salah leads Golden Boot race after brace

-

German far-right AfD to march in city hit by Christmas market attack

-

Ireland centre Henshaw signs IRFU contract extension

Ireland centre Henshaw signs IRFU contract extension

-

Bangladesh launches $5bn graft probe into Hasina's family

-

US probes China chip industry on 'anticompetitive' concerns

US probes China chip industry on 'anticompetitive' concerns

-

Biden commutes sentences for 37 of 40 federal death row inmates

-

Clock ticks down on France government nomination

Clock ticks down on France government nomination

-

Mozambique on edge as judges rule on disputed election

-

Mobile cinema brings Tunisians big screen experience

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

Stock markets climb, dollar dips as US votes

Major stock markets mostly rose and the dollar remained under pressure Tuesday as Americans cast votes in a knife-edge presidential election.

Wall Street's main indexes, which had fallen the previous day, rebounded after voting began in the world's biggest economy.

In Europe, London dipped 0.1 percent as investors await an interest-rate decision by the Bank of England on Thursday while Paris and Frankfurt ended the day with modest gains.

Equities in Shanghai and Hong Kong won strong support from hopes over China's economy.

The dollar weakened against the euro, the British pound and the yen.

Kathleen Brooks, research director at XTB, said markets have priced in a victory by Donald Trump and thus a win by Kamala Harris would be a surprise that causes short-term volatility.

"A win for Harris could lead to a short term sell off in the dollar, gold and potentially in US stocks," she said in a note to clients,

"This could also boost global equities, as Harris is seen to be less tempted to slap tariffs on imports. Chinese stocks could rally sharply, along with key European and UK firms."

A win for Republican Donald Trump is expected to restoke inflation and send Treasury yields higher owing to his pledges to slash taxes and impose tariffs on imports, which could push up the dollar.

Analysts see less upheaval from a win by Democratic Vice President Kamala Harris.

"A pro-tariff Trump presidency could see the dollar strengthen amid concerns higher inflation will prompt the Fed to keep interest rates higher," predicted Matt Britzman, senior equity analyst at Hargreaves Lansdown.

"There is likely to be a period of volatility particularly if the result is contested, but investors should keep their eyes on long-term horizons as historically financial markets have risen over the course of both Democratic and Republican presidencies," he added.

Fawad Razaqzada, analyst at City Index and Forex.com, said that "traders are not committing to any particular direction across financial markets, and you can’t really blame them."

Given that the race appears to be a toss-up "this makes it extremely difficult to make a strong case for the direction of the dollar or stocks this week," he added.

Investors are also awaiting another US Federal Reserve rate cut on Thursday as inflation cools.

- Asia up -

Hong Kong and Shanghai each closed up by more than two percent Tuesday after data showed China's services sector expanded last month at its fastest pace since July.

The news came as traders await the end of a Chinese government meeting this week to hammer out an economic stimulus.

Officials are expected to give the go-ahead to about $140 billion in extra budget spending, mostly for indebted local governments, and a similar one-off payment for banks.

Chinese Premier Li Qiang, meanwhile, said he was "fully confident" that China's economy would hit its growth targets this year and indicated that there was room to do more.

Oil prices rose, but less sharply, having surged almost three percent Monday on worries about the Middle East crisis and as top producers agreed to extend output cuts through to the end of December.

On the corporate front, Boeing shares fell slightly even though striking workers approved a contract proposal late Monday, ending more than seven weeks of stoppages that underscored discontent in the workforce of the beleaguered US aviation giant.

- Key figures around 1640 GMT -

New York - Dow: UP 0.7 percent at 42,104.25 points

New York - S&P 500: UP 0.9 percent at 5,766.42

New York - Nasdaq: UP 1.2 percent at 18,395.64

London - FTSE 100: DOWN 0.1 percent at 8,172.39 (close)

Paris - CAC 40: UP 0.5 percent at 7,407.15 (close)

Frankfurt - DAX: UP 0.6 percent at 19,256.27 (close)

Tokyo - Nikkei 225: UP 1.1 percent at 38,474.90 (close)

Hong Kong - Hang Seng Index: UP 2.1 percent at 21,006.97 (close)

Shanghai - Composite: UP 2.3 percent at 3,386.99 (close)

Euro/dollar: UP at $1.0915 from $1.0878 on Monday

Pound/dollar: UP at $1.3007 from $1.2954

Dollar/yen: DOWN at 152.01 yen from 152.17 yen

Euro/pound: DOWN at 83.93 from 83.94 pence

Brent North Sea Crude: UP 1.3 percent at $76.06 per barrel

West Texas Intermediate: UP 1.4 percent at $72.50 per barrel

burs-rl/gv

A.Magalhes--PC