-

Tesla reports lower 2024 auto deliveries, missing forecast

Tesla reports lower 2024 auto deliveries, missing forecast

-

Meghan Markle's lifestyle show to premiere Jan 15 on Netflix

-

On Bourbon Street, a grim cleanup after deadly nightmare

On Bourbon Street, a grim cleanup after deadly nightmare

-

New Orleans killer acted alone, professed loyalty to jihadist group: FBI

-

UK's biggest dinosaur footprint site uncovered

UK's biggest dinosaur footprint site uncovered

-

Former Australia coach Langer to take charge of London Spirit

-

Most UK doctors suffer from 'compassion fatigue': poll

Most UK doctors suffer from 'compassion fatigue': poll

-

Everton boss Dyche unconcerned by Maupay jibe

-

FBI probes potential accomplices in New Orleans truck ramming

FBI probes potential accomplices in New Orleans truck ramming

-

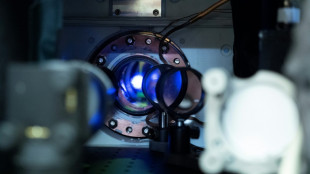

Secret lab developing UK's first quantum clock: defence ministry

-

Premier League chief fears Club World Cup's impact on Man City and Chelsea

Premier League chief fears Club World Cup's impact on Man City and Chelsea

-

US mulls new restrictions on Chinese drones

-

Rosita Missoni of Italy's eponymous fashion house dies age 93

Rosita Missoni of Italy's eponymous fashion house dies age 93

-

27 sub-Saharan African migrants die off Tunisia in shipwrecks

-

UK grime star Stormzy banned from driving for nine months

UK grime star Stormzy banned from driving for nine months

-

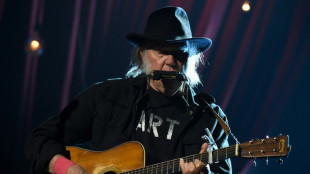

Neil Young dumps Glastonbury alleging 'BBC control'

-

Swiatek battles back to take Poland into United Cup semis

Swiatek battles back to take Poland into United Cup semis

-

Electric cars took 89% of Norway market in 2024

-

Rival South Korea camps face off as president holds out

Rival South Korea camps face off as president holds out

-

French downhill ace Sarrazin out of intensive care

-

Djokovic cruises past Monfils as rising stars impress in Brisbane

Djokovic cruises past Monfils as rising stars impress in Brisbane

-

Montenegro mourns after gunman kills 12

-

Sales surge in 2024 for Chinese EV giant BYD

Sales surge in 2024 for Chinese EV giant BYD

-

Agnes Keleti, world's oldest Olympic champion, dies at 103

-

Andreeva, Mpetshi Perricard showcase Australian Open potential

Andreeva, Mpetshi Perricard showcase Australian Open potential

-

Afghan refugees suffer 'like prisoners' in Pakistan crackdown

-

Coach tight-lipped on whether Rohit will play in final Australia Test

Coach tight-lipped on whether Rohit will play in final Australia Test

-

Blooming hard: Taiwan's persimmon growers struggle

-

South Korea's impeached president resists arrest over martial law bid

South Korea's impeached president resists arrest over martial law bid

-

Knicks roll to ninth straight NBA win, Ivey hurt in Pistons victory

-

'Numb' New Orleans grapples with horror of deadly truck attack

'Numb' New Orleans grapples with horror of deadly truck attack

-

Asia stocks begin year on cautious note

-

FBI probes 'terrorist' links in New Orleans truck-ramming that killed 15

FBI probes 'terrorist' links in New Orleans truck-ramming that killed 15

-

2024 was China's hottest year on record: weather agency

-

Perera smashes 46-ball ton as Sri Lanka pile up 218-5 in 3rd NZ T20

Perera smashes 46-ball ton as Sri Lanka pile up 218-5 in 3rd NZ T20

-

South Korea police raid Muan airport over Jeju Air crash that killed 179

-

South Korea's Yoon resists arrest over martial law bid

South Korea's Yoon resists arrest over martial law bid

-

Sainz set to step out of comfort zone to defend Dakar Rally title

-

New Year's fireworks accidents kill five in Germany

New Year's fireworks accidents kill five in Germany

-

'I'm Still Here': an ode to Brazil resistance

-

New Orleans attack suspect was US-born army veteran

New Orleans attack suspect was US-born army veteran

-

Australia axe Marsh, call-up Webster for fifth India Test

-

Jets quarterback Rodgers ponders NFL future ahead of season finale

Jets quarterback Rodgers ponders NFL future ahead of season finale

-

Eagles' Barkley likely to sit out season finale, ending rushing record bid

-

Syria FM hopes first foreign visit to Saudi opens 'new, bright page'

Syria FM hopes first foreign visit to Saudi opens 'new, bright page'

-

At least 10 dead in Montenegro restaurant shooting: minister

-

Arteta reveals Arsenal hit by virus before vital win at Brentford

Arteta reveals Arsenal hit by virus before vital win at Brentford

-

Palestinian Authority suspends Al Jazeera broadcasts

-

Arsenal close gap on Liverpool as Jesus stars again

Arsenal close gap on Liverpool as Jesus stars again

-

Witnesses describe 'war zone' left in wake of New Orleans attack

| RBGPF | -5.05% | 59.02 | $ | |

| CMSC | 0.93% | 23.145 | $ | |

| CMSD | 1.09% | 23.384 | $ | |

| GSK | 0.28% | 33.915 | $ | |

| NGG | 0.42% | 59.67 | $ | |

| BTI | 0.32% | 36.435 | $ | |

| SCS | -1.46% | 11.65 | $ | |

| RIO | -0.17% | 58.71 | $ | |

| RYCEF | 2.34% | 7.25 | $ | |

| BCC | -1.57% | 117.027 | $ | |

| BP | 0.84% | 29.81 | $ | |

| BCE | -0.13% | 23.15 | $ | |

| AZN | 0.67% | 65.96 | $ | |

| VOD | -0.18% | 8.475 | $ | |

| RELX | -0.28% | 45.295 | $ | |

| JRI | 0.04% | 12.135 | $ |

India slashes size of biggest IPO

India has slashed the size of an initial public offering by insurance giant LIC but the share issue will still be the country's largest to date, with a targeted windfall of $2.7 billion, regulatory filings showed Wednesday.

Prime Minister Narendra Modi's government is desperate for proceeds from the IPO by Life Insurance Corporation of India and the sale of other state assets to help fix tattered public finances.

The long-awaited IPO -- originally slated for March -- will open next week, after the government chose to wait out recent market volatility triggered by the Russian invasion of Ukraine, the filing seen by AFP showed.

But the adverse market conditions did force the government to substantially cut its stake sale from an earlier five percent to 3.5 percent.

The government will sell 221 million shares within a price band of 902 to 949 rupees, the prospectus showed.

This implies an IPO size of between 200 and 210 billion rupees ($2.61 billion to $2.74 billion), overtaking that of payments firm Paytm, which raised $2.5 billion in November in India's largest public share sale to date.

The offer values LIC at six trillion rupees ($78 billion), and follows a years-long exercise by bankers and bureaucrats to appraise the mammoth insurer and ready it for listing.

Founded in 1956 by nationalising and combining 245 insurers, LIC was for decades synonymous with life insurance in post-independence India, until the entry of private companies in 2000.

It continues to lead the pack with a 61 percent share of the life insurance market in a country of 1.4 billion people, with its army of 1.3 million "LIC agents" giving it huge reach, especially in rural India.

LIC's market share has, however, declined steadily in the face of competition from net-savvy private insurers offering specialised products.

The firm warned in its regulatory filing that "there can be no assurance that our corporation will not lose further market share" to private companies.

The insurer is also India's largest asset manager, with 39.55 trillion rupees under management as of September 30, including significant stakes in Indian blue chips like Reliance and Infosys.

The government hopes LIC's IPO will attract legions of first-time investors to the stock market, in a country where less than five percent of people have trading accounts.

It will be a crucial step in Modi's policy to "monetise and modernise" state-run companies and plug an estimated 16.6 trillion rupee fiscal deficit this financial year.

In the last financial year, ending March 31, the government missed its privatisation goal for the third straight year, raising 135.61 billion rupees -- only eight percent of its original divestment target.

J.Oliveira--PC