-

US court blocks Biden-era net neutrality rules

US court blocks Biden-era net neutrality rules

-

Asian shares rise defying slow Wall Street start to 2025

-

Axing could be end for India's 'Hitman' Rohit in Test cricket

Axing could be end for India's 'Hitman' Rohit in Test cricket

-

10 years after attack, Charlie Hebdo is uncowed and still provoking

-

Iran artist's vision for culture hub enlivens rustic district

Iran artist's vision for culture hub enlivens rustic district

-

'Emilia Perez' heads into Golden Globes as strong favorite

-

'You need to be happy': graffiti encourages Cuban self-reflection

'You need to be happy': graffiti encourages Cuban self-reflection

-

Rohit-less India 57-3 as Australia assert early control in final Test

-

Disaster-hit Chilean park sows seeds of fire resistance

Disaster-hit Chilean park sows seeds of fire resistance

-

South Korea investigators in standoff to arrest President Yoon

-

Philadelphia name South African Carnell as new head coach

Philadelphia name South African Carnell as new head coach

-

Vikings-Lions showdown to end season will decide NFC top seed

-

Allen and Goff to start NFL Pro Bowl Games as Mahomes snubbed

Allen and Goff to start NFL Pro Bowl Games as Mahomes snubbed

-

Apple agrees to $95 mn deal to settle Siri eavesdropping suit

-

Tears, tourism on Bourbon Street after US terror nightmare

Tears, tourism on Bourbon Street after US terror nightmare

-

Venezuela offers $100,000 reward for exiled opposition candidate

-

South Korea investigators arrive to attempt to arrest president

South Korea investigators arrive to attempt to arrest president

-

Giannis and Jokic lead NBA All-Star voting with LeBron well back

-

Mixed day for global stocks as dollar pushes higher

Mixed day for global stocks as dollar pushes higher

-

Nick Clegg leaves Meta global policy team

-

Vegas Tesla blast suspect shot himself in head: officials

Vegas Tesla blast suspect shot himself in head: officials

-

Shiffrin hopes to be back on slopes 'in the next week'

-

Dumfries double takes Inter into Italian Super Cup final

Dumfries double takes Inter into Italian Super Cup final

-

Spain's Canary Islands received record 46,843 migrants in 2024: ministry

-

Panama says migrant jungle crossings fell 41% in 2024

Panama says migrant jungle crossings fell 41% in 2024

-

UN experts slam Israel's 'blatant assault' on health rights in Gaza

-

Tesla reports lower 2024 auto deliveries, missing forecast

Tesla reports lower 2024 auto deliveries, missing forecast

-

Meghan Markle's lifestyle show to premiere Jan 15 on Netflix

-

On Bourbon Street, a grim cleanup after deadly nightmare

On Bourbon Street, a grim cleanup after deadly nightmare

-

New Orleans killer acted alone, professed loyalty to jihadist group: FBI

-

UK's biggest dinosaur footprint site uncovered

UK's biggest dinosaur footprint site uncovered

-

Former Australia coach Langer to take charge of London Spirit

-

Most UK doctors suffer from 'compassion fatigue': poll

Most UK doctors suffer from 'compassion fatigue': poll

-

Everton boss Dyche unconcerned by Maupay jibe

-

FBI probes potential accomplices in New Orleans truck ramming

FBI probes potential accomplices in New Orleans truck ramming

-

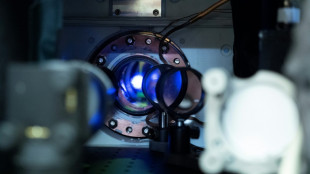

Secret lab developing UK's first quantum clock: defence ministry

-

Premier League chief fears Club World Cup's impact on Man City and Chelsea

Premier League chief fears Club World Cup's impact on Man City and Chelsea

-

US mulls new restrictions on Chinese drones

-

Rosita Missoni of Italy's eponymous fashion house dies age 93

Rosita Missoni of Italy's eponymous fashion house dies age 93

-

27 sub-Saharan African migrants die off Tunisia in shipwrecks

-

UK grime star Stormzy banned from driving for nine months

UK grime star Stormzy banned from driving for nine months

-

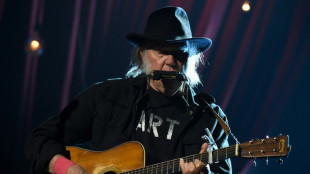

Neil Young dumps Glastonbury alleging 'BBC control'

-

Swiatek battles back to take Poland into United Cup semis

Swiatek battles back to take Poland into United Cup semis

-

Electric cars took 89% of Norway market in 2024

-

Rival South Korea camps face off as president holds out

Rival South Korea camps face off as president holds out

-

French downhill ace Sarrazin out of intensive care

-

Djokovic cruises past Monfils as rising stars impress in Brisbane

Djokovic cruises past Monfils as rising stars impress in Brisbane

-

Montenegro mourns after gunman kills 12

-

Sales surge in 2024 for Chinese EV giant BYD

Sales surge in 2024 for Chinese EV giant BYD

-

Agnes Keleti, world's oldest Olympic champion, dies at 103

HSBC first-quarter pre-tax profits drop nearly 30% to US$4.2 bn

HSBC said on Tuesday that first-quarter profits dropped nearly 30 percent owing to higher-than-expected credit losses and inflation but the Asia-focused lending giant remained upbeat about its outlook.

The London-based bank announced pre-tax profits of $4.2 billion for January-March, down 28 percent on-year but beating estimates, while reporting revenue declined four percent to $12.5 billion.

"While profits were down on last year's first quarter due to market impacts on wealth revenue and a more normalised level of ECL (expected credit losses), higher lending across all businesses and regions, and good business growth in personal banking, insurance and trade finance bode well for future quarters," chief executive Noel Quinn said in a statement.

The lender reported an ECL of $600 million, compared with a release of $400 million from the same period last year.

The bank said it continued to expect "mid single-digit percentage" growth this year for revenue and lending respectively.

Tuesday's results were published against the backdrop of Russia’s invasion of Ukraine, which the bank said was exacerbating inflationary pressures and contributing to higher ECL charges for the quarter.

"The repercussions from the Russia-Ukraine war, alongside the economic impacts that continue to result from Covid-19, have pushed up the prices of a broad range of commodities, with the resulting increase in inflation creating further challenges for monetary authorities and our customers," the bank said.

Quinn said the "vast majority" of HSBC business in Russia serves multinational corporate clients headquartered in other countries, and the bank was implementing sanctions put in place by the United Kingdom and other governments.

But the bank forecast its operation in Russia may become "untenable" if subject to further restrictions.

HSBC has embarked on a multi-year strategic pivot to Asia and the Middle East, and on Tuesday it noted that while coronavirus restrictions were lifting across much of the globe, key markets such as China and Hong Kong remained committed to zero-Covid controls.

"China's government-imposed lockdown restrictions in major Chinese cities have impacted China’s economy, Asia tourism and global supply chains adversely," the bank said.

China is struggling to deal with skyrocketing case counts in multiple cities and has locked down its finance hub Shanghai for the past month.

Meanwhile, Hong Kong -- HSBC's largest market -- has entered its third year of strict coronavirus controls that have isolated it from the rest of the world and hit businesses hard.

The bank noted that the financial services sector in Hong Kong has remained strong.

HSBC's restructuring effort to lead the market in Asia wealth management had earlier included a programme to invest $6 billion in Hong Kong, China and Singapore and to hire more than 5,000 wealth advisors.

The lender has slashed 35,000 jobs and sold its retail operations in the United States and France.

In February, the bank announced a boon to investors in the form of a $1.0 billion share buyback, adding to a $2.0 billion buyback announced last year.

A.Santos--PC