-

EU universal charger rules come into force

EU universal charger rules come into force

-

Evenepoel targets return in time for Ardennes classics

-

Duffy bowls New Zealand to T20 victory over Sri Lanka

Duffy bowls New Zealand to T20 victory over Sri Lanka

-

Turkey's pro-Kurd party to meet jailed PKK leader on Saturday

-

Gaza hospital shut after Israeli raid, director held: health officials

Gaza hospital shut after Israeli raid, director held: health officials

-

Surgery for French skier Sarrazin 'went well': federation

-

Mitchell, Bracewell boost New Zealand in Sri Lanka T20

Mitchell, Bracewell boost New Zealand in Sri Lanka T20

-

Kyrgios says tennis integrity 'awful' after doping scandals

-

S. Korean prosecutors say Yoon authorised 'shooting' during martial law bid

S. Korean prosecutors say Yoon authorised 'shooting' during martial law bid

-

Vendee Globe skipper Pip Hare limps into Melbourne after dismasting

-

Reddy's defiant maiden ton claws India back into 4th Australia Test

Reddy's defiant maiden ton claws India back into 4th Australia Test

-

Doubles partner Thompson calls Purcell doping case 'a joke'

-

Reddy reaches fighting maiden century for India against Australia

Reddy reaches fighting maiden century for India against Australia

-

Sabalenka enjoying 'chilled' rivalry with Swiatek

-

Political turmoil shakes South Korea's economy

Political turmoil shakes South Korea's economy

-

New mum Bencic wins first tour-level match since 2023 US Open

-

'Romeo and Juliet' star Olivia Hussey dies aged 73

'Romeo and Juliet' star Olivia Hussey dies aged 73

-

Brown dominates as NBA champion Celtics snap skid

-

Indian state funeral for former PM Manmohan Singh

Indian state funeral for former PM Manmohan Singh

-

France asks Indonesia to transfer national on death row

-

Ambitious Ruud targets return to top five in 2025

Ambitious Ruud targets return to top five in 2025

-

Late bloomer Paolini looking to build on 'amazing' 2024

-

Australia remove Pant, Jadeja as India reach 244-7 at lunch

Australia remove Pant, Jadeja as India reach 244-7 at lunch

-

Scheffler sidelined by Christmas cooking injury

-

Rice seeks trophies as Arsenal chase down 'full throttle' Liverpool

Rice seeks trophies as Arsenal chase down 'full throttle' Liverpool

-

Trump asks US Supreme Court to pause law threatening TikTok ban

-

Arsenal edge past Ipswich to go second in Premier League

Arsenal edge past Ipswich to go second in Premier League

-

LawConnect wins punishing and deadly Sydney-Hobart yacht race

-

Ronaldo slams 'unfair' Ballon d'Or result after Vinicius snub

Ronaldo slams 'unfair' Ballon d'Or result after Vinicius snub

-

Several wounded N.Korean soldiers died after being captured by Ukraine: Zelensky

-

Fresh strike hits Yemen's rebel-held capital

Fresh strike hits Yemen's rebel-held capital

-

Netflix with Beyonce make splash despite NFL ratings fall

-

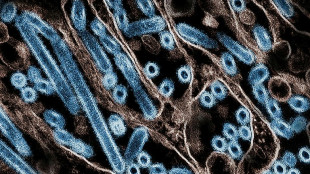

Bird flu mutated inside US patient, raising concern

Bird flu mutated inside US patient, raising concern

-

Slovakia says ready to host Russia-Ukraine peace talks

-

Maresca challenges Chelsea to react to Fulham blow

Maresca challenges Chelsea to react to Fulham blow

-

Tech slump slays Santa rally, weak yen lifts Japan stocks higher

-

Test records for Zimbabwe and Williams as Afghanistan toil

Test records for Zimbabwe and Williams as Afghanistan toil

-

LawConnect wins punishing Sydney-Hobart yacht race

-

Barca's Yamal vows to 'come back better' after ankle injury

Barca's Yamal vows to 'come back better' after ankle injury

-

Olmo closer to Barcelona exit after registration request rejected

-

Watching the sun rise over a new Damascus

Watching the sun rise over a new Damascus

-

Malaysia man flogged in mosque for crime of gender mixing

-

Montenegro to extradite crypto entrepreneur Do Kwon to US

Montenegro to extradite crypto entrepreneur Do Kwon to US

-

Brazil views labor violations at BYD site as human 'trafficking'

-

No extra pressure for Slot as Premier League leaders Liverpool pull clear

No extra pressure for Slot as Premier League leaders Liverpool pull clear

-

Tourists return to post-Olympic Paris for holiday magic

-

'Football harder than Prime Minister' comment was joke, says Postecoglou

'Football harder than Prime Minister' comment was joke, says Postecoglou

-

Driver who killed 35 in China car ramming sentenced to death

-

Bosch gives South Africa 90-run lead against Pakistan

Bosch gives South Africa 90-run lead against Pakistan

-

French skier Sarrazin 'conscious' after training crash

| RBGPF | 100% | 59.84 | $ | |

| RELX | -0.61% | 45.58 | $ | |

| VOD | 0.12% | 8.43 | $ | |

| RIO | -0.41% | 59.01 | $ | |

| GSK | -0.12% | 34.08 | $ | |

| NGG | 0.66% | 59.31 | $ | |

| SCS | 0.58% | 11.97 | $ | |

| CMSD | -0.67% | 23.32 | $ | |

| RYCEF | 0.14% | 7.27 | $ | |

| CMSC | -0.85% | 23.46 | $ | |

| AZN | -0.39% | 66.26 | $ | |

| BCC | -1.91% | 120.63 | $ | |

| BTI | -0.33% | 36.31 | $ | |

| BP | 0.38% | 28.96 | $ | |

| BCE | -0.93% | 22.66 | $ | |

| JRI | -0.41% | 12.15 | $ |

Nickel trading resumes only briefly in London

Trading in nickel resumed Wednesday on the London Metal Exchange after a lengthy pause linked to the Ukraine crisis but was quickly suspended again after a sharp fall.

Nickel stopped trading having swiftly breached a new five-percent daily price movement limit to stand at $43,995 per tonne on the LME.

"Following re-open, the market moved to its limit-down pricing band," the exchange said in a statement.

"We have now halted the electronic market to investigate a potential issue with the limit-down band, and will update the market in due course."

Nickel, used in stainless steel and electric vehicle batteries, spiked on March 8 to a then-record high of $101,365 per tonne on a bad bet from a Chinese billionaire following Russia's invasion of Ukraine.

However, the LME subsequently decided to cancel all trades made that day and halted trading.

That leaves nickel's record high at $48,002 per tonne, set March 7.

Moscow's invasion sparked market chaos last week owing to supply concerns in Russia, the world's third biggest nickel producer.

The metal's price, already soaring, was catapulted even higher by a bad pricing call from Chinese billionaire Xiang Guangda.

Guangda -- owner of the world's biggest nickel producer Tsingshan Holding Group -- had bet on nickel prices falling since late last year, but was blindsided by the Ukraine war.

A short squeeze occurs when investors bet on falling prices but are then forced to close out their positions and purchase at a far higher price, triggering a spike.

H.Silva--PC