-

WHO chief says narrowly escaped death in Israeli strikes on Yemen airport

WHO chief says narrowly escaped death in Israeli strikes on Yemen airport

-

Swiss Monney takes maiden World Cup win in Bormio downhill

-

De Minaur wins but Australia crash to Argentina at United Cup

De Minaur wins but Australia crash to Argentina at United Cup

-

EU universal charger rules come into force

-

Evenepoel targets return in time for Ardennes classics

Evenepoel targets return in time for Ardennes classics

-

Duffy bowls New Zealand to T20 victory over Sri Lanka

-

Turkey's pro-Kurd party to meet jailed PKK leader on Saturday

Turkey's pro-Kurd party to meet jailed PKK leader on Saturday

-

Gaza hospital shut after Israeli raid, director held: health officials

-

Surgery for French skier Sarrazin 'went well': federation

Surgery for French skier Sarrazin 'went well': federation

-

Mitchell, Bracewell boost New Zealand in Sri Lanka T20

-

Kyrgios says tennis integrity 'awful' after doping scandals

Kyrgios says tennis integrity 'awful' after doping scandals

-

S. Korean prosecutors say Yoon authorised 'shooting' during martial law bid

-

Vendee Globe skipper Pip Hare limps into Melbourne after dismasting

Vendee Globe skipper Pip Hare limps into Melbourne after dismasting

-

Reddy's defiant maiden ton claws India back into 4th Australia Test

-

Doubles partner Thompson calls Purcell doping case 'a joke'

Doubles partner Thompson calls Purcell doping case 'a joke'

-

Reddy reaches fighting maiden century for India against Australia

-

Sabalenka enjoying 'chilled' rivalry with Swiatek

Sabalenka enjoying 'chilled' rivalry with Swiatek

-

Political turmoil shakes South Korea's economy

-

New mum Bencic wins first tour-level match since 2023 US Open

New mum Bencic wins first tour-level match since 2023 US Open

-

'Romeo and Juliet' star Olivia Hussey dies aged 73

-

Brown dominates as NBA champion Celtics snap skid

Brown dominates as NBA champion Celtics snap skid

-

Indian state funeral for former PM Manmohan Singh

-

France asks Indonesia to transfer national on death row

France asks Indonesia to transfer national on death row

-

Ambitious Ruud targets return to top five in 2025

-

Late bloomer Paolini looking to build on 'amazing' 2024

Late bloomer Paolini looking to build on 'amazing' 2024

-

Australia remove Pant, Jadeja as India reach 244-7 at lunch

-

Scheffler sidelined by Christmas cooking injury

Scheffler sidelined by Christmas cooking injury

-

Rice seeks trophies as Arsenal chase down 'full throttle' Liverpool

-

Trump asks US Supreme Court to pause law threatening TikTok ban

Trump asks US Supreme Court to pause law threatening TikTok ban

-

Arsenal edge past Ipswich to go second in Premier League

-

LawConnect wins punishing and deadly Sydney-Hobart yacht race

LawConnect wins punishing and deadly Sydney-Hobart yacht race

-

Ronaldo slams 'unfair' Ballon d'Or result after Vinicius snub

-

Several wounded N.Korean soldiers died after being captured by Ukraine: Zelensky

Several wounded N.Korean soldiers died after being captured by Ukraine: Zelensky

-

Fresh strike hits Yemen's rebel-held capital

-

Netflix with Beyonce make splash despite NFL ratings fall

Netflix with Beyonce make splash despite NFL ratings fall

-

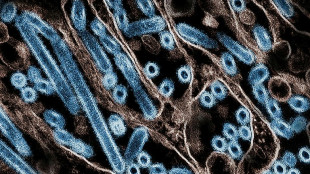

Bird flu mutated inside US patient, raising concern

-

Slovakia says ready to host Russia-Ukraine peace talks

Slovakia says ready to host Russia-Ukraine peace talks

-

Maresca challenges Chelsea to react to Fulham blow

-

Tech slump slays Santa rally, weak yen lifts Japan stocks higher

Tech slump slays Santa rally, weak yen lifts Japan stocks higher

-

Test records for Zimbabwe and Williams as Afghanistan toil

-

LawConnect wins punishing Sydney-Hobart yacht race

LawConnect wins punishing Sydney-Hobart yacht race

-

Barca's Yamal vows to 'come back better' after ankle injury

-

Olmo closer to Barcelona exit after registration request rejected

Olmo closer to Barcelona exit after registration request rejected

-

Watching the sun rise over a new Damascus

-

Malaysia man flogged in mosque for crime of gender mixing

Malaysia man flogged in mosque for crime of gender mixing

-

Montenegro to extradite crypto entrepreneur Do Kwon to US

-

Brazil views labor violations at BYD site as human 'trafficking'

Brazil views labor violations at BYD site as human 'trafficking'

-

No extra pressure for Slot as Premier League leaders Liverpool pull clear

-

Tourists return to post-Olympic Paris for holiday magic

Tourists return to post-Olympic Paris for holiday magic

-

'Football harder than Prime Minister' comment was joke, says Postecoglou

| RBGPF | 100% | 59.84 | $ | |

| SCS | 0.58% | 11.97 | $ | |

| BCC | -1.91% | 120.63 | $ | |

| NGG | 0.66% | 59.31 | $ | |

| CMSD | -0.67% | 23.32 | $ | |

| AZN | -0.39% | 66.26 | $ | |

| GSK | -0.12% | 34.08 | $ | |

| BTI | -0.33% | 36.31 | $ | |

| RELX | -0.61% | 45.58 | $ | |

| CMSC | -0.85% | 23.46 | $ | |

| RIO | -0.41% | 59.01 | $ | |

| BCE | -0.93% | 22.66 | $ | |

| VOD | 0.12% | 8.43 | $ | |

| RYCEF | 0.14% | 7.27 | $ | |

| BP | 0.38% | 28.96 | $ | |

| JRI | -0.41% | 12.15 | $ |

Fed set to raise interest rates to rein in inflation

US central bankers on Wednesday are poised to take the first step to raise borrowing costs in a bid to cap rising inflation before it surges out of control.

The Federal Reserve will have to walk a tightrope to ensure its efforts don't derail the recovery from the Covid-19 pandemic as Russia's invasion of Ukraine introduces new uncertainty in an economy battered by supply chain snarls and labor shortages.

"There is no good answer to that in any economics textbook," David Wilcox, a former senior Fed advisor, told AFP, stressing that communication from the central bank about its willingness to act will be key in pulling off its balancing act.

The central bank's Federal Open Market Committee is due to announce its rate decision at 1800 GMT, when its two-day meeting concludes.

Fed Chair Jerome Powell has said he favors increasing the benchmark interest rate by 0.25 percentage points from zero, where it has been since March 2020.

It would be the first in a series of hikes, which would pull back on the stimulus rushed into place at the start of the Covid-19 pandemic.

The Fed chief has expressed confidence that inflation will retreat in the coming months as supply chain issues and shortages are resolved in the world's largest economy.

But China's latest lockdowns of several cities, affecting tens of millions of people and closing off a key supplier to American tech giant Apple, shows the pandemic and its disruptions are not over.

Policymakers are better equipped to handle inflation that is too high rather than too low, as was the case in the decade following the 2008 global financial crisis, during which inflation and employment were slow to recover.

However, with the annual consumer price index growing 7.9 percent in February, its fastest pace in four decades, the central bank faces intense criticism that it missed the inflation danger, and has moved too slowly in response to rising prices for cars, housing and food.

And the war in Ukraine together with Western sanctions on Russia have sent oil prices surging, although they retreated Tuesday closing below $100 a barrel for the first time in three weeks.

- Raising rates a must -

"The Federal Reserve's delays in raising interest rates and its continued misreading of inflation, monetary and fiscal policies are now complicated by the negative supply shock imposed by Russia's invasion of Ukraine," said Mickey Levy of Berenberg Capital Markets.

"Even without the surge in oil and commodity prices, the Fed is wrong on every count," Levy wrote in a column in The Wall Street Journal, saying the central bank "must begin to raise rates."

But Wilcox, now with the Peterson Institute for International Economics and Bloomberg Economics, defended the Fed's performance, saying officials have adjusted to changing circumstances.

"I think the allegation that the Fed is behind the curve is considerably over done," he said. "They have been caught by surprise, as the vast majority of prognosticators were," but "they've had the guts and the courage" to change their mind publicly.

Economists project six or seven rate increases this year, which would still leave the policy rate below two percent, assuming central bankers raise it in quarter-point steps.

However, Powell and other policymakers have stressed that they will do whatever is needed to tamp down inflation.

After it begins ratcheting up borrowing costs, the Fed is next expected to begin offloading its massive stockpile of assets purchased to provide liquidity to the economy during the pandemic, a process expected to start in the summer and proceed gradually, to avoid roiling financial markets.

"The most important thing for the Fed to communicate in an environment of enormous uncertainty" is to make clear "how it will respond," Wilcox said.

P.Sousa--PC