-

Fresh strike hits Yemen's rebel-held capital

Fresh strike hits Yemen's rebel-held capital

-

Netflix with Beyonce make splash despite NFL ratings fall

-

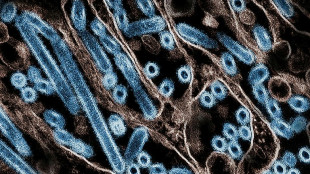

Bird flu mutated inside US patient, raising concern

Bird flu mutated inside US patient, raising concern

-

Slovakia says ready to host Russia-Ukraine peace talks

-

Maresca challenges Chelsea to react to Fulham blow

Maresca challenges Chelsea to react to Fulham blow

-

Tech slump slays Santa rally, weak yen lifts Japan stocks higher

-

Test records for Zimbabwe and Williams as Afghanistan toil

Test records for Zimbabwe and Williams as Afghanistan toil

-

LawConnect wins punishing Sydney-Hobart yacht race

-

Barca's Yamal vows to 'come back better' after ankle injury

Barca's Yamal vows to 'come back better' after ankle injury

-

Olmo closer to Barcelona exit after registration request rejected

-

Watching the sun rise over a new Damascus

Watching the sun rise over a new Damascus

-

Malaysia man flogged in mosque for crime of gender mixing

-

Montenegro to extradite crypto entrepreneur Do Kwon to US

Montenegro to extradite crypto entrepreneur Do Kwon to US

-

Brazil views labor violations at BYD site as human 'trafficking'

-

No extra pressure for Slot as Premier League leaders Liverpool pull clear

No extra pressure for Slot as Premier League leaders Liverpool pull clear

-

Tourists return to post-Olympic Paris for holiday magic

-

'Football harder than Prime Minister' comment was joke, says Postecoglou

'Football harder than Prime Minister' comment was joke, says Postecoglou

-

Driver who killed 35 in China car ramming sentenced to death

-

Bosch gives South Africa 90-run lead against Pakistan

Bosch gives South Africa 90-run lead against Pakistan

-

French skier Sarrazin 'conscious' after training crash

-

NATO to boost military presence in Baltic after cables 'sabotage'

NATO to boost military presence in Baltic after cables 'sabotage'

-

Howe hopes Newcastle have 'moved on' in last two seasons

-

German president dissolves parliament, sets Feb 23 election date

German president dissolves parliament, sets Feb 23 election date

-

Slot says 'too early' for Liverpool title talk

-

Mayotte faces environment, biodiversity crisis after cyclone

Mayotte faces environment, biodiversity crisis after cyclone

-

Amorm says 'survival' aim for Man Utd after Wolves loss

-

Desertions spark panic, and pardons, in Ukraine's army

Desertions spark panic, and pardons, in Ukraine's army

-

China sanctions US firms over Taiwan military support

-

World number six Rybakina makes winning start at United Cup

World number six Rybakina makes winning start at United Cup

-

Israeli strikes hit Yemen airport as WHO chief prepares to leave

-

Swiatek not expecting WADA appeal over doping scandal

Swiatek not expecting WADA appeal over doping scandal

-

'Dangerous new era': climate change spurs disaster in 2024

-

Fritz motivated for Slam success after low-key off-season

Fritz motivated for Slam success after low-key off-season

-

Move over Mercedes: Chinese cars grab Mexican market share

-

Zverev aiming to challenge Sinner for top ranking

Zverev aiming to challenge Sinner for top ranking

-

N. Korean soldier captured in Russia-Ukraine war: Seoul

-

Inspired Tsitsipas looking to 'refresh, regroup' in Australia

Inspired Tsitsipas looking to 'refresh, regroup' in Australia

-

Seahawks edge Bears to boost NFL playoff hopes

-

Thunder NBA win streak at nine as Shai ties career high with 45

Thunder NBA win streak at nine as Shai ties career high with 45

-

India announces state funeral for ex-PM Manmohan Singh

-

Japan govt approves record budget for ageing population, defence

Japan govt approves record budget for ageing population, defence

-

Japanese shares gain on weaker yen after Christmas break

-

South Korea's acting president faces impeachment vote

South Korea's acting president faces impeachment vote

-

Fleeing Myanmar, Rohingya refugees recall horror of war

-

Smith century puts Australia in control of 4th Test against India

Smith century puts Australia in control of 4th Test against India

-

Israeli strikes hit Yemen as Netanyahu fires warning

-

Peru ex-official denies running Congress prostitution ring

Peru ex-official denies running Congress prostitution ring

-

Australia's Smith reaches 34th Test century

-

NHL Red Wings fire Lalonde and name McLellan as head coach

NHL Red Wings fire Lalonde and name McLellan as head coach

-

The Bilingual Book Company Launches New, Innovative Bilingual Audiobook App

| CMSD | -0.54% | 23.35 | $ | |

| NGG | 0.64% | 59.3 | $ | |

| BCC | -1.58% | 121.02 | $ | |

| CMSC | -0.9% | 23.45 | $ | |

| RBGPF | -1.17% | 59.8 | $ | |

| SCS | 0.84% | 12.001 | $ | |

| RIO | -0.31% | 59.065 | $ | |

| JRI | -0.29% | 12.165 | $ | |

| GSK | -0.22% | 34.045 | $ | |

| BCE | -0.93% | 22.66 | $ | |

| RYCEF | -0.69% | 7.2 | $ | |

| AZN | -0.26% | 66.345 | $ | |

| RELX | -0.48% | 45.643 | $ | |

| VOD | 0.36% | 8.45 | $ | |

| BTI | -0.25% | 36.34 | $ | |

| BP | 0.57% | 29.015 | $ |

European, US stocks rise on Ukraine hope as oil slumps

European and US equities largely rebounded Monday as investors seized on hopes of progress in peace talks between Russia and Ukraine, sending oil tanking alongside news of key crude consumer China's Covid lockdown of tech hub Shenzhen.

Europe shrugged off tech-fuelled Asian losses after Moscow said it made headway in peace talks with Kyiv ahead of Monday's latest round.

Frankfurt shares rallied 2.2 percent and Paris won 1.8 percent in afternoon deals, while London gained 0.3 percent.

US equities showed a meeker improvement, as traders reckoned with the prospect of the Federal Reserve raising interest rates at its meeting this week.

The S&P 500 rose by 0.2 percent and the Dow Jones Industrial Average by 0.6 percent in early deals, while the Nasdaq lost 0.2 percent.

The prospect of easing supply tensions and growing demand fears also sent oil prices sliding six percent.

"Moscow claims substantial progress in peace talks while escalating conflict ... but that is enough for traders grabbing onto any good headline," said Markets.com analyst Neil Wilson.

The latest talks come more than two weeks after Russia's President Vladimir Putin ordered his army to invade its pro-Western neighbour.

Back in Asia, traders fretted that China's spreading coronavirus lockdowns could slam the Asian superpower's demand for crude.

Asian equities mostly fell Monday with Hong Kong taking a pounding as the Shenzhen lockdown fuelled a tech-sector rout.

"The rapid spread of Covid across China is now unsettling investors, with expectations that mass lockdowns will once again blight the economy," said Hargreaves Lansdown analyst Susannah Streeter.

She added that oil "demand (is) expected to take a hit if Chinese economic output falls".

Crude has continued to drop from last week's near 14-year peak close to $140 per barrel.

However, the commodity -- which oils the wheels of the global economy -- remains elevated, keeping major upward pressure on inflation.

The Fed's latest monetary policy gathering is expected to end Wednesday with the bank announcing a quarter-point interest rate hike to tackle decades-high inflation in the US.

The US central bank is trying to walk a fine line between trying to rein in runaway inflation while also trying to support the world's biggest economy in the face of the war in Ukraine, which many fear could lead to another recession.

- Key figures around 1400 GMT -

New York - Dow: UP 0.6 percent at 33,155.03 points

London - FTSE 100: UP 0.3 percent at 7,179.41

Frankfurt - DAX: UP 2.2 percent at 13,932.67

Paris - CAC 40: UP 1.8 percent at 6,370.19

EURO STOXX 50: UP 1.6 percent at 3,747.18

West Texas Intermediate: DOWN 6.4 percent at $102.35

Brent North Sea crude: DOWN 6.0 percent at $105.89 per barrel

Hong Kong - Hang Seng Index: DOWN 5.0 percent at 19,531.66 (close)

Shanghai - Composite: DOWN 2.6 percent at 3,223.53 (close)

Tokyo - Nikkei 225: UP 0.6 percent at 25,307.85 (close)

Euro/dollar: UP at $1.0943 from $1.0912 Friday

Pound/dollar: UP at $1.3050 from $1.3037

Euro/pound: UP at 83.87 pence from 83.70 pence

Dollar/yen: UP at 118.00 yen from 117.29 yen

burs-sea/lth

A.F.Rosado--PC