-

Le Pen says days of new French govt numbered

Le Pen says days of new French govt numbered

-

Villa boss Emery set for 'very difficult' clash with Newcastle

-

Investors swoop in to save German flying taxi startup

Investors swoop in to save German flying taxi startup

-

How Finnish youth learn to spot disinformation

-

12 killed in blast at Turkey explosives plant

12 killed in blast at Turkey explosives plant

-

Panama leaders past and present reject Trump's threat of Canal takeover

-

Hong Kong police issue fresh bounties for activists overseas

Hong Kong police issue fresh bounties for activists overseas

-

Saving the mysterious African manatee at Cameroon hotspot

-

India consider second spinner for Boxing Day Test

India consider second spinner for Boxing Day Test

-

London wall illuminates Covid's enduring pain at Christmas

-

Poyet appointed manager at South Korea's Jeonbuk

Poyet appointed manager at South Korea's Jeonbuk

-

South Korea's opposition vows to impeach acting president

-

The tsunami detection buoys safeguarding lives in Thailand

The tsunami detection buoys safeguarding lives in Thailand

-

Teen Konstas to open for Australia in Boxing Day India Test

-

Asian stocks mostly up after US tech rally

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

The real-life violence that inspired South Korea's 'Squid Game'

-

Blogs to Bluesky: social media shifts responses after 2004 tsunami

-

Tennis power couple de Minaur and Boulter get engaged

Tennis power couple de Minaur and Boulter get engaged

-

Supermaxi yachts eye record in gruelling Sydney-Hobart race

-

Hawaii's Kilauea volcano erupts, spewing columns of lava

Hawaii's Kilauea volcano erupts, spewing columns of lava

-

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

Five things to know about Panama Canal, in Trump's sights

-

NBA fines Minnesota guard Edwards $75,000 for outburst

-

Haitians massacred for practicing voodoo were abducted, hacked to death: UN

Haitians massacred for practicing voodoo were abducted, hacked to death: UN

-

Inter beat Como to keep in touch with leaders Atalanta

-

Man Utd boss Amorim questions 'choices' of Rashford's entourage

Man Utd boss Amorim questions 'choices' of Rashford's entourage

-

Trump's TikTok love raises stakes in battle over app's fate

-

Is he serious? Trump stirs unease with Panama, Greenland ploys

Is he serious? Trump stirs unease with Panama, Greenland ploys

-

England captain Stokes to miss three months with torn hamstring

-

Support grows for Blake Lively over smear campaign claim

Support grows for Blake Lively over smear campaign claim

-

Canada records 50,000 opioid overdose deaths since 2016

-

Jordanian, Qatari envoys hold talks with Syria's new leader

Jordanian, Qatari envoys hold talks with Syria's new leader

-

France's second woman premier makes surprise frontline return

-

France's Macron announces fourth government of the year

France's Macron announces fourth government of the year

-

Netanyahu tells Israel parliament 'some progress' on Gaza hostage deal

-

Guatemalan authorities recover minors taken by sect members

Guatemalan authorities recover minors taken by sect members

-

Germany's far-right AfD holds march after Christmas market attack

-

Serie A basement club Monza fire coach Nesta

Serie A basement club Monza fire coach Nesta

-

Mozambique top court confirms ruling party disputed win

-

Syrian medics say were coerced into false chemical attack testimony

Syrian medics say were coerced into false chemical attack testimony

-

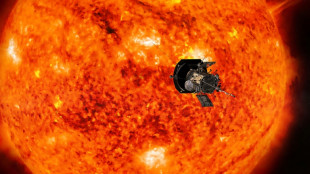

NASA solar probe to make its closest ever pass of Sun

-

London toy 'shop' window where nothing is for sale

London toy 'shop' window where nothing is for sale

-

Volkswagen boss hails cost-cutting deal but shares fall

-

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

-

Global stock markets mostly higher

-

Not for sale. Greenland shrugs off Trump's new push

Not for sale. Greenland shrugs off Trump's new push

-

Acid complicates search after deadly Brazil bridge collapse

-

Norwegian Haugan dazzles in men's World Cup slalom win

Norwegian Haugan dazzles in men's World Cup slalom win

-

Arsenal's Saka out for 'many weeks' with hamstring injury

Asian markets track Wall St rally as traders weigh Russia sanctions

Equities bounced back Friday from the previous day's rout with investors taking their lead from a rally on Wall Street after Washington decided against imposing the stiffest sanctions on Russia over its invasion of Ukraine.

Russian President Vladimir Putin's decision to send troops into Ukraine sent shockwaves through Asian and European markets and sent oil past $100 for the first time since 2014 as traders contemplated a major conflict in Eastern Europe.

Speculation had been growing for weeks about an incursion, which has stoked fears about supplies of key commodities including wheat, metals and crude.

Investors have also been fretting over the impact of any sanctions Western leaders would impose on Moscow.

Despite a chorus of outrage at Putin's move, the punishments have so far been seen as well short of the most stringent.

While the latest measures from Washington target Russia's two largest banks and see controls on high-tech items aimed at crippling its defence and aerospace sectors, US President Joe Biden has not cut off oil exports.

The news provided a big boost to Wall Street, where all three main indexes surged from deep in the red to end Thursday on a positive note, while crude eased back below $100.

The Nasdaq was the standout performer, ending more than three percent higher as commentators said the crisis could keep the Federal Reserve from embarking on an aggressive series of interest rate hikes to tame inflation.

Tech firms are more susceptible to higher borrowing costs and have been hammered in recent months on bets for tighter monetary policy.

"Stocks don't always move in the way we expect them to," Callie Cox, at trading platform eToro, said on Bloomberg's "QuickTake Stock" broadcast.

"We're sitting here processing these headlines and trying to understand what they mean for the global economy, but first and foremost, fear is a contrarian indicator.

"While we’re all rightfully fearful right now, some investors may be seeing this as a time to jump back in."

The gains in New York filtered through to Asia, where Tokyo, Shanghai, Seoul, Singapore and Wellington all rose more than one percent. Hong Kong, Sydney, Taipei and Jakarta were also up.

Still, oil rose again with Brent back above $100 a barrel as traders remained sensitive to headlines and analysts warned the conflict could keep prices elevated for months.

The caution came despite signs of progress on Iran nuclear talks that could see it begin exporting crude globally again, ramping up supplies at a time when demand is soaring as the world reopens.

While there is talk that the Ukraine crisis could lead the Fed to rethink its plans for tightening monetary policy, there were warnings bank boss Jerome Powell was not likely to be swayed by equity market losses.

"If investors are bidding up the Nasdaq 100 because they think Putin brought back the Powell Put, they may be sadly disappointed," Max Gokhman, of AlphaTrAI, said referring to the idea the Fed would step in to support stocks from suffering hefty losses.

"The Fed isn’t going to stop tightening when the US labour market remains tight and growth is above-trend."

Meanwhile, Federal Reserve Governor Christopher Waller said Thursday the US economy was healthy enough to withstand a rise in rates to one percent by summer with a 50 basis point move next month -- double the usual amount in a single hike.

However, he admitted that the Ukraine crisis could force officials to rethink their plans.

- Key figures around 0230 GMT -

Tokyo - Nikkei 225: UP 1.5 percent at 26,353.58 (break)

Hong Kong - Hang Seng Index: UP 0.4 percent at 22,981.18

Shanghai - Composite: UP 1.2 percent at 3,471.88

Brent North Sea crude: UP 2.1 percent at $101.12 per barrel

West Texas Intermediate: UP 2.1 percent at $94.77 per barrel

Dollar/yen: DOWN at 115.31 yen from 115.49 yen late Thursday

Euro/dollar: UP at $1.1208 from $1.1202

Pound/dollar: UP at $1.3398 from $1.3378

Euro/pound: DOWN at 83.66 pence from 83.70 pence

New York - Dow: UP 0.3 percent at 33,223.83 (close)

London - FTSE 100: DOWN 3.9 percent at 7,207.38 (close)

L.Carrico--PC