-

Postecoglou says Spurs 'need to reinforce' in transfer window

Postecoglou says Spurs 'need to reinforce' in transfer window

-

Le Pen says days of new French govt numbered

-

Villa boss Emery set for 'very difficult' clash with Newcastle

Villa boss Emery set for 'very difficult' clash with Newcastle

-

Investors swoop in to save German flying taxi startup

-

How Finnish youth learn to spot disinformation

How Finnish youth learn to spot disinformation

-

12 killed in blast at Turkey explosives plant

-

Panama leaders past and present reject Trump's threat of Canal takeover

Panama leaders past and present reject Trump's threat of Canal takeover

-

Hong Kong police issue fresh bounties for activists overseas

-

Saving the mysterious African manatee at Cameroon hotspot

Saving the mysterious African manatee at Cameroon hotspot

-

India consider second spinner for Boxing Day Test

-

London wall illuminates Covid's enduring pain at Christmas

London wall illuminates Covid's enduring pain at Christmas

-

Poyet appointed manager at South Korea's Jeonbuk

-

South Korea's opposition vows to impeach acting president

South Korea's opposition vows to impeach acting president

-

The tsunami detection buoys safeguarding lives in Thailand

-

Teen Konstas to open for Australia in Boxing Day India Test

Teen Konstas to open for Australia in Boxing Day India Test

-

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

-

Blogs to Bluesky: social media shifts responses after 2004 tsunami

Blogs to Bluesky: social media shifts responses after 2004 tsunami

-

Tennis power couple de Minaur and Boulter get engaged

-

Supermaxi yachts eye record in gruelling Sydney-Hobart race

Supermaxi yachts eye record in gruelling Sydney-Hobart race

-

Hawaii's Kilauea volcano erupts, spewing columns of lava

-

El Salvador Congress votes to end ban on metal mining

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

-

NBA fines Minnesota guard Edwards $75,000 for outburst

NBA fines Minnesota guard Edwards $75,000 for outburst

-

Haitians massacred for practicing voodoo were abducted, hacked to death: UN

-

Inter beat Como to keep in touch with leaders Atalanta

Inter beat Como to keep in touch with leaders Atalanta

-

Man Utd boss Amorim questions 'choices' of Rashford's entourage

-

Trump's TikTok love raises stakes in battle over app's fate

Trump's TikTok love raises stakes in battle over app's fate

-

Is he serious? Trump stirs unease with Panama, Greenland ploys

-

England captain Stokes to miss three months with torn hamstring

England captain Stokes to miss three months with torn hamstring

-

Support grows for Blake Lively over smear campaign claim

-

Canada records 50,000 opioid overdose deaths since 2016

Canada records 50,000 opioid overdose deaths since 2016

-

Jordanian, Qatari envoys hold talks with Syria's new leader

-

France's second woman premier makes surprise frontline return

France's second woman premier makes surprise frontline return

-

France's Macron announces fourth government of the year

-

Netanyahu tells Israel parliament 'some progress' on Gaza hostage deal

Netanyahu tells Israel parliament 'some progress' on Gaza hostage deal

-

Guatemalan authorities recover minors taken by sect members

-

Germany's far-right AfD holds march after Christmas market attack

Germany's far-right AfD holds march after Christmas market attack

-

Serie A basement club Monza fire coach Nesta

-

Mozambique top court confirms ruling party disputed win

Mozambique top court confirms ruling party disputed win

-

Syrian medics say were coerced into false chemical attack testimony

-

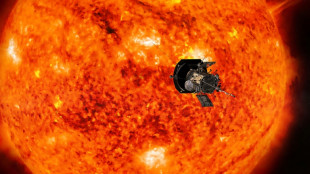

NASA solar probe to make its closest ever pass of Sun

NASA solar probe to make its closest ever pass of Sun

-

London toy 'shop' window where nothing is for sale

-

Volkswagen boss hails cost-cutting deal but shares fall

Volkswagen boss hails cost-cutting deal but shares fall

-

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

-

Global stock markets mostly higher

Global stock markets mostly higher

-

Not for sale. Greenland shrugs off Trump's new push

-

Acid complicates search after deadly Brazil bridge collapse

Acid complicates search after deadly Brazil bridge collapse

-

Norwegian Haugan dazzles in men's World Cup slalom win

SWIFT, the global finance arm that the West can twist

An exclusion from SWIFT, a very discreet but important cog in the machinery of international finance, is one of the most disruptive of the possible sanctions that the West could deploy against Russia for its invasion of Ukraine.

Ukrainian President Volodymyr Zelensky called Thursday for such a move after Russian forces invaded his country, as Western powers consider imposing additional sanctions on Moscow.

The White House has pointedly refused in recent weeks to exclude the possibility of barring Russia from the international system that banks use to transfer money, a move that would cripple Russia's ability to trade with most of the world.

European leaders were expected to discuss the measure at their emergency summit later Thursday as one possible option. An EU official briefing journalists suggested the measure would most likely be held in reserve for a future round of sanctions, should the EU need to escalate its punishment.

What is SWIFT?

Founded in 1973, the Society for Worldwide Interbank Financial Telecommunication, or SWIFT, actually doesn't handle any transfers of funds itself.

But its messaging system, developed in the 1970s to replace relying upon Telex machines, provides banks the means to communicate rapidly, securely and inexpensively.

The non-listed, Belgium-based firm is actually a cooperative of banks and proclaims to remain neutral.

What does SWIFT do?

Banks use the SWIFT system to send standardised messages about transfers of sums between themselves, transfers of sums for clients, and buy and sell orders for assets.

More than 11,000 financial institutions in over 200 countries use SWIFT, making it the backbone of the international financial transfer system.

But its preeminent role in finance has also meant that the firm has had to cooperate with authorities to prevent the financing of terrorism.

Who represents SWIFT in Russia?

According to the national association Rosswift, Russia is the second-largest country following the United States in terms of the number of users, with some 300 Russian financial institutions belonging to the system.

More than half of Russia's financial institutions are members of SWIFT, it added.

Russia does have its own domestic financial infrastructure, including the SPFS system for bank transfers and the Mir system for card payments, similar to the Visa and Mastercard systems.

Are there precedents for excluding countries?

In November 2019, SWIFT "suspended" access to its network by certain Iranian banks.

The move followed the imposition of sanctions on Iran by the United States and threats by then Treasury Secretary Steven Mnuchin that SWIFT would be targeted by US sanctions if it didn't comply.

Iran had already been disconnected from the SWIFT network from 2012 to 2016.

Is it a credible threat?

Tactically, "the advantages and disadvantages are debatable," Guntram Wolff, director of the Brussels-based Bruegel think tank, told AFP.

In practical terms, being removed from SWIFT means Russian banks can't use it to make or receive payments with foreign financial institutions for trade transactions.

"Operationally it would be a real headache," said Wolff, especially for European countries which have considerable trade with Russia, which is their single biggest supplier of natural gas.

Western nations threatened to exclude Russia from SWIFT in 2014 following its annexation of Crimea.

But excluding such a major country -- Russia is also a major oil exporter -- could spur Moscow to accelerate the development of an alternative transfer system, with China for example.

J.V.Jacinto--PC