-

Postecoglou says Spurs 'need to reinforce' in transfer window

Postecoglou says Spurs 'need to reinforce' in transfer window

-

Le Pen says days of new French govt numbered

-

Villa boss Emery set for 'very difficult' clash with Newcastle

Villa boss Emery set for 'very difficult' clash with Newcastle

-

Investors swoop in to save German flying taxi startup

-

How Finnish youth learn to spot disinformation

How Finnish youth learn to spot disinformation

-

12 killed in blast at Turkey explosives plant

-

Panama leaders past and present reject Trump's threat of Canal takeover

Panama leaders past and present reject Trump's threat of Canal takeover

-

Hong Kong police issue fresh bounties for activists overseas

-

Saving the mysterious African manatee at Cameroon hotspot

Saving the mysterious African manatee at Cameroon hotspot

-

India consider second spinner for Boxing Day Test

-

London wall illuminates Covid's enduring pain at Christmas

London wall illuminates Covid's enduring pain at Christmas

-

Poyet appointed manager at South Korea's Jeonbuk

-

South Korea's opposition vows to impeach acting president

South Korea's opposition vows to impeach acting president

-

The tsunami detection buoys safeguarding lives in Thailand

-

Teen Konstas to open for Australia in Boxing Day India Test

Teen Konstas to open for Australia in Boxing Day India Test

-

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

-

Blogs to Bluesky: social media shifts responses after 2004 tsunami

Blogs to Bluesky: social media shifts responses after 2004 tsunami

-

Tennis power couple de Minaur and Boulter get engaged

-

Supermaxi yachts eye record in gruelling Sydney-Hobart race

Supermaxi yachts eye record in gruelling Sydney-Hobart race

-

Hawaii's Kilauea volcano erupts, spewing columns of lava

-

El Salvador Congress votes to end ban on metal mining

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

-

NBA fines Minnesota guard Edwards $75,000 for outburst

NBA fines Minnesota guard Edwards $75,000 for outburst

-

Haitians massacred for practicing voodoo were abducted, hacked to death: UN

-

Inter beat Como to keep in touch with leaders Atalanta

Inter beat Como to keep in touch with leaders Atalanta

-

Man Utd boss Amorim questions 'choices' of Rashford's entourage

-

Trump's TikTok love raises stakes in battle over app's fate

Trump's TikTok love raises stakes in battle over app's fate

-

Is he serious? Trump stirs unease with Panama, Greenland ploys

-

England captain Stokes to miss three months with torn hamstring

England captain Stokes to miss three months with torn hamstring

-

Support grows for Blake Lively over smear campaign claim

-

Canada records 50,000 opioid overdose deaths since 2016

Canada records 50,000 opioid overdose deaths since 2016

-

Jordanian, Qatari envoys hold talks with Syria's new leader

-

France's second woman premier makes surprise frontline return

France's second woman premier makes surprise frontline return

-

France's Macron announces fourth government of the year

-

Netanyahu tells Israel parliament 'some progress' on Gaza hostage deal

Netanyahu tells Israel parliament 'some progress' on Gaza hostage deal

-

Guatemalan authorities recover minors taken by sect members

-

Germany's far-right AfD holds march after Christmas market attack

Germany's far-right AfD holds march after Christmas market attack

-

Serie A basement club Monza fire coach Nesta

-

Mozambique top court confirms ruling party disputed win

Mozambique top court confirms ruling party disputed win

-

Syrian medics say were coerced into false chemical attack testimony

-

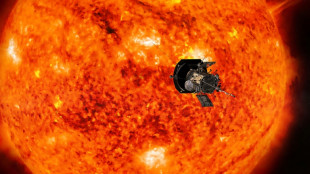

NASA solar probe to make its closest ever pass of Sun

NASA solar probe to make its closest ever pass of Sun

-

London toy 'shop' window where nothing is for sale

-

Volkswagen boss hails cost-cutting deal but shares fall

Volkswagen boss hails cost-cutting deal but shares fall

-

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

-

Global stock markets mostly higher

Global stock markets mostly higher

-

Not for sale. Greenland shrugs off Trump's new push

-

Acid complicates search after deadly Brazil bridge collapse

Acid complicates search after deadly Brazil bridge collapse

-

Norwegian Haugan dazzles in men's World Cup slalom win

World stocks plunge, oil tops $100 as Russia invades Ukraine

Global equities tumbled on Thursday and oil prices breached $100 for the first time in more than seven years after key crude producer Russia launched an invasion of Ukraine, accelerating fears of a major war in eastern Europe.

Asian, European, then US stock markets nosedived -- with Frankfurt and Paris both shedding as much as five percent during part of the trading session -- as investors fled risky equities, while haven investment, gold, rose to over $1,923 per ounce.

After weeks of warnings from the United States and other powers, Russian President Vladimir Putin ordered a wide-ranging offensive into its neighbour, sparking fury from world leaders and vows to ramp up sanctions on Moscow.

In reaction, oil rocketed, with European benchmark Brent prices briefly cruising past $105 per barrel for the first time since 2014, while aluminium and wheat surged to record peaks on fears over output from major exporter Russia.

"The latest twist in the Russia-Ukraine crisis is likely to keep commodity prices elevated over the coming weeks and months," analysts at Capital Economics said.

"And if the situation spirals into a more serious and wide-ranging conflict between Russia and the West, commodity prices could rise further from here."

- 'Pulled rug from markets' -

IMF Managing Director Kristalina Georgieva warned the conflict would have repercussions for the global economic recovery.

Frankfurt stocks finished 4.0 percent lower, and both London and Paris ended the day with a loss of 3.8 percent, as fears grew of a broader conflict.

On Wall Street, the Dow slumped around 1.7 percent in late morning trade.

"The escalation of tensions arising from the Russian action has pulled the rug from markets, adding to an already brittle environment in the face of rising inflation and interest rate concerns," Richard Hunter, head of markets at interactive investor, said.

Asian equities plunged, with Hong Kong, Sydney, Mumbai, Singapore and Wellington down at least three percent, while there were steep losses in Tokyo and Shanghai.

Analysts pointed to fear of the unknown for investors, especially over retaliatory sanctions by the West, as US President Joe Biden met G7 allies to hammer out a raft of new sanctions against Russia.

- Russia-exposed firms hit -

Companies with the biggest presence in Russia were among those whose share prices were getting hammered.

Shares in Russian metal giants Polymetal and Evraz tanked by 38 percent and 30 percent respectively in London.

"With tough incoming sanctions expected, their businesses are likely to take a major hit with little respite in sight given the seriousness of the situation," said Hargreaves Lansdown analyst Susannah Streeter.

French carmaker Renault, which owns a majority stake in Russia's Avtovaz, the maker of the Lada, saw its shares skid about nine percent.

Also in Paris trading, Societe Generale dived about 12 percent on concerns over its Russian retail banking subsidiary Rosbank.

"There will be pressure on (European) banking stocks, particularly banks in France and Austria as they have the largest exposure to Russian loans," added Streeter.

Germany's Deutsche Bank also shed 12.5 percent.

Other haven assets profited, with the Swiss franc hitting a five-year peak versus the euro.

The ruble fell 6.8 percent to 87.8 rubles to the dollar, while the Moscow stock exchange's MOEX index plunged 33.3 percent after suspending trading early in the day.

"The Russian ruble has hit a record low today, and could have further to run in the days ahead as events unfold, and the impact of any sanctions become clearer," said Michael Hewson at CMC Markets.

- Gas prices spike -

European natural gas prices vaulted higher on disruption worries, particularly after Germany this week halted the approval of the Nord Stream 2 pipeline from Russia.

Europe's reference Dutch TTF gas price jumped to more than 134 euros per megawatt hour.

Domestic energy prices had already rocketed in Europe during recent months, fuelling decades-high inflation that has caused central banks to raise or prepare to raise interest rates, which could in turn slow the economic recovery.

- Key figures around 1630 GMT -

Brent North Sea crude: UP 7.4 percent at $103.97 per barrel

West Texas Intermediate: UP 5.5 percent at $97.12 per barrel

New York - Dow: DOWN 1.7 percent at 32,580.46 points

EURO STOXX 50: DOWN 3.6 percent at 3,829.16

London - FTSE 100: DOWN 3.8 percent at 7,211.99 (close)

Frankfurt - DAX: DOWN 4.0 percent at 14,052.10 (close)

Paris - CAC 40: DOWN 3.8 percent at 6,521.05 (close)

Tokyo - Nikkei 225: DOWN 1.8 percent at 25,970.82 (close)

Hong Kong - Hang Seng Index: DOWN 3.2 percent at 22,901.56 (close)

Shanghai - Composite: DOWN 1.7 percent at 3,429.96 (close)

Euro/dollar: DOWN at $1.1142 from $1.1307 late Wednesday

Pound/dollar: DOWN at $1.3341 from $1.3544

Euro/pound: DOWN at 83.46 pence from 83.48 pence

Dollar/yen: UP at 115.41 yen from 115.01 yen

burs-kjm/rl

M.Carneiro--PC