-

Jurgen Klopp to target player welfare in Red Bull role

Jurgen Klopp to target player welfare in Red Bull role

-

Volkswagen sees 'painful' cost cuts ahead as profit plunges

-

Spain races to save victims as floods kill 62

Spain races to save victims as floods kill 62

-

Tuberculosis cases hit record high: WHO

-

Volcanoes 'hidden source' of CO2 in past climate change: study

Volcanoes 'hidden source' of CO2 in past climate change: study

-

Eurozone economy grows faster than expected

-

Mediators to propose Gaza truce amid deadly Israeli strikes

Mediators to propose Gaza truce amid deadly Israeli strikes

-

China's Hisense first sponsor of new Club World Cup

-

Georgia prosecutors probe alleged election 'falsification'

Georgia prosecutors probe alleged election 'falsification'

-

New Zealand's Ajaz 'emotional' on Mumbai return after perfect 10

-

Trump, Harris in frantic campaign push as US election nears

Trump, Harris in frantic campaign push as US election nears

-

Worries for Japan economy after election shock

-

Israel short on soldiers after year of war

Israel short on soldiers after year of war

-

Volkswagen profit plunges on high costs, Chinese slump

-

De Zorzi out for 177 as S.Africa power to 413-5 against Bangladesh

De Zorzi out for 177 as S.Africa power to 413-5 against Bangladesh

-

'CEO of supercute': Hello Kitty turns 50

-

Australia head coach McDonald handed new deal until 2027

Australia head coach McDonald handed new deal until 2027

-

Visual artist grabs 'decisive moment' to nurture Chad art scene

-

Industrial slump leaves Germany on brink of recession

Industrial slump leaves Germany on brink of recession

-

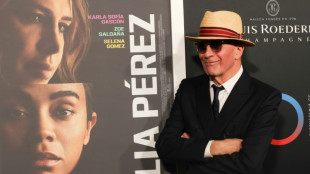

'I'm terrified': French auteur Audiard hits Oscars trail for 'Emilia Perez'

-

New Indonesia defence chief harks back to dictator's rule

New Indonesia defence chief harks back to dictator's rule

-

In Tennessee, the despair of gun control advocates

-

US economy's solid growth unlikely to register at ballot box

US economy's solid growth unlikely to register at ballot box

-

'A treasure': Japan's Ohtani a hometown hero win or lose in World Series

-

Botswana votes with ruling party seeking to extend six decades of power

Botswana votes with ruling party seeking to extend six decades of power

-

Bitcoin close to record as cautious markets eye US election

-

Hometown hero Volpe lives dream with grand slam for Yankees

Hometown hero Volpe lives dream with grand slam for Yankees

-

Rested relief pitchers please Roberts even after Dodgers defeat

-

UK's Labour govt prepares to deliver decisive first budget

UK's Labour govt prepares to deliver decisive first budget

-

Volpe's grand slam helps Yankees avoid World Series sweep

-

Taiwan battens down for Super Typhoon Kong-rey

Taiwan battens down for Super Typhoon Kong-rey

-

MotoGP world title in sight as Martin, Bagnaia set for Sepang duel

-

'New wave' as start-up sweeps up Thai ocean plastic

'New wave' as start-up sweeps up Thai ocean plastic

-

Botswana votes with ruling party aiming to extend six decades of power

-

How harmful are microplastics to human health?

How harmful are microplastics to human health?

-

Are bioplastics really the wonder alternative to petro plastics?

-

Rumble in the Jungle remembered after 50 years

Rumble in the Jungle remembered after 50 years

-

Trump risks backlash with anti-trans ads targeting Harris

-

Alzheimer's patient 'relieved' at Quebec's assisted suicide policy shift

Alzheimer's patient 'relieved' at Quebec's assisted suicide policy shift

-

Who should get paid for nature's sequenced genes?

-

Bodies found as torrential rains slam Spain

Bodies found as torrential rains slam Spain

-

Climate change driving 'record threats to health': report

-

Harris warns of 'obsessed' Trump power grab at mass Washington rally

Harris warns of 'obsessed' Trump power grab at mass Washington rally

-

Southampton, Brentford scrape into League Cup quarter-finals

-

PGA players council seeks smaller fields, fewer full tour spots

PGA players council seeks smaller fields, fewer full tour spots

-

Napoli extend lead at top of Serie A with win at AC Milan

-

Jennifer Lopez to boost Harris at glitzy Las Vegas event

Jennifer Lopez to boost Harris at glitzy Las Vegas event

-

Global stocks mixed as markets await Big Tech results

-

Three-person crew blasts off for China's Tiangong space station

Three-person crew blasts off for China's Tiangong space station

-

Google reports strong growth driven by AI, Cloud

| RBGPF | 100% | 62.35 | $ | |

| CMSC | -0.65% | 24.57 | $ | |

| SCS | -3.11% | 12.21 | $ | |

| NGG | -1.35% | 65.12 | $ | |

| BCC | -5.3% | 131.64 | $ | |

| GSK | 0.76% | 38.17 | $ | |

| AZN | -1.05% | 75.22 | $ | |

| BTI | -1.31% | 34.46 | $ | |

| RELX | -0.52% | 47.91 | $ | |

| RIO | 0.6% | 66.58 | $ | |

| RYCEF | 0.55% | 7.25 | $ | |

| BCE | -0.71% | 32.46 | $ | |

| JRI | -0.69% | 12.98 | $ | |

| CMSD | -0.16% | 24.84 | $ | |

| VOD | -2.8% | 9.28 | $ | |

| BP | -5.76% | 29.36 | $ |

US stocks fall again as Russia-Ukraine tensions mount

Wall Street stocks fell again Wednesday amid unease over Ukraine and shifting Federal Reserve policy, while oil prices finished a volatile session little changed.

Major US indices opened the day higher, but began retreating soon thereafter amid fresh Ukraine headlines, finishing the day sharply lower.

A United Nations meeting on Ukraine heard that a full-scale Russian invasion of the country would have a devastating global impact that would likely spark a new "refugee crisis."

Also Wednesday, Ukraine's parliament declared a national state of emergency aimed at helping to forge a response to the threat of a full-scale Russian invasion.

And President Joe Biden followed up Tuesday's sanctions announcement, saying the United States will join Germany in imposing sanctions on the Russian Nord Stream 2 natural gas pipeline project.

But so far the penalties were not as bad as markets had feared -- crucially with none aimed at Russia's crude exports -- providing much-needed breathing room for investors and halting the surge in oil prices that has seen both main contracts pile on more than 20 percent so far this year.

After a mixed day in European stocks, the broad-based S&P 500 dropped 1.8 percent, its fourth straight decline.

The market "is really agitated with all the uncertainty," said Briefing.com analyst Patrick O'Hare, who also said wariness over the Fed's shifting policy was an exacerbating factor.

O'Hare noted that US Treasury yields rallied Wednesday, a sign investors so far aren't flooding into US debt in a "flight to quality."

Oil prices fluctuated throughout the day, but finished little changed, but analysts are still eyeing a possible spike in prices depending on what happens with Ukraine.

"There's still considerable risk that oil prices may surge above $100 a barrel" if the situation escalates, said Vivek Dhar at Commonwealth Bank of Australia.

"Oil markets are particularly vulnerable at the moment given that global oil stockpiles are at seven‑year lows."

- Key figures around 2220 GMT -

New York - Dow: DOWN 1.4 percent at 33,131.76 (close)

New York - S&P 500: DOWN 1.8 percent at 4,225.50 (close)

New York - Nasdaq: DOWN 2.6 percent at 13,037.49 (close)

London - FTSE 100: UP 0.1 percent at 7,498.18 (close)

Frankfurt - DAX: DOWN 0.4 percent at 14,631.36 (close)

Paris - CAC 40: DOWN 0.1 percent at 6,780.67 (close)

EURO STOXX 50: DOWN 0.3 percent at 3,973.41 (close)

Hong Kong - Hang Seng Index: UP 0.6 percent at 23,660.28 (close)

Shanghai - Composite: UP 0.9 percent at 3,489.15 (close)

Tokyo - Nikkei 225: Closed for a holiday

Brent North Sea crude: FLAT at $96.84 per barrel

West Texas Intermediate: DOWN 0.2 percent at $92.10 per barrel

Euro/dollar: DOWN at $1.1308 from $1.1325 late Tuesday

Pound/dollar: DOWN at $1.3545 from $1.3585

Euro/pound: UP at 83.41 pence from 83.36 pence

Dollar/yen: DOWN at 114.96 yen from 115.13 yen

burs-jmb/hs

H.Silva--PC