-

Hawaii's Kilauea volcano erupts, spewing columns of lava

Hawaii's Kilauea volcano erupts, spewing columns of lava

-

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

Five things to know about Panama Canal, in Trump's sights

-

NBA fines Minnesota guard Edwards $75,000 for outburst

-

Haitians massacred for practicing voodoo were abducted, hacked to death: UN

Haitians massacred for practicing voodoo were abducted, hacked to death: UN

-

Inter beat Como to keep in touch with leaders Atalanta

-

Man Utd boss Amorim questions 'choices' of Rashford's entourage

Man Utd boss Amorim questions 'choices' of Rashford's entourage

-

Trump's TikTok love raises stakes in battle over app's fate

-

Is he serious? Trump stirs unease with Panama, Greenland ploys

Is he serious? Trump stirs unease with Panama, Greenland ploys

-

England captain Stokes to miss three months with torn hamstring

-

Support grows for Blake Lively over smear campaign claim

Support grows for Blake Lively over smear campaign claim

-

Canada records 50,000 opioid overdose deaths since 2016

-

Jordanian, Qatari envoys hold talks with Syria's new leader

Jordanian, Qatari envoys hold talks with Syria's new leader

-

France's second woman premier makes surprise frontline return

-

France's Macron announces fourth government of the year

France's Macron announces fourth government of the year

-

Netanyahu tells Israel parliament 'some progress' on Gaza hostage deal

-

Guatemalan authorities recover minors taken by sect members

Guatemalan authorities recover minors taken by sect members

-

Germany's far-right AfD holds march after Christmas market attack

-

Serie A basement club Monza fire coach Nesta

Serie A basement club Monza fire coach Nesta

-

Mozambique top court confirms ruling party disputed win

-

Syrian medics say were coerced into false chemical attack testimony

Syrian medics say were coerced into false chemical attack testimony

-

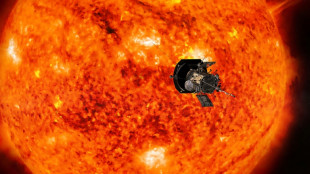

NASA solar probe to make its closest ever pass of Sun

-

London toy 'shop' window where nothing is for sale

London toy 'shop' window where nothing is for sale

-

Volkswagen boss hails cost-cutting deal but shares fall

-

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

-

Global stock markets mostly higher

-

Not for sale. Greenland shrugs off Trump's new push

Not for sale. Greenland shrugs off Trump's new push

-

Acid complicates search after deadly Brazil bridge collapse

-

Norwegian Haugan dazzles in men's World Cup slalom win

Norwegian Haugan dazzles in men's World Cup slalom win

-

Arsenal's Saka out for 'many weeks' with hamstring injury

-

Mali singer Traore child custody case postponed

Mali singer Traore child custody case postponed

-

France mourns Mayotte victims amid uncertainy over government

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

African players in Europe: Salah leads Golden Boot race after brace

-

German far-right AfD to march in city hit by Christmas market attack

German far-right AfD to march in city hit by Christmas market attack

-

Ireland centre Henshaw signs IRFU contract extension

-

Bangladesh launches $5bn graft probe into Hasina's family

Bangladesh launches $5bn graft probe into Hasina's family

-

US probes China chip industry on 'anticompetitive' concerns

-

Biden commutes sentences for 37 of 40 federal death row inmates

Biden commutes sentences for 37 of 40 federal death row inmates

-

Clock ticks down on France government nomination

-

Mozambique on edge as judges rule on disputed election

Mozambique on edge as judges rule on disputed election

-

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

Honda and Nissan to launch merger talks

-

Police arrest suspect who set woman on fire in New York subway

-

China vows 'cooperation' over ship linked to severed Baltic Sea cables

China vows 'cooperation' over ship linked to severed Baltic Sea cables

-

Australian tennis star Purcell provisionally suspended for doping

-

Luxury Western goods line Russian stores, three years into sanctions

Luxury Western goods line Russian stores, three years into sanctions

-

Wallace and Gromit return with comic warning about AI dystopia

-

Philippine military says will acquire US Typhon missile system

Philippine military says will acquire US Typhon missile system

-

Afghan bread, the humble centrepiece of every meal

Barclays freezes ex-boss bonuses over Epstein probe

British bank Barclays on Wednesday suspended £22 million of bonuses owed to ex-boss Jes Staley amid a probe into his links with US sex offender Jeffrey Epstein.

Barclays has frozen its former chief executive's unvested long-term bonus share awards -- worth $30 million or 26 million euros -- while he remains the subject of a regulatory investigation, the group said as it posted surging annual profits.

The bank said its nominations committee made the decision "pending further developments in respect of the regulatory and legal proceedings related to the ongoing investigation regarding Mr Staley".

The former boss, who quit last year, was nevertheless entitled to a contractual entitlement of £2.4 million in cash and shares -- equivalent of 12 months' salary -- as well as pension and other benefits.

Staley resigned in November ahead of contesting the outcome of the UK investigation into his historical relationship with Epstein, the American financier who killed himself in 2019 while awaiting trial on charges of trafficking underage girls for sex.

Staley stepped down after UK regulators informed the Barclays board of the preliminary conclusions of an ongoing probe.

The bank has stressed that watchdogs have made no findings that Staley saw or was aware of Epstein's crimes.

Staley for his part has expressed deep regret at having had a professional relationship with Epstein prior to becoming Barclays head in late 2015.

Epstein continues to cause huge fallout elsewhere, with Queen Elizabeth II's second son Prince Andrew this month settling a sexual assault lawsuit for an undisclosed sum with a woman who says she was "lent out" for underage sex by the late financier.

The prince has not been criminally charged and has denied the allegations.

- Profits surge -

Barclays on Wednesday also revealed that it had beefed up its staff bonus pool after 2021 net profits more than quadrupled as the economy recovered from coronavirus fallout.

Profit after tax surged to almost £6.4 billion, helped by the release of £700 million that had been set aside for bad loans during the pandemic.

That compared with a £1.5-billion profit the prior year, when Barclays had taken a £4.8-billion charge to cover Covid-19 fallout.

The bank ramped up its total bonus pool by almost a quarter to more than £1.9 billion, becoming the latest UK lender to shrug off Britain's cost of living crisis with dizzying staff incentives.

The 2021 profits performance was "driven by an improved macroeconomic outlook" and buoyed also by reduced unsecured lending balances and a benign credit environment, the bank said.

"Barclays demonstrated a clear and sustainable path to growth over the course of 2021," said chief executive C.S. Venkatakrishnan.

The annual results are the first under Venkatakrishnan, who was promoted from his role as head of global markets following Staley's sudden departure.

Barclays on Wednesday named Anna Cross as its new finance director with effect from April.

The deputy finance director was the first woman to take the top finance job at the lender.

T.Batista--PC