-

Hawaii's Kilauea volcano erupts, spewing columns of lava

Hawaii's Kilauea volcano erupts, spewing columns of lava

-

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

Five things to know about Panama Canal, in Trump's sights

-

NBA fines Minnesota guard Edwards $75,000 for outburst

-

Haitians massacred for practicing voodoo were abducted, hacked to death: UN

Haitians massacred for practicing voodoo were abducted, hacked to death: UN

-

Inter beat Como to keep in touch with leaders Atalanta

-

Man Utd boss Amorim questions 'choices' of Rashford's entourage

Man Utd boss Amorim questions 'choices' of Rashford's entourage

-

Trump's TikTok love raises stakes in battle over app's fate

-

Is he serious? Trump stirs unease with Panama, Greenland ploys

Is he serious? Trump stirs unease with Panama, Greenland ploys

-

England captain Stokes to miss three months with torn hamstring

-

Support grows for Blake Lively over smear campaign claim

Support grows for Blake Lively over smear campaign claim

-

Canada records 50,000 opioid overdose deaths since 2016

-

Jordanian, Qatari envoys hold talks with Syria's new leader

Jordanian, Qatari envoys hold talks with Syria's new leader

-

France's second woman premier makes surprise frontline return

-

France's Macron announces fourth government of the year

France's Macron announces fourth government of the year

-

Netanyahu tells Israel parliament 'some progress' on Gaza hostage deal

-

Guatemalan authorities recover minors taken by sect members

Guatemalan authorities recover minors taken by sect members

-

Germany's far-right AfD holds march after Christmas market attack

-

Serie A basement club Monza fire coach Nesta

Serie A basement club Monza fire coach Nesta

-

Mozambique top court confirms ruling party disputed win

-

Syrian medics say were coerced into false chemical attack testimony

Syrian medics say were coerced into false chemical attack testimony

-

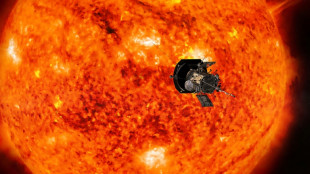

NASA solar probe to make its closest ever pass of Sun

-

London toy 'shop' window where nothing is for sale

London toy 'shop' window where nothing is for sale

-

Volkswagen boss hails cost-cutting deal but shares fall

-

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

-

Global stock markets mostly higher

-

Not for sale. Greenland shrugs off Trump's new push

Not for sale. Greenland shrugs off Trump's new push

-

Acid complicates search after deadly Brazil bridge collapse

-

Norwegian Haugan dazzles in men's World Cup slalom win

Norwegian Haugan dazzles in men's World Cup slalom win

-

Arsenal's Saka out for 'many weeks' with hamstring injury

-

Mali singer Traore child custody case postponed

Mali singer Traore child custody case postponed

-

France mourns Mayotte victims amid uncertainy over government

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

African players in Europe: Salah leads Golden Boot race after brace

-

German far-right AfD to march in city hit by Christmas market attack

German far-right AfD to march in city hit by Christmas market attack

-

Ireland centre Henshaw signs IRFU contract extension

-

Bangladesh launches $5bn graft probe into Hasina's family

Bangladesh launches $5bn graft probe into Hasina's family

-

US probes China chip industry on 'anticompetitive' concerns

-

Biden commutes sentences for 37 of 40 federal death row inmates

Biden commutes sentences for 37 of 40 federal death row inmates

-

Clock ticks down on France government nomination

-

Mozambique on edge as judges rule on disputed election

Mozambique on edge as judges rule on disputed election

-

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

Honda and Nissan to launch merger talks

-

Police arrest suspect who set woman on fire in New York subway

-

China vows 'cooperation' over ship linked to severed Baltic Sea cables

China vows 'cooperation' over ship linked to severed Baltic Sea cables

-

Australian tennis star Purcell provisionally suspended for doping

-

Luxury Western goods line Russian stores, three years into sanctions

Luxury Western goods line Russian stores, three years into sanctions

-

Wallace and Gromit return with comic warning about AI dystopia

-

Philippine military says will acquire US Typhon missile system

Philippine military says will acquire US Typhon missile system

-

Afghan bread, the humble centrepiece of every meal

Volkswagen eyes separate stock market listing for Porsche

German auto giant Volkswagen on Tuesday said it was drawing up plans to list its luxury brand Porsche as it looks to raise the funds for its move to electric vehicles.

Volkswagen and its largest shareholder Porsche SE had "negotiated a framework agreement which should form the basis for further steps" towards a separate stock market listing, the carmaker said in a statement.

A "final decision" on the future of the storied sports car brand had not yet been taken, the group said.

The flotation would represent a major shake up at Volkswagen, which is searching for a ways to finance its shift away from traditional combustion engines towards electric vehicles.

According to the daily Handelsblatt, Volkswagen could be willing to part with 49 percent of Porsche shares, which it currently holds in their entirety.

Volkswagen group's parent company and main shareholder is Porsche SE, which is also listed on the Frankfurt Stock Exchange.

Shares in both the carmaker and the holding company jumped on the news. Volkswagen shares were up almost nine percent to 190 euros ($216) around 1330 GMT, while the holding group's stock rose by over 12 percent.

- Blockbuster deal -

Analysts value Porsche, maker of the famous 911 sports car, at between 60 and 80 billion euros.

The blockbuster deal could see the similarly named holding company directly "purchase stock in Porsche AG", it said in a statement.

Porsche SE, which manages the investments of the Porsche-Piech family, could in turn finance the move by selling part of its majority stake in the Volkswagen group, according to recent reports in the local press.

The consent of the two parties' supervisory boards is still needed for the deal to go through.

But approval seems likely given the familial ties between the two groups and the fact that a number of members of the carmaker's supervisory board also have roles at the holding company.

The Volkswagen group -- whose 12 brands include Audi, Porsche and Skoda -- is pumping 35 billion euros into the shift to electric vehicles and aims to become the world's largest electric carmaker by 2025.

The world's second largest automaker is in a tussle with its American rival Tesla, which has parked its tanks on Volkswagen's lawn by building a factory in Germany.

Herbert Diess, the German group's CEO, has sought to overhaul the group's image, turning it from an auto behemoth into a more of a technology company focussed on electric vehicles.

As part of the shake-up, Volkswagen introduced its bus and lorry subsidiary Traton onto the stock exchange in 2019 and let go its majority in the niche luxury carmaker Bugatti last year.

A.Magalhes--PC