-

Hawaii's Kilauea volcano erupts, spewing columns of lava

Hawaii's Kilauea volcano erupts, spewing columns of lava

-

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

Five things to know about Panama Canal, in Trump's sights

-

NBA fines Minnesota guard Edwards $75,000 for outburst

-

Haitians massacred for practicing voodoo were abducted, hacked to death: UN

Haitians massacred for practicing voodoo were abducted, hacked to death: UN

-

Inter beat Como to keep in touch with leaders Atalanta

-

Man Utd boss Amorim questions 'choices' of Rashford's entourage

Man Utd boss Amorim questions 'choices' of Rashford's entourage

-

Trump's TikTok love raises stakes in battle over app's fate

-

Is he serious? Trump stirs unease with Panama, Greenland ploys

Is he serious? Trump stirs unease with Panama, Greenland ploys

-

England captain Stokes to miss three months with torn hamstring

-

Support grows for Blake Lively over smear campaign claim

Support grows for Blake Lively over smear campaign claim

-

Canada records 50,000 opioid overdose deaths since 2016

-

Jordanian, Qatari envoys hold talks with Syria's new leader

Jordanian, Qatari envoys hold talks with Syria's new leader

-

France's second woman premier makes surprise frontline return

-

France's Macron announces fourth government of the year

France's Macron announces fourth government of the year

-

Netanyahu tells Israel parliament 'some progress' on Gaza hostage deal

-

Guatemalan authorities recover minors taken by sect members

Guatemalan authorities recover minors taken by sect members

-

Germany's far-right AfD holds march after Christmas market attack

-

Serie A basement club Monza fire coach Nesta

Serie A basement club Monza fire coach Nesta

-

Mozambique top court confirms ruling party disputed win

-

Syrian medics say were coerced into false chemical attack testimony

Syrian medics say were coerced into false chemical attack testimony

-

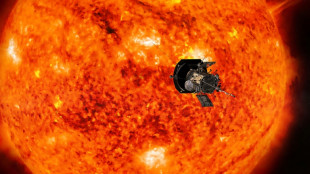

NASA solar probe to make its closest ever pass of Sun

-

London toy 'shop' window where nothing is for sale

London toy 'shop' window where nothing is for sale

-

Volkswagen boss hails cost-cutting deal but shares fall

-

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

-

Global stock markets mostly higher

-

Not for sale. Greenland shrugs off Trump's new push

Not for sale. Greenland shrugs off Trump's new push

-

Acid complicates search after deadly Brazil bridge collapse

-

Norwegian Haugan dazzles in men's World Cup slalom win

Norwegian Haugan dazzles in men's World Cup slalom win

-

Arsenal's Saka out for 'many weeks' with hamstring injury

-

Mali singer Traore child custody case postponed

Mali singer Traore child custody case postponed

-

France mourns Mayotte victims amid uncertainy over government

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

African players in Europe: Salah leads Golden Boot race after brace

-

German far-right AfD to march in city hit by Christmas market attack

German far-right AfD to march in city hit by Christmas market attack

-

Ireland centre Henshaw signs IRFU contract extension

-

Bangladesh launches $5bn graft probe into Hasina's family

Bangladesh launches $5bn graft probe into Hasina's family

-

US probes China chip industry on 'anticompetitive' concerns

-

Biden commutes sentences for 37 of 40 federal death row inmates

Biden commutes sentences for 37 of 40 federal death row inmates

-

Clock ticks down on France government nomination

-

Mozambique on edge as judges rule on disputed election

Mozambique on edge as judges rule on disputed election

-

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

Honda and Nissan to launch merger talks

-

Police arrest suspect who set woman on fire in New York subway

-

China vows 'cooperation' over ship linked to severed Baltic Sea cables

China vows 'cooperation' over ship linked to severed Baltic Sea cables

-

Australian tennis star Purcell provisionally suspended for doping

-

Luxury Western goods line Russian stores, three years into sanctions

Luxury Western goods line Russian stores, three years into sanctions

-

Wallace and Gromit return with comic warning about AI dystopia

-

Philippine military says will acquire US Typhon missile system

Philippine military says will acquire US Typhon missile system

-

Afghan bread, the humble centrepiece of every meal

HSBC announces $1 bn share buyback as annual profits double

HSBC on Tuesday announced bumper 2021 profits and plans to repurchase shares worth up to $1.0 billion as the Asia-focused bank continues its recovery from the coronavirus pandemic and major restructuring.

The lender endured a tumultuous 2020 like the rest of the banking sector as the virus outbreak rocked the economy just as it embarked on a restructuring programme to slash 35,000 jobs to refocus on its most profitable areas in Asia and the Middle East.

Pre-tax profit soared 115 percent to $18.9 billion in 2021 from the prior year, helped by lower bad loans and operating expenses.

Net profit more than tripled to $12.6 billion, up from $3.9 bilion last time around.

- 'Good momentum' -

"We have good momentum coming into 2022 and are confident that we can continue to execute against our strategy," Chief Executive Officer Noel Quinn said in the statement.

"We also remain cognisant of the potential impact that further Covid-19- related uncertainty and continued inflation might have on us and our clients."

In a boon for investors, the bank announced plans for a $1.0 billion share buyback, adding to a $2.0 billion buyback announced last year.

HSBC also ramped up its staff bonus pool by almost a third to $3.5 billion, citing the "strong" financial performance and the "extraordinarily competitive" labour market.

HSBC made 65 percent of its profit in Asia last year, down from as high as 90 percent previously, as the group was partly hit by a slowdown in China's recovery.

Early last year it published a new strategy laying out plans to redouble its attempt to seize more of Asia's market.

HSBC is also hopeful of a significant boost to income thanks to the prospect of higher interest rates to fight surging global inflation.

However its reliance on China could also be a vulnerability. Both the mainland and Hong Kong are among the last few remaining places rigidly sticking to a zero-Covid strategy.

That strategy has crumbled in Hong Kong this year during a wave of infections forcing the reimposition of economically painful restrictions and a deepening of the financial hub's international isolation.

Quinn, however, played down the impact.

"We do not believe the current Covid situation in Hong Kong threatens the long-term growth in Hong Kong," he told reporters on a conference call.

After strong growth for much of last year, China's recovery also slowed in the last quarter.

- 'Closely watching' Russia -

Tuesday's results were published against the backdrop of spiking geopolitical tensions, as Russia prepared to send troops into two breakaway regions of Ukraine.

Western nations are readying economic sanctions against Moscow in the event of such a move.

Asked about fallout, Quinn told reporters that HSBC had "very modest" exposure with 250 staff in Moscow serving international clients.

"We'll watch closely for the next few weeks," he added.

"Any military action would be a concern... in terms of collateral damage on market confidence."

HSBC added Tuesday that its reported profit after tax jumped $8.6 billion to $14.7 billion last year.

Fourth quarter profit before tax rose $1.3 billion to $2.7 billion.

M.Carneiro--PC