-

Serie A basement club Monza fire coach Nesta

Serie A basement club Monza fire coach Nesta

-

Mozambique top court confirms ruling party disputed win

-

Syrian medics say were coerced into false chemical attack testimony

Syrian medics say were coerced into false chemical attack testimony

-

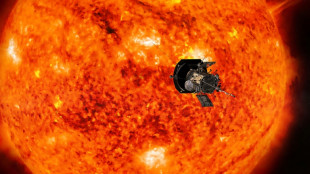

NASA solar probe to make its closest ever pass of Sun

-

London toy 'shop' window where nothing is for sale

London toy 'shop' window where nothing is for sale

-

Volkswagen boss hails cost-cutting deal but shares fall

-

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

-

Global stock markets mostly higher

-

Not for sale. Greenland shrugs off Trump's new push

Not for sale. Greenland shrugs off Trump's new push

-

Acid complicates search after deadly Brazil bridge collapse

-

Norwegian Haugan dazzles in men's World Cup slalom win

Norwegian Haugan dazzles in men's World Cup slalom win

-

Arsenal's Saka out for 'many weeks' with hamstring injury

-

Mali singer Traore child custody case postponed

Mali singer Traore child custody case postponed

-

France mourns Mayotte victims amid uncertainy over government

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

African players in Europe: Salah leads Golden Boot race after brace

-

German far-right AfD to march in city hit by Christmas market attack

German far-right AfD to march in city hit by Christmas market attack

-

Ireland centre Henshaw signs IRFU contract extension

-

Bangladesh launches $5bn graft probe into Hasina's family

Bangladesh launches $5bn graft probe into Hasina's family

-

US probes China chip industry on 'anticompetitive' concerns

-

Biden commutes sentences for 37 of 40 federal death row inmates

Biden commutes sentences for 37 of 40 federal death row inmates

-

Clock ticks down on France government nomination

-

Mozambique on edge as judges rule on disputed election

Mozambique on edge as judges rule on disputed election

-

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

Honda and Nissan to launch merger talks

-

Police arrest suspect who set woman on fire in New York subway

-

China vows 'cooperation' over ship linked to severed Baltic Sea cables

China vows 'cooperation' over ship linked to severed Baltic Sea cables

-

Australian tennis star Purcell provisionally suspended for doping

-

Luxury Western goods line Russian stores, three years into sanctions

Luxury Western goods line Russian stores, three years into sanctions

-

Wallace and Gromit return with comic warning about AI dystopia

-

Philippine military says will acquire US Typhon missile system

Philippine military says will acquire US Typhon missile system

-

Afghan bread, the humble centrepiece of every meal

-

Honda and Nissan expected to begin merger talks

Honda and Nissan expected to begin merger talks

-

'Draconian' Vietnam internet law heightens free speech fears

-

Israeli women mobilise against ultra-Orthodox military exemptions

Israeli women mobilise against ultra-Orthodox military exemptions

-

Asian markets track Wall St rally as US inflation eases rate worries

-

Tens of thousands protest in Serbian capital over fatal train station accident

Tens of thousands protest in Serbian capital over fatal train station accident

-

Trump vows to 'stop transgender lunacy' as a top priority

-

'Who's next?': Misinformation and online threats after US CEO slaying

'Who's next?': Misinformation and online threats after US CEO slaying

-

Only 12 trucks delivered food, water in North Gaza Governorate since October: Oxfam

-

Beyond Work Unveils Next-Generation Memory-Augmented AI Agent (MATRIX) for Enterprise Document Intelligence

Beyond Work Unveils Next-Generation Memory-Augmented AI Agent (MATRIX) for Enterprise Document Intelligence

-

Langers edge Tiger and son Charlie in PNC Championship playoff

-

Explosive batsman Jacobs gets New Zealand call-up for Sri Lanka series

Explosive batsman Jacobs gets New Zealand call-up for Sri Lanka series

-

Holders PSG edge through on penalties in French Cup

-

Daniels throw five TDs as Commanders down Eagles

Daniels throw five TDs as Commanders down Eagles

-

Atalanta fight back to take top spot in Serie A, Roma hit five

-

Mancini admits regrets over leaving Italy for Saudi Arabia

Mancini admits regrets over leaving Italy for Saudi Arabia

-

Run machine Ayub shines as Pakistan sweep South Africa

-

Slovak PM Fico on surprise visit to Kremlin

Slovak PM Fico on surprise visit to Kremlin

-

'Incredible' Liverpool must stay focused: Slot

NY Fed president sees no need for 'big' rate hike in March

With high inflation hitting the US economy, it is time for the central bank to raise the benchmark borrowing rate, but there is no reason for a "big" early move, a top Federal Reserve official said Friday.

Instead, policymakers can "move steadily" to get the key lending rate off zero and back to more normal levels over the next year or more, New York Federal Reserve Bank President John Williams told reporters.

His comment downplayed expectations among many economists and investors that the Fed could move aggressively to raise interest rates by a half point in March to combat inflation, rather than its usual quarter-point increase.

"There's no need to do something extra at the beginning of the process of liftoff," Williams said in response to a question from AFP. "I don't see any compelling argument to take a big step" to start the process.

US inflation has hit the highest rate in four decades, battering President Joe Biden's popularity and hitting households and businesses in the world's largest economy.

Williams acknowledged prices rose higher and lingered longer than he was expecting, and left the door open to more aggressive action if the situation demands it.

"What I'm trying to convey is that we'll be moving in a series of steps" to get the policy rate up from zero to "more normal levels" of 2-2.5 percent.

The official, who serves as vice chair of the policy-setting Federal Open Market Committee (FOMC), said the central bank could "either slow down or move faster. But I don't see the need to do that at the beginning."

His stance runs counter to others, like St. Louis Fed President James Bullard, who has called for the central bank to "front load" its rate increases, and would be open to hiking outside the regularly scheduled meetings.

- March hike 'appropriate' -

Williams, in a speech delivered virtually to New Jersey City University, noted that the Fed also will begin to reduce the massive bond holdings built up as part of the pandemic stimulus efforts.

That, combined with higher interest rates, will help bring inflation back down to around three percent by the end of the year, Williams predicted, adding that he is confident the economy will continue to recover.

Markets already were anticipating the first of several rate hikes will come at the March 15-16 FOMC meeting.

Like other central bankers and officials in the Biden administration, Williams attributed much of the inflation increase to pandemic-related issues, including supply and transportation snags and labor shortages.

While the rapid improvement in employment is "great news," Williams said, "we have seen inflation rise to a level that's far too high."

"I expect it will be appropriate to raise the target range at our upcoming meeting in March," he said, indicating it would be the first of several hikes.

"Once the interest rate increases are underway, the next step will be to start the process of steadily and predictably reducing our holdings of Treasury and mortgage-based securities," Williams said.

The combined moves "should help bring demand closer to supply" and reduce price pressures.

"I am confident we will achieve a sustained, strong economy and inflation at our two percent longer-run goal," he said, projecting the Fed's preferred inflation measure will "drop back to around three percent" at the end of 2022 "before falling further next year as supply issues continue to recede."

J.V.Jacinto--PC