-

Serie A basement club Monza fire coach Nesta

Serie A basement club Monza fire coach Nesta

-

Mozambique top court confirms ruling party disputed win

-

Syrian medics say were coerced into false chemical attack testimony

Syrian medics say were coerced into false chemical attack testimony

-

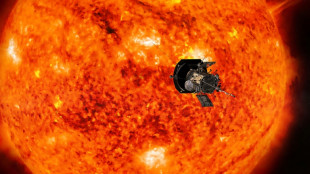

NASA solar probe to make its closest ever pass of Sun

-

London toy 'shop' window where nothing is for sale

London toy 'shop' window where nothing is for sale

-

Volkswagen boss hails cost-cutting deal but shares fall

-

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

-

Global stock markets mostly higher

-

Not for sale. Greenland shrugs off Trump's new push

Not for sale. Greenland shrugs off Trump's new push

-

Acid complicates search after deadly Brazil bridge collapse

-

Norwegian Haugan dazzles in men's World Cup slalom win

Norwegian Haugan dazzles in men's World Cup slalom win

-

Arsenal's Saka out for 'many weeks' with hamstring injury

-

Mali singer Traore child custody case postponed

Mali singer Traore child custody case postponed

-

France mourns Mayotte victims amid uncertainy over government

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

African players in Europe: Salah leads Golden Boot race after brace

-

German far-right AfD to march in city hit by Christmas market attack

German far-right AfD to march in city hit by Christmas market attack

-

Ireland centre Henshaw signs IRFU contract extension

-

Bangladesh launches $5bn graft probe into Hasina's family

Bangladesh launches $5bn graft probe into Hasina's family

-

US probes China chip industry on 'anticompetitive' concerns

-

Biden commutes sentences for 37 of 40 federal death row inmates

Biden commutes sentences for 37 of 40 federal death row inmates

-

Clock ticks down on France government nomination

-

Mozambique on edge as judges rule on disputed election

Mozambique on edge as judges rule on disputed election

-

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

Honda and Nissan to launch merger talks

-

Police arrest suspect who set woman on fire in New York subway

-

China vows 'cooperation' over ship linked to severed Baltic Sea cables

China vows 'cooperation' over ship linked to severed Baltic Sea cables

-

Australian tennis star Purcell provisionally suspended for doping

-

Luxury Western goods line Russian stores, three years into sanctions

Luxury Western goods line Russian stores, three years into sanctions

-

Wallace and Gromit return with comic warning about AI dystopia

-

Philippine military says will acquire US Typhon missile system

Philippine military says will acquire US Typhon missile system

-

Afghan bread, the humble centrepiece of every meal

-

Honda and Nissan expected to begin merger talks

Honda and Nissan expected to begin merger talks

-

'Draconian' Vietnam internet law heightens free speech fears

-

Israeli women mobilise against ultra-Orthodox military exemptions

Israeli women mobilise against ultra-Orthodox military exemptions

-

Asian markets track Wall St rally as US inflation eases rate worries

-

Tens of thousands protest in Serbian capital over fatal train station accident

Tens of thousands protest in Serbian capital over fatal train station accident

-

Trump vows to 'stop transgender lunacy' as a top priority

-

'Who's next?': Misinformation and online threats after US CEO slaying

'Who's next?': Misinformation and online threats after US CEO slaying

-

Only 12 trucks delivered food, water in North Gaza Governorate since October: Oxfam

-

Beyond Work Unveils Next-Generation Memory-Augmented AI Agent (MATRIX) for Enterprise Document Intelligence

Beyond Work Unveils Next-Generation Memory-Augmented AI Agent (MATRIX) for Enterprise Document Intelligence

-

Langers edge Tiger and son Charlie in PNC Championship playoff

-

Explosive batsman Jacobs gets New Zealand call-up for Sri Lanka series

Explosive batsman Jacobs gets New Zealand call-up for Sri Lanka series

-

Holders PSG edge through on penalties in French Cup

-

Daniels throw five TDs as Commanders down Eagles

Daniels throw five TDs as Commanders down Eagles

-

Atalanta fight back to take top spot in Serie A, Roma hit five

-

Mancini admits regrets over leaving Italy for Saudi Arabia

Mancini admits regrets over leaving Italy for Saudi Arabia

-

Run machine Ayub shines as Pakistan sweep South Africa

-

Slovak PM Fico on surprise visit to Kremlin

Slovak PM Fico on surprise visit to Kremlin

-

'Incredible' Liverpool must stay focused: Slot

| RBGPF | 0% | 60.5 | $ | |

| BCC | -0% | 122.748 | $ | |

| CMSD | -0.04% | 23.55 | $ | |

| CMSC | 0.33% | 23.939 | $ | |

| SCS | -0.51% | 11.68 | $ | |

| BCE | -2.27% | 22.647 | $ | |

| RIO | 0.53% | 58.95 | $ | |

| RELX | -0.05% | 45.446 | $ | |

| NGG | 0.54% | 58.82 | $ | |

| JRI | 0.08% | 12.07 | $ | |

| RYCEF | -0.97% | 7.2 | $ | |

| GSK | 0.61% | 33.805 | $ | |

| VOD | -0.42% | 8.355 | $ | |

| BP | 0.21% | 28.66 | $ | |

| AZN | 1.05% | 66.045 | $ | |

| BTI | -0.62% | 36.015 | $ |

Stocks buckle as Ukraine fears linger

Stock markets retreated on Friday at the end of a highly volatile week rocked by twists and turns in the Ukraine crisis and concerns about interest rate hikes.

Asia's main equity markets closed lower after a steep drop on Wall Street Thursday fuelled by renewed fears that Russia would soon invade Ukraine, adding to long-running angst about the Federal Reserve's plans to hike interest rates.

On Friday, US stock markets retreated in early trading, with the Dow Jones Industrial Average shedding 0.3 percent. The S&P 500 and tech-heavy were briefly in the green after opening but fell minutes later.

London's FTSE 100 and the Paris CAC 40 fell in afternoon trading after being in the black earlier in the day. Frankfurt was also down.

"Markets continue to chop around on these Russia headlines", said Neil Wilson, analyst at Markets.com.

Shellfire rang out near the frontline between government forces and rebel-held territory in eastern Ukraine, as Kyiv and Washington accused Russia of seeking to provoke an incident to falsely justify an invasion.

Russian President Vladimir Putin, who will oversee a ballistic missile drill this weekend, warned of a "deterioration of the situation" in eastern Ukraine.

US President Joe Biden will hold talks with Western allies on Friday to discuss Ukraine.

"The markets may be getting some relief as Secretary of State Antony Blinken is expected to meet with Russian Foreign Minister Sergei Lavrov next week," said a note by analysts at Charles Schwab investment firm.

- Oil prices slump -

The crisis over Ukraine comes as traders continue to contend with the prospect of US interest rates rising sharply this year as the Fed tries to rein in inflation at a 40-year high.

After spending most of last year saying surging prices would be transitory, the US central bank is now in full-on firefighting mode.

But commentators fear it may be behind the curve and will have to act more stringently than previously thought.

While tensions in Eastern Europe continue to absorb most of the attention, oil prices extended losses as traders grow increasingly optimistic of a deal on Iran's nuclear programme that could see it restart crude exports.

"Reports of the US and Iran nearing a new nuclear deal couldn't have come at a better time and oil prices are slipping at the prospect of more than a million barrels of crude re-entering the market," noted Craig Erlam, senior market analyst at OANDA trading group.

"In the absence of a deal, we could already be talking about triple-figure oil prices."

Oil prices on Friday lost two percent, with the WTI contract dropping under the $88 mark.

- Key figures around 1435 GMT -

New York - Dow: DOWN 0.3 percent at 34,214.24 points

London - FTSE 100: DOWN 0.1 percent at 7,529.40

Frankfurt - DAX: DOWN 1.1 percent at 15,093.88

Paris - CAC 40: DOWN 0.3 percent at 6,928.68

EURO STOXX 50: DOWN 0.8 percent at 4,079.65

Tokyo - Nikkei 225: DOWN 0.4 percent at 27,122.07 (close)

Hong Kong - Hang Seng Index: DOWN 1.9 percent at 24,327.71 (close)

Shanghai - Composite: DOWN 0.7 percent at 3,490.76 (close)

West Texas Intermediate: DOWN 2.1 percent at $88.15 per barrel

Brent North Sea crude: DOWN 2.0 percent at $91.16 per barrel

Euro/dollar: DOWN at $1.1342 from $1.1366 late Thursday

Pound/dollar: DOWN at $1.3596 from $1.3615

Euro/pound: DOWN at 83.42 pence from 83.44 pence

Dollar/yen: UP at 114.99 yen from 114.91 yen

A.Seabra--PC