-

Serie A basement club Monza fire coach Nesta

Serie A basement club Monza fire coach Nesta

-

Mozambique top court confirms ruling party disputed win

-

Syrian medics say were coerced into false chemical attack testimony

Syrian medics say were coerced into false chemical attack testimony

-

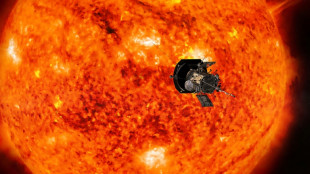

NASA solar probe to make its closest ever pass of Sun

-

London toy 'shop' window where nothing is for sale

London toy 'shop' window where nothing is for sale

-

Volkswagen boss hails cost-cutting deal but shares fall

-

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

-

Global stock markets mostly higher

-

Not for sale. Greenland shrugs off Trump's new push

Not for sale. Greenland shrugs off Trump's new push

-

Acid complicates search after deadly Brazil bridge collapse

-

Norwegian Haugan dazzles in men's World Cup slalom win

Norwegian Haugan dazzles in men's World Cup slalom win

-

Arsenal's Saka out for 'many weeks' with hamstring injury

-

Mali singer Traore child custody case postponed

Mali singer Traore child custody case postponed

-

France mourns Mayotte victims amid uncertainy over government

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

African players in Europe: Salah leads Golden Boot race after brace

-

German far-right AfD to march in city hit by Christmas market attack

German far-right AfD to march in city hit by Christmas market attack

-

Ireland centre Henshaw signs IRFU contract extension

-

Bangladesh launches $5bn graft probe into Hasina's family

Bangladesh launches $5bn graft probe into Hasina's family

-

US probes China chip industry on 'anticompetitive' concerns

-

Biden commutes sentences for 37 of 40 federal death row inmates

Biden commutes sentences for 37 of 40 federal death row inmates

-

Clock ticks down on France government nomination

-

Mozambique on edge as judges rule on disputed election

Mozambique on edge as judges rule on disputed election

-

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

Honda and Nissan to launch merger talks

-

Police arrest suspect who set woman on fire in New York subway

-

China vows 'cooperation' over ship linked to severed Baltic Sea cables

China vows 'cooperation' over ship linked to severed Baltic Sea cables

-

Australian tennis star Purcell provisionally suspended for doping

-

Luxury Western goods line Russian stores, three years into sanctions

Luxury Western goods line Russian stores, three years into sanctions

-

Wallace and Gromit return with comic warning about AI dystopia

-

Philippine military says will acquire US Typhon missile system

Philippine military says will acquire US Typhon missile system

-

Afghan bread, the humble centrepiece of every meal

-

Honda and Nissan expected to begin merger talks

Honda and Nissan expected to begin merger talks

-

'Draconian' Vietnam internet law heightens free speech fears

-

Israeli women mobilise against ultra-Orthodox military exemptions

Israeli women mobilise against ultra-Orthodox military exemptions

-

Asian markets track Wall St rally as US inflation eases rate worries

-

Tens of thousands protest in Serbian capital over fatal train station accident

Tens of thousands protest in Serbian capital over fatal train station accident

-

Trump vows to 'stop transgender lunacy' as a top priority

-

'Who's next?': Misinformation and online threats after US CEO slaying

'Who's next?': Misinformation and online threats after US CEO slaying

-

Only 12 trucks delivered food, water in North Gaza Governorate since October: Oxfam

-

Beyond Work Unveils Next-Generation Memory-Augmented AI Agent (MATRIX) for Enterprise Document Intelligence

Beyond Work Unveils Next-Generation Memory-Augmented AI Agent (MATRIX) for Enterprise Document Intelligence

-

Langers edge Tiger and son Charlie in PNC Championship playoff

-

Explosive batsman Jacobs gets New Zealand call-up for Sri Lanka series

Explosive batsman Jacobs gets New Zealand call-up for Sri Lanka series

-

Holders PSG edge through on penalties in French Cup

-

Daniels throw five TDs as Commanders down Eagles

Daniels throw five TDs as Commanders down Eagles

-

Atalanta fight back to take top spot in Serie A, Roma hit five

-

Mancini admits regrets over leaving Italy for Saudi Arabia

Mancini admits regrets over leaving Italy for Saudi Arabia

-

Run machine Ayub shines as Pakistan sweep South Africa

-

Slovak PM Fico on surprise visit to Kremlin

Slovak PM Fico on surprise visit to Kremlin

-

'Incredible' Liverpool must stay focused: Slot

Asian markets mixed as Ukraine fears return, oil extends losses

Asian markets were mixed Friday following a steep drop on Wall Street fuelled by renewed fears that Russia will soon invade Ukraine, adding to long-running angst about the Federal Reserve's plans to hike interest rates.

While tensions in Eastern Europe continue to absorb most of the attention, oil extended losses as traders grow increasingly optimistic of a deal on Iran's nuclear programme that could see it restart crude exports.

After a disappointing start to the year, investors are still to get their mojo back as they contend with a range of risk-off issues including Russia-Ukraine, soaring inflation, imminent rate hikes, supply chain snarls and China's Covid outbreaks.

And analysts warned the uncertainty will likely last for some time.

For now eyes are on the Russia-Ukraine border after Joe Biden warned Vladimir Putin's forces could attack any time soon.

There had been optimism the crisis had passed after Moscow said troops were withdrawing but Western powers said there is no sign that is the case, while accusing it of preparing a "false flag operation" as a pretext for invasion.

Putin denies he is planning any incursion but investors remain on edge as observers warn such a move could have wide-ranging implications for the world economic recovery, particularly with Russia being a major energy exporter.

The mood was given a little help when Washington said Thursday that US Secretary of State Antony Blinken and his Russian counterpart Sergei Lavrov will meet next week if there is no invasion.

All three main US indexes ended well down, with the Nasdaq almost three percent off, though Asia fared slightly better.

Tokyo, Hong Kong, Sydney, Singapore, Taipei, Wellington and Manila slipped, though Shanghai, Mumbai, Jakarta and Bangkok edged up slightly. Seoul was flat.

"For now, simmering frictions in the Ukraine are keeping markets nervous and after (Thursday's) glimpses of a risk of tone, news over the past 24 hours have turned sentiment decisively negative," said National Australia Bank's Rodrigo Catril.

Still, oil prices remain in their downward spiral, dropping again Friday after a two percent drop Thursday as it emerged that Tehran and world powers were edging closer to an agreement on its nuclear programme.

A deal could see the return of hundreds of thousands of barrels of crude to the global market, providing a much-needed boost to supplies just as demand surges and uncertainty reigns in Europe. Both main contracts remain around their 2014 levels, however, and analysts expect them to break $100 this year.

The crisis in the Ukraine comes as traders continue to contend with the prospect of interest rates rising sharply this year as the Fed tries to rein in inflation at a 40-year high.

After spending most of last year saying surging prices would be transitory, the US central bank is now in full-on firefighting mode but commentators fear it may be behind the curve and will have to act more stringently than previously thought.

While minutes from January's meeting appeared to ease worries of a big 50 basis point rise in March, there is an expectation it could still lift borrowing costs as many as seven times this year. As early as late 2021 markets were pricing in three.

The prospect of higher costs has dealt a blow to the two-year pandemic rally and while the economy continues to recover, observers warn the uncertainty will not go away soon.

"We've been calling for a long time for increased volatility, but when it finally comes it's nerve wracking for everybody," Carol Schleif, at BMO Family Office, told Bloomberg TV.

"It's important to remember that the Fed isn't going to start pulling back its support for the economy -- either in terms of the balance sheet purchases or interest-rate raises -- if they weren't trying to cool a very strong economy."

- Key figures around 0710 GMT -

Tokyo - Nikkei 225: DOWN 0.4 percent at 27,122.07 (close)

Hong Kong - Hang Seng Index: DOWN 1.0 percent at 24,541.06

Shanghai - Composite: DOWN 0.7 percent at 3,490.76 (close)

West Texas Intermediate: DOWN 0.4 percent at $91.37 per barrel

Brent North Sea crude: DOWN 0.4 percent at $92.64 per barrel

Euro/dollar: UP at $1.1369 from $1.1366 late Wednesday

Pound/dollar: DOWN at $1.3610 from $1.3615

Euro/pound: UP at 83.49 pence from 83.44 pence

Dollar/yen: DOWN at 115.18 yen from 114.91 yen

New York - Dow: DOWN 1.8 percent at 34,312.03 (close)

London - FTSE 100: DOWN 0.9 percent at 7,537.37 (close)

L.Carrico--PC