-

Marseille down Lens to stay in touch with Ligue 1 leaders

Marseille down Lens to stay in touch with Ligue 1 leaders

-

Novak Djokovic: All-conquering, divisive tennis superstar

-

World approves UN rules for carbon trading between nations at COP29

World approves UN rules for carbon trading between nations at COP29

-

Putin signs law letting Ukraine fighters write off bad debts

-

Thousands march against Angola govt

Thousands march against Angola govt

-

Ireland coast to victory as they run Fiji ragged

-

Atletico make comeback to beat Alaves as Simeone hits milestone

Atletico make comeback to beat Alaves as Simeone hits milestone

-

Aid only 'delaying deaths' as Sudan counts down to famine: agency chief

-

Leipzig lose more ground on Bayern with Hoffenheim loss

Leipzig lose more ground on Bayern with Hoffenheim loss

-

Arsenal back to winning ways, Chelsea up to third in Premier League

-

Sinner powers Davis Cup holders Italy past Australia to final

Sinner powers Davis Cup holders Italy past Australia to final

-

Andy Murray to coach Novak Djokovic

-

Leipzig lose ground on Bayern, Dortmund and Leverkusen win

Leipzig lose ground on Bayern, Dortmund and Leverkusen win

-

Fear in central Beirut district hit by Israeli strikes

-

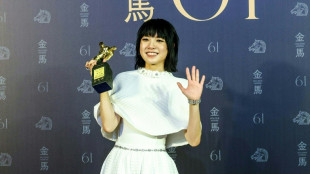

Chinese film about Covid-19 wins Taiwan's top Golden Horse prizes

Chinese film about Covid-19 wins Taiwan's top Golden Horse prizes

-

Tuipulotu puts anger behind him as he captains Scotland against native Australia

-

Inter smash Verona to take Serie A lead

Inter smash Verona to take Serie A lead

-

Mass rape trial sparks demonstrations across France

-

Eddie Jones will revel in winding up England - Genge

Eddie Jones will revel in winding up England - Genge

-

Storms bring chaos to Ireland, France, UK

-

Berrettini gives Italy edge on Australia in Davis Cup semis

Berrettini gives Italy edge on Australia in Davis Cup semis

-

Amber Glenn storms to gold in Cup of China

-

High-flying Chelsea see off Leicester

High-flying Chelsea see off Leicester

-

Climate-threatened nations stage protest at COP29 over contentious deal

-

Families fleeing after 32 killed in new sectarian violence in Pakistan

Families fleeing after 32 killed in new sectarian violence in Pakistan

-

Ancelotti says 'ugly' to speculate about Mbappe mental health

-

Failure haunts UN environment conferences

Failure haunts UN environment conferences

-

Colapinto in doubt for Las Vegas GP after crashing

-

Lebanon says 11 killed in Israeli strike on central Beirut

Lebanon says 11 killed in Israeli strike on central Beirut

-

Three arrested in Spain for racist abuse at Liga Clasico

-

Pope to skip Notre Dame opening for Corsica visit

Pope to skip Notre Dame opening for Corsica visit

-

Tokyo police care for lost umbrellas, keys, flying squirrels

-

Neuville closes in on world title after Rally Japan recovery

Neuville closes in on world title after Rally Japan recovery

-

Jaiswal slams unbeaten 90 as India seize control against Australia

-

'Nice surprise' for Verstappen to edge Norris in Las Vegas GP qualifying

'Nice surprise' for Verstappen to edge Norris in Las Vegas GP qualifying

-

Indian teen admits to 'some nerves' in bid for world chess crown

-

Patrick Reed shoots rare 59 to make Hong Kong Open history

Patrick Reed shoots rare 59 to make Hong Kong Open history

-

Record-breaker Kane hits back after England criticism

-

Cameron Smith jumps into lead at Australian PGA Championship

Cameron Smith jumps into lead at Australian PGA Championship

-

Russell on pole position at Las Vegas GP, Verstappen ahead of Norris

-

Philippine VP made 'active threat' on Marcos' life: palace

Philippine VP made 'active threat' on Marcos' life: palace

-

Celtics labor to win over Wizards, Warriors into Cup quarters

-

Balkans women stage ancient Greek play to condemn women's suffering in war

Balkans women stage ancient Greek play to condemn women's suffering in war

-

Nvidia CEO says will balance compliance and tech advances under Trump

-

Grand Slam ambition dawning for Australia against Scotland

Grand Slam ambition dawning for Australia against Scotland

-

Japan game set to leave England with more questions than answers

-

Amorim's to-do list to make Man Utd great again

Amorim's to-do list to make Man Utd great again

-

What forcing Google to sell Chrome could mean

-

Fears for Gaza hospitals as fuel and aid run low

Fears for Gaza hospitals as fuel and aid run low

-

Anderson to Starc: Five up for grabs in IPL player auction

Investors seek 750 mn euros in damages over Wirecard collapse

A lawsuit by Wirecard investors claiming 750 million euros ($780 million) in compensation over the German payment company's collapse in a 2020 fraud scandal had its first hearing on Friday.

Some 8,500 investors are hoping to rake back some of the money they lost when it was revealed Wirecard had a two-billion-euro hole in its accounts.

The class action lawsuit, which is being heard at Bavaria's regional supreme court in Munich, is aimed at the company's top management, its auditor EY and Wirecard's insolvency administrator.

The scale of the trial means it is exceptionally being held in the arrivals hall at the former Munich-Riem international airport.

The large number of claimants could eventually swell even further, according to the court.

Around 19,000 people have lodged claims for compensation not included in the original suit and could join the case, the court said.

Central to the proceedings will be the question of whether positive audit reports from EY can be used as evidence.

In its heyday, Wirecard was heralded as a success story for German technology and was admitted into the Frankfurt Stock Exchange's blue-chip DAX index.

The firm imploded in June 2020 after it was forced to admit that 1.9 billion euros in cash, meant to be sitting in trustee accounts in Asia, did not actually exist.

Several senior figures from the company are separately facing criminal trial over the scandal, including ex-CEO Markus Braun.

In September, a Munich court ordered three former board members, including Braun, to pay damages for "negligently" approving a loan to a business in Asia.

T.Resende--PC